Analysis

July 28, 2022

Final Thoughts

Written by Michael Cowden

There’s plenty of doom and gloom these days in steel. Our recent Community Chat with Associated General Contractors of America chief economist Ken Simonson provided a welcome respite from the dreary mood among some steel buyers.

But let’s not get carried away. Simonson didn’t say prices weren’t falling. In fact, it’s not just steel prices that are declining, so too are prices for lumber, aluminum, and copper and brass.

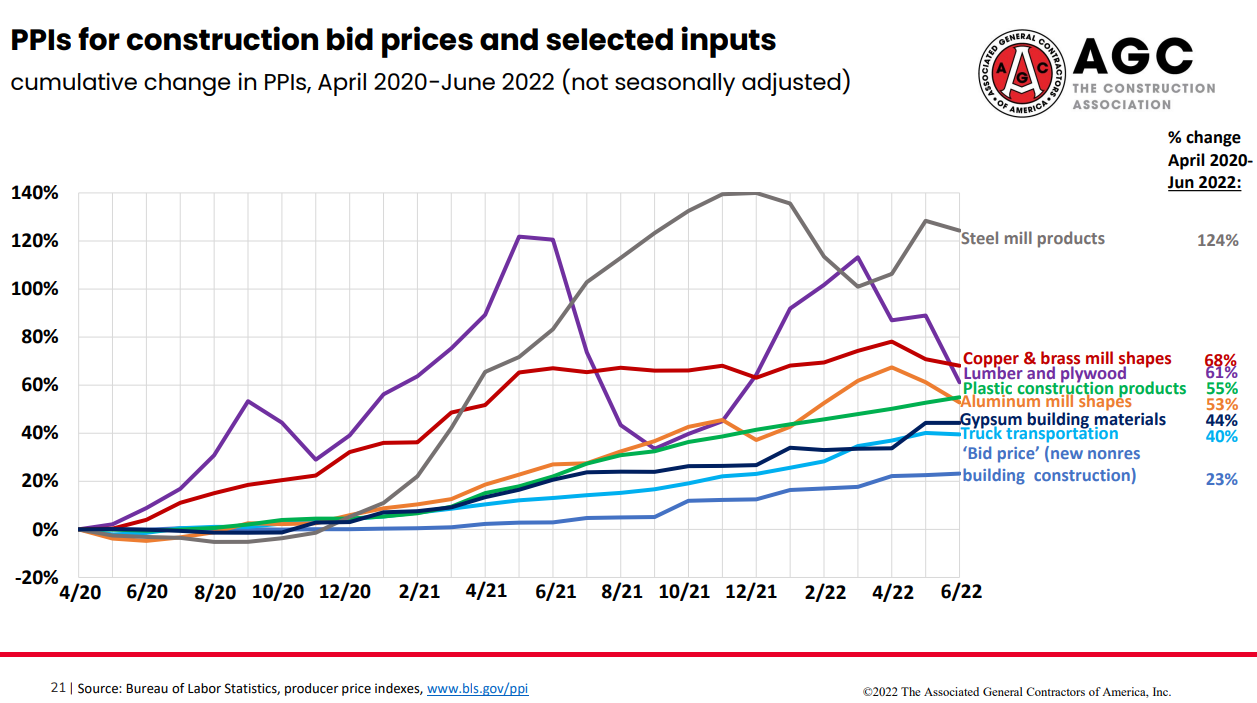

Check out the chart below, or Simonson’s complete presentation, which is here:

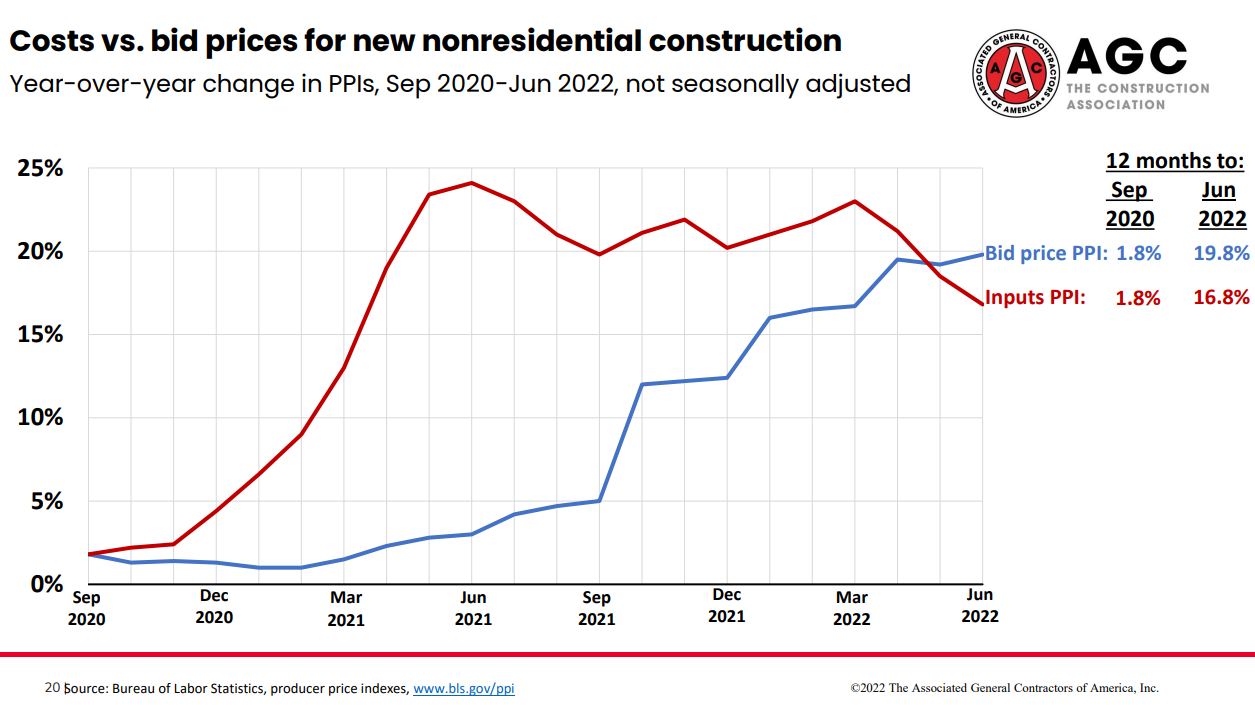

So why the optimism? Falling prices aren’t good for producers, but they’re good for consumers. And contractors are finally seeing some relief from the brutal price squeeze they’ve experienced for almost two years now.

The result: Bid prices are significantly above input costs for the first time since at least September 2020. Let’s remember that healthy customers are not a bad thing.

Another piece of good news is that infrastructure spending should begin to kick in as federal funds slowly translate into projects—notably for steel-intensive stuff like bridges, which Simonson said should help demand for products like steel plate.

In short, when it comes to stuff, supply has caught up to demand—and so prices are falling. But there are good reasons to be optimistic about demand over the longer term, which should help to ease some of the heartache caused by price volatility.

Labor, a Bigger Problem Than Price?

The bigger concern might be over labor. Markets, it turns out, are relatively efficient when it comes to balancing supply and demand of goods. They’re not (at least as currently configured) very good at balancing supply and demand of people.

Developing a skilled construction workforce will take time—and probably a combination of higher wages, legislation, and better marketing about what it means to be a construction worker these days. (Yes, it’s still hard hats. But also drones.)

Simonson suggested in the meantime easing immigration restrictions to allow more skilled construction workers to enter the US. That makes sense. But is it realistic to expect movement on an issue like immigration that has become a political football?

On the issue of wages, Simonson also noted that the premium paid for construction workers relative to wages in other private sector industries has dropped from about 20–23% before the pandemic to 17.5% as of June 2022. That in the short term means more money will have to go toward pay, toward overtime, and toward investments in software and equipment that might reduce the need for more labor.

And wages are of course also an issue in ongoing contract negotiations between the United Steelworkers (USW) union and union-represented mills in both the US and Canada.

USW members at Stelco have been working without a new contract since a previous one expired at the end of June. USW Local 1005, which represents workers at Stelco’s mill in Hamilton, Ontario, says it is less optimistic about striking a deal.

It’s a similar story at Sault Ste. Marie, Ontario-based Algoma Steel. USW Local 2251, which represents hourly production workers at the mill, says it is not optimistic that a deal will be reached before its current contract expires at the end of the month.

Workers want more after seeing companies through the early, dangerous days of the pandemic in 2020 and after seeing those same companies reap windfalls in 2021 and into the first half of this year.

Does either development mean there will be a strike or lockout? No. Does it add yet more uncertainty to a market already exhausted by two years of unprecedented price volatility? Yes.

Another question worth asking is whether developments in Canada provide a preview of what’s to come in the US, where USW contracts with Cleveland-Cliffs and US Steel expire on Sept. 1.

Those talks are still in the relatively early stages. But it’s worth considering what a strike or lockout at either would do to steel prices—and to what extent that premium is or isn’t baked into current forecasts.

Am I predicting a strike or lockout in the US? No. Do I think it’s best to be prepared for all outcomes after the Black Swans of the pandemic and the war in Ukraine? You bet.

By Michael Cowden, Michael@SteelMarketUpdate.com