Market Data

July 18, 2022

Energy Market Analysis through July

Written by Brett Linton

The Energy Information Administration’s July Short-Term Energy Outlook (STEO) remains subject to a high level of uncertainty, driven by factors such as sanctions affecting Russia’s oil production, the production decisions of OPEC (Organization of the Petroleum Exporting Countries), and the rate at which US producers increase drilling. Due to these variabilities, the EIA continues to warn that actual price outcomes could vary substantially from their forecasts.

In this Premium analysis we cover oil and natural gas prices, North American drilling rig activity, active drill rigs by state, and US crude oil stock levels.

Updated on July 12, you can view the latest EIA Short-Term Energy Outlook here.

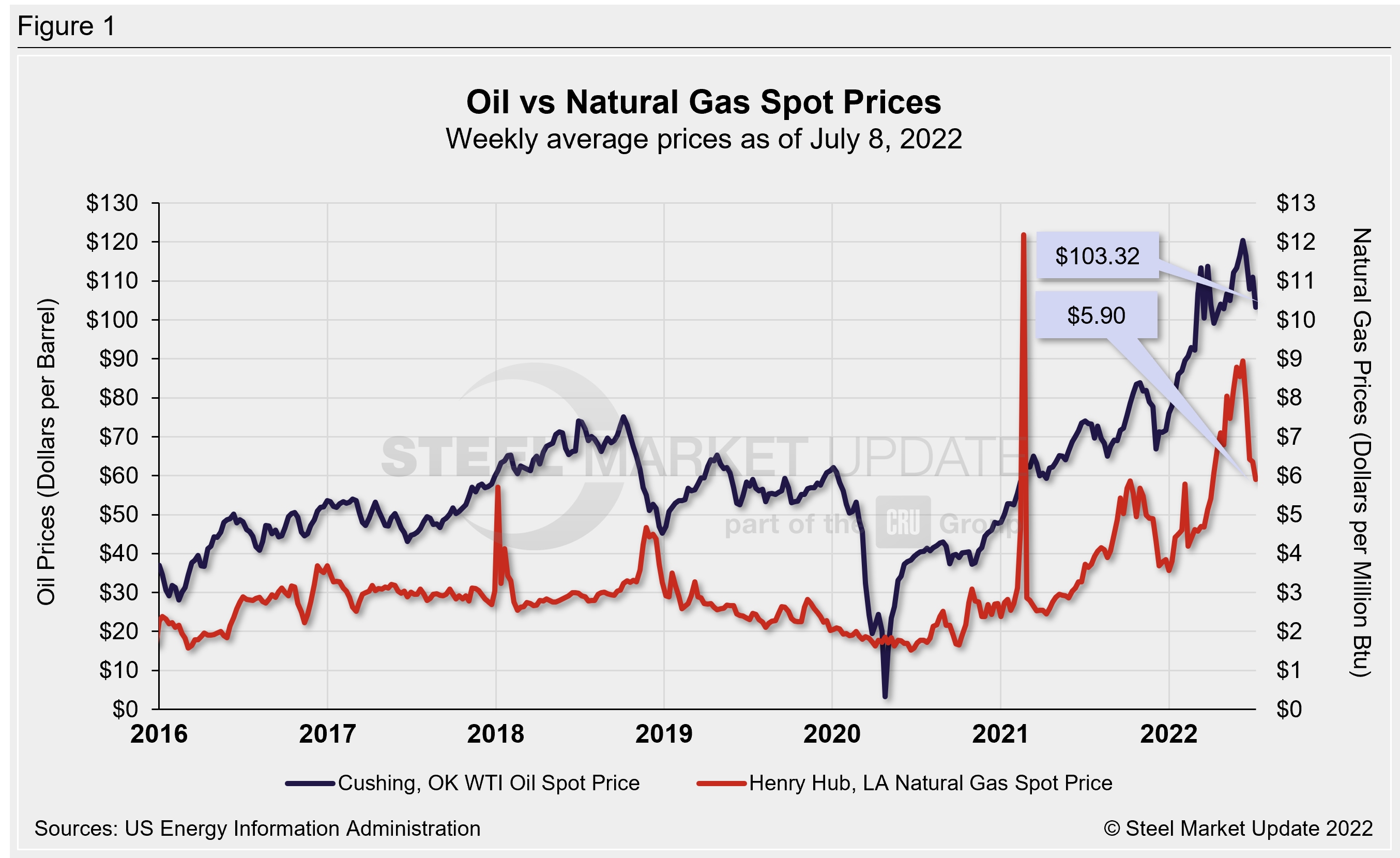

Oil and Gas Spot Prices

The weekly West Texas Intermediate oil spot market price was $103.32 per barrel as of July 8 (Figure 1), easing from a 13+ year high of $120.43/b seen in early June. For comparison, the record high in the EIA’s 36-year data history occurred the week of July 4, 2008, at $142.52/b. As of last week, the EIA expects spot prices to average $104/b in the second half of 2022 (down from last month’s estimate of $108/b) and forecasts an average price of $94/b across 2023 (down from $97 in the previous estimate).

Regarding increasing fuel prices for consumers, EIA forecasts the retail price for regular grade gasoline to average $4.05 per gallon in 2022 and $3.57/gal in 2023. Diesel is forecast to average $4.73/gal in 2022 and $4.07/gal in 2023.

Natural gas spot prices have declined from the multi-year records seen in June. The spot price as of July 8 was $5.90 per MMBTU (Metric Million British Thermal Units). In early June spot prices peaked at $8.95/MMBTU, the highest level since Aug. 2008. (We are excluding high spot prices in Feb. 2021 resulting from winter storms and supply scarcity.) The record high in the EIA’s 36-year history was $14.49/MMBTU the week of Dec. 16, 2005. EIA expects natural gas prices to average $5.97/MMBTU in the second half of 2022 (down from June’s estimate of $8.69/MMBTU) and forecasts 2023 to average $4.76/MMBTU.

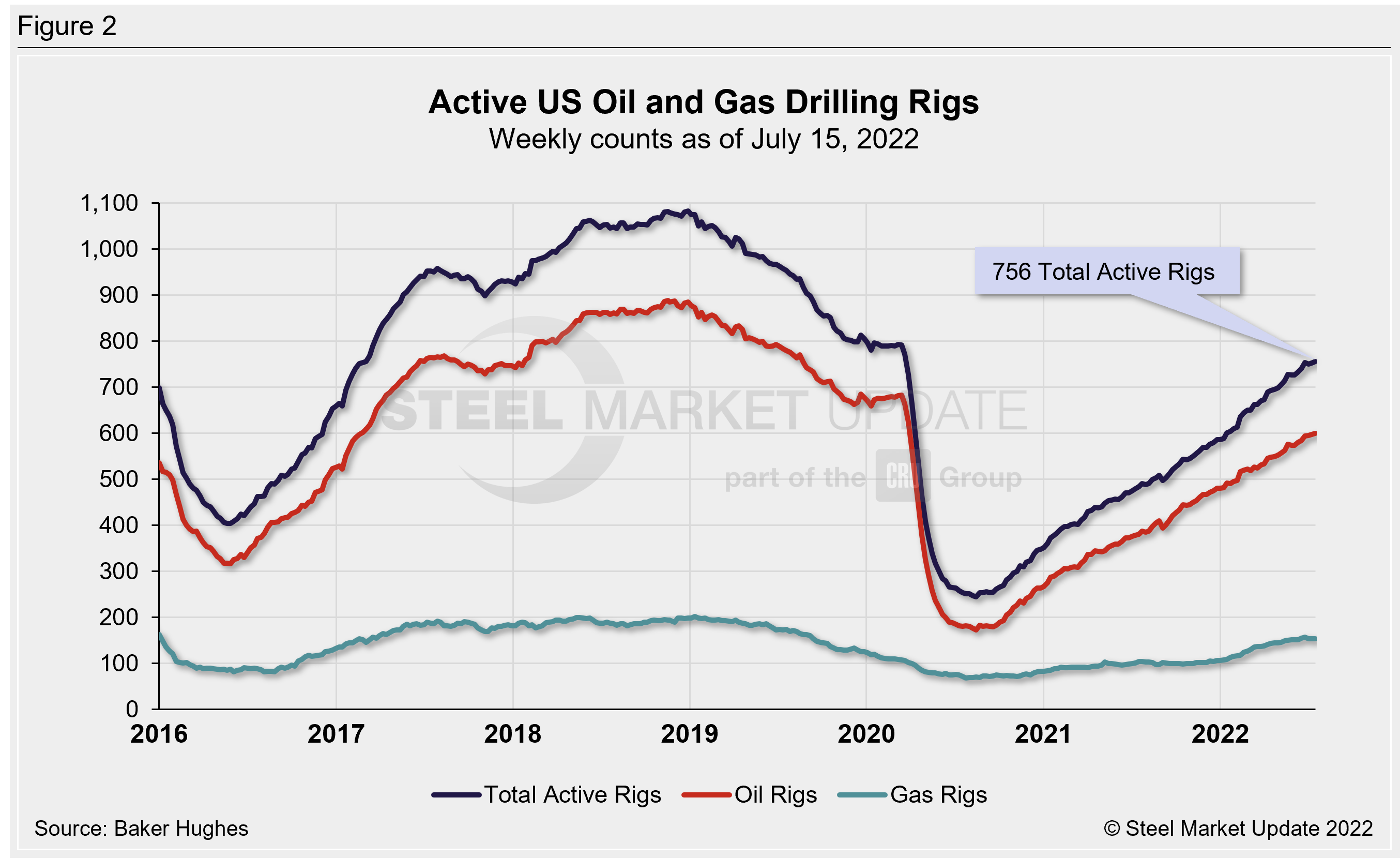

Rig Counts

The number of active US oil and gas drill rigs continues to recover from mid-2020 lows. The latest US count was 756 active drill rigs as of the end of last week, comprised of 599 oil rigs, 153 gas rigs, and 4 miscellaneous rigs, according to Baker Hughes (Figure 2). Active rig counts are up 56% versus this time last year, and down just 5% compared to pre-Covid shutdowns in March 2020.

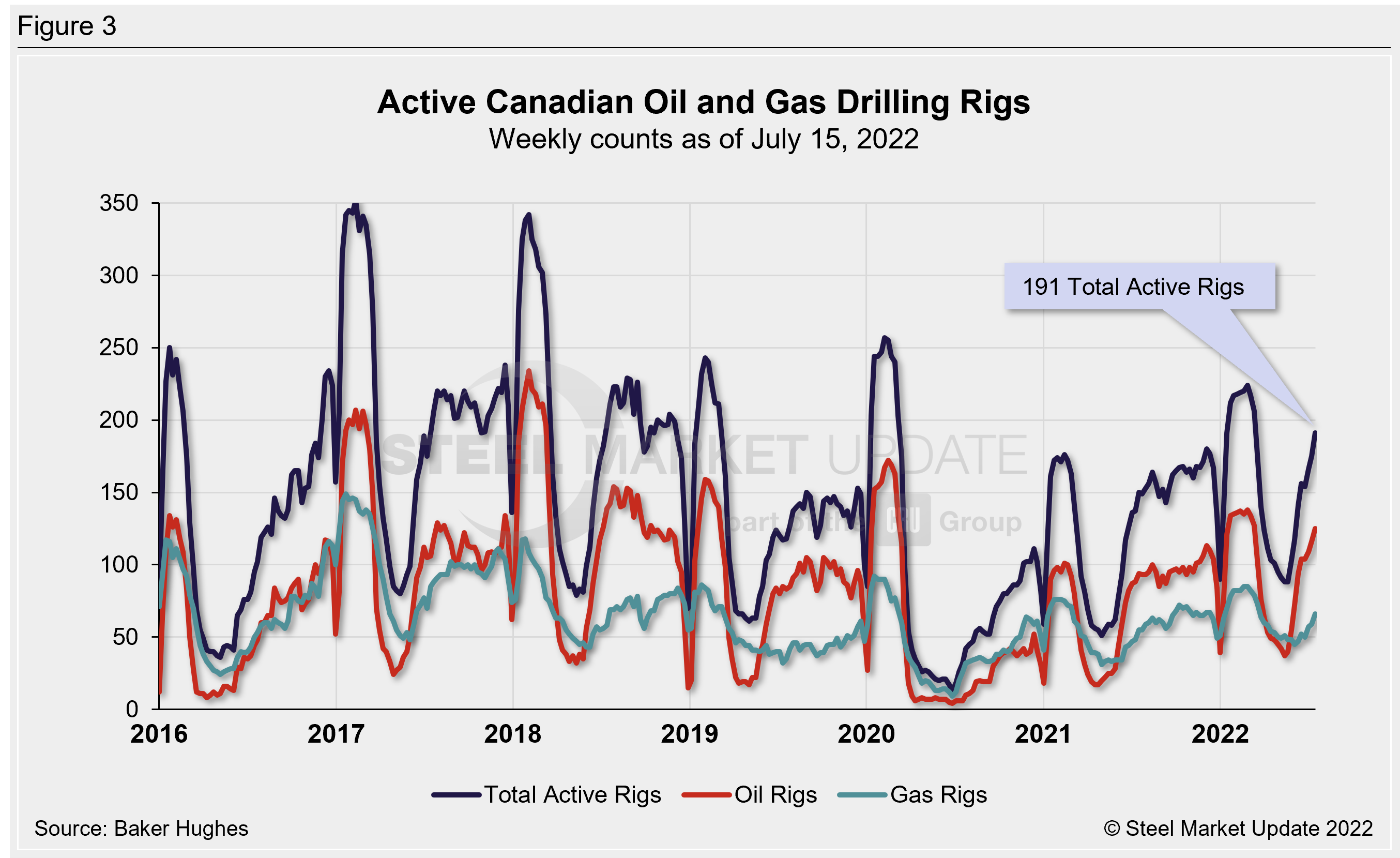

The latest Canadian rig count climbed to 191 rigs, comprised of 125 oil rigs and 66 gas rigs. Candian rig counts are up 27% compared to one year prior, but down 22% from pre-Covid levels (Figure 3).

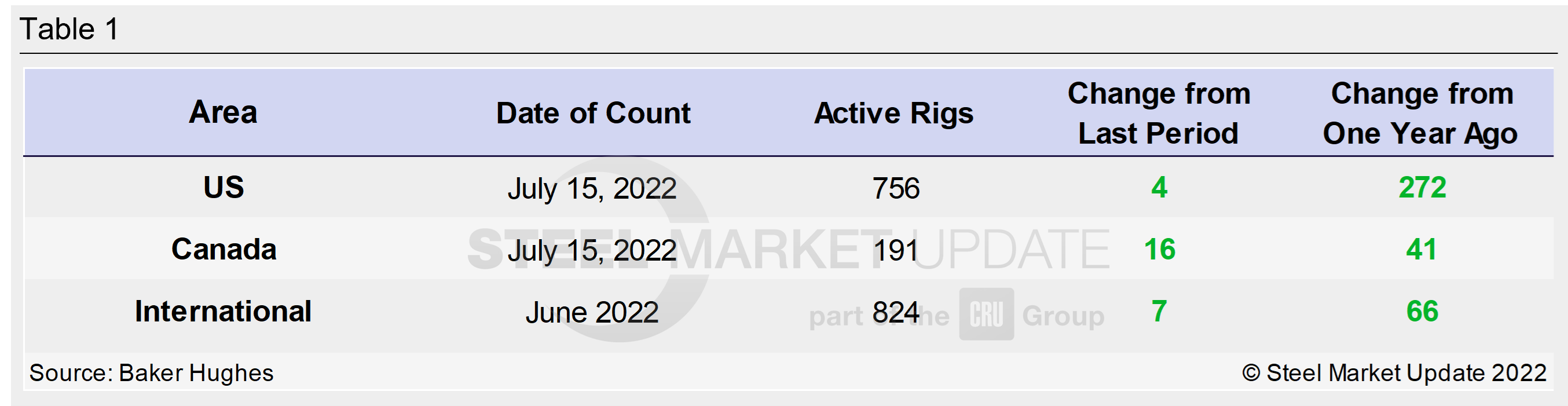

Table 1 below compares the current US, Canadian and international rig counts to historical levels.

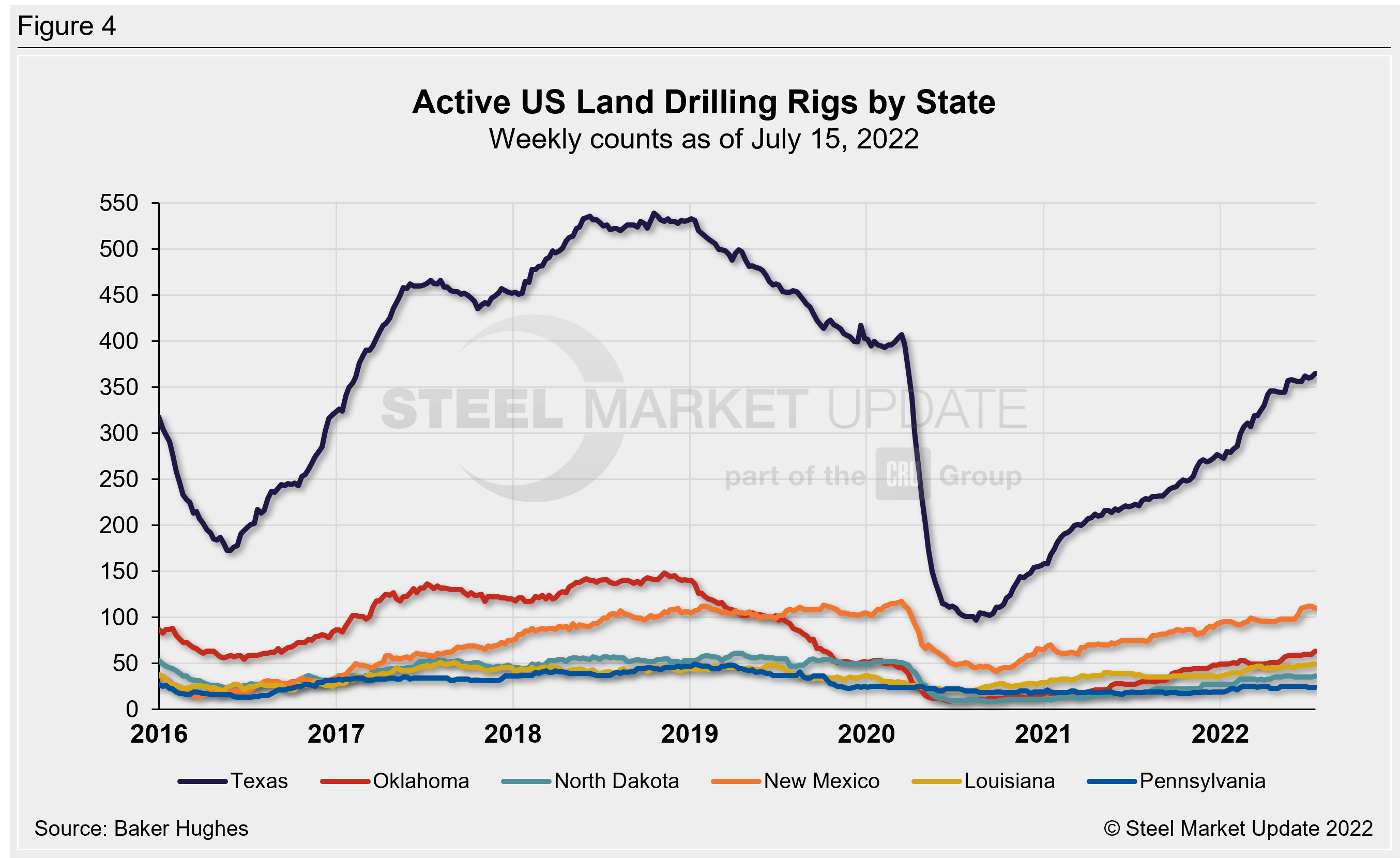

US oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota, and New Mexico. As of July 15, production continues to steadily increase for each state (Figure 4). Texas is the most active state with 365 rigs in operation and New Mexico is the second highest with 110 rigs. Recall that the number of active Texas rigs had plummeted 76% in 2020, falling from 407 in April to 97 rigs in August.

Stock Levels

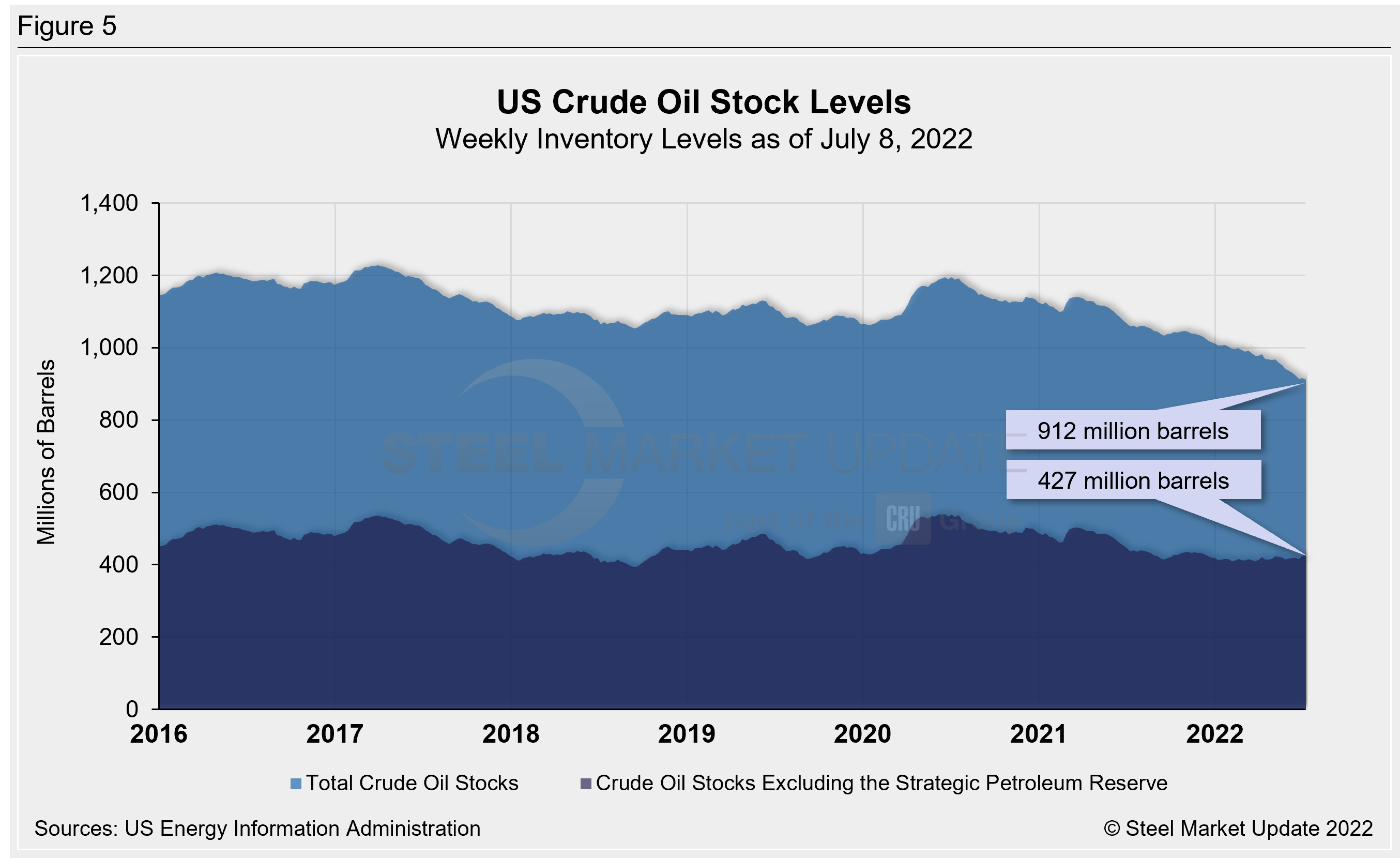

US total crude oil stocks continue to decline from mid-2020 highs, falling to an 18-year low of 912 million barrels on July 8. For comparison, the record low in the EIA’s 40-year history was 608 million barrels in October 1982. The June stock level is down 14% from 1.059 billion barrels one year ago (Figure 5).

Trends in energy prices and rig counts are an advanced indicator of demand for oil country tubular goods (OCTG), line pipe and other steel products.

By Brett Linton, Brett@SteelMarketUpdate.com