Prices

August 2, 2022

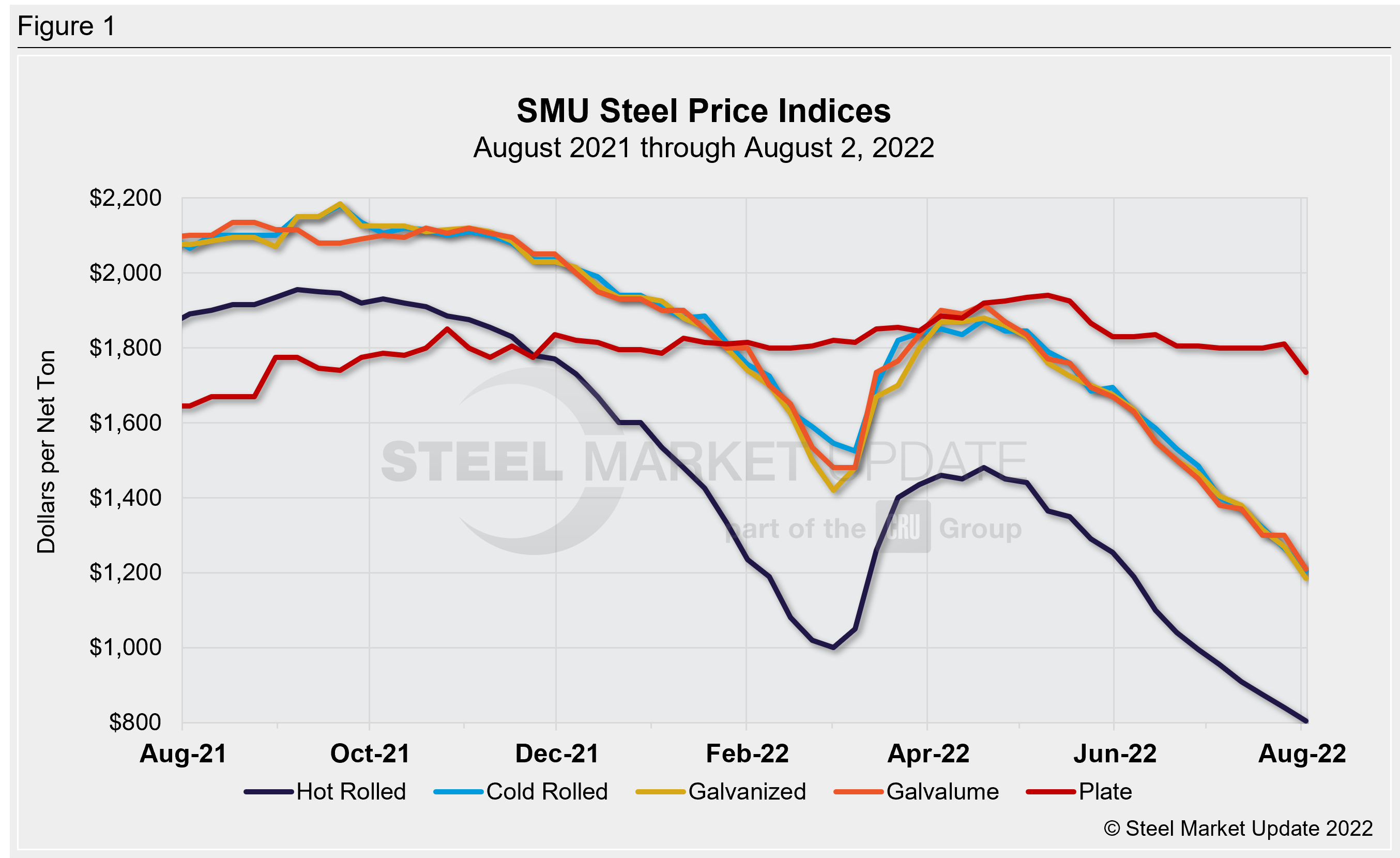

SMU Price Ranges: HR Clings to $800/ton, Coated Declines Accelerate

Written by Brett Linton

Sheet prices continued to move lower this week, and plate joined the downward trend following a price decrease announced last week by Nucor Corp.

Hot-rolled coil prices now have a tenuous grasp on $800 per ton ($40 per cwt).

SMU’s average HRC price stands at $805 per ton, down $35 per ton from last week and marking the lowest point for hot band prices since Dec. 1, 2020.

One new wrinkle: Price declines for cold-rolled and coated products are now outpacing those in HRC.

Case in point: SMU’s average galvanized base price is at $1,185 per ton, down $85 per ton from a week ago and marking the lowest price levels for galvanized product since early January 2021.

Plate prices, meanwhile, fell to $1,735 per ton on average, down $75 per ton from last week and marking the lowest point for plate tags since mid-August 2021.

All our price momentum indicators continue to point to Lower, which means we expect to see continued price declines over the next 30 days.

Hot Rolled Coil: SMU price range is $760–850 per net ton ($38.00–42.50/cwt) with an average of $805 per ton ($40.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3–6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,150–1,260 per net ton ($57.50–63.00/cwt) with an average of $1,205 per ton ($60.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week, while the upper end decreased $90 per ton. Our overall average is down $60 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4–8 weeks*

Galvanized Coil: SMU price range is $1,130–1,240 per net ton ($56.50–62.00/cwt) with an average of $1,185 per ton ($59.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to one week ago, while the upper end decreased $120 per ton. Our overall average is down $85 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,227–1,337 per ton with an average of $1,282 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–9 weeks*

Galvalume Coil: SMU price range is $1,180–1,240 per net ton ($59.00-62.00/cwt) with an average of $1,210 per ton ($60.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end decreased $160 per ton. Our overall average is down $90 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,474–1,534 per ton with an average of $1,504 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks*

Plate: SMU price range is $1,720–1,750 per net ton ($86.00–87.50/cwt) with an average of $1,735 per ton ($86.75/cwt) FOB mill. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $110 per ton. Our overall average is down $75 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 5–7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com