Analysis

July 26, 2022

Final Thoughts

Written by Michael Cowden

We’ve updated our prices, and it’s another week of declines for hot-rolled, cold-rolled, and galvanized flat-rolled steel. That’s not new.

But this might be: Hot-rolled prices had been falling at a modestly faster pace than galvanized prices base prices. That was not the case this week.

HR is down $35 per ton ($1.75 per cwt) week over week. Galv base prices are down $45 per ton ($2.25 per cwt). That might be a trend to keep an eye on.

Why? HR price are no longer in “unprecedented” territory. We’re at $840 per ton now. Prices were significantly higher in the summer of 2018 following the initiation of Section 232 tariffs. They were ~$900 per ton in June-Aug 2018, according to SMU pricing records. That’s ~$1,060 per ton in if you adjust for inflation.

The same cannot be said of galvanized base prices. They were around $1,000 per ton in the summer of 2018, or ~$1,175 per ton if you adjust for inflation. That’s well below our current base price of $1,270 per ton.

HR can’t fall $35-50 per ton for much longer before we’re back to “normal” pre-pandemic price levels. Galvanized could. But will it?

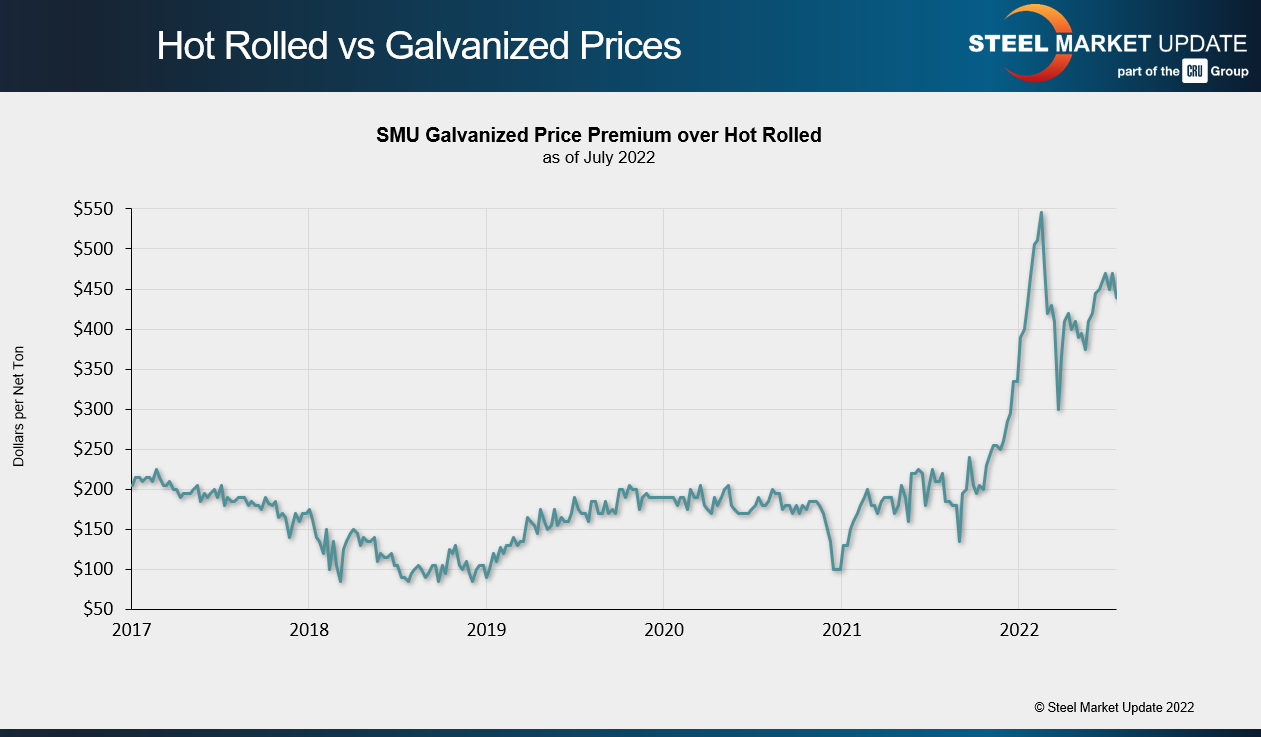

I’d suggest keeping a close eye on the spreads between hot-rolled coil and galvanized base prices. Check out the chart below.

Spreads have been around $450 per ton recently. That’s more than double an average of approximately $200 per ton over the last five years or so.

Yes, the steel industry has consolidated a lot since 2020, especially with Cleveland-Cliffs’ acquisition of the former AK Steel and the former ArcelorMittal USA. But has it consolidated to a point where mills can enforce a $400/450-per-ton spread between HR and galvanized base prices?

Another thing worth considering is whether it’s even realistic to say that domestic mills have such power amid a weakening global market.

We’re told that steel prices continue to fall in Asia, Chinese hot-rolled coil prices included. China can’t ship directly to the US because of prohibitive duties. But low prices there put pressure on prices elsewhere in the region.

And recall that South Korea is subject to a Section 232 quota, not the 25% tariff most other nations face. Japan, meanwhile, has negotiated a tariff-rate quota (TRQ) with the US that largely removes Section 232 tariffs there as well. The Europe Union, facing a recession and an energy crisis, also has a TRQ.

Does this mean that tons from Asia and Europe will flood into the US? Not necessarily. But does it mean that import prices might keep a lid on domestic tags? That’s worth asking.

By Michael Cowden, Michael@SteelMarketUpdate.com