Analysis

August 17, 2022

US Light Vehicle Sales Hold in July

Written by David Schollaert

Steel Market Update is pleased to share this Premium content with Executive members. For information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

US light vehicle (LV) sales were largely unchanged in July, coming in at 1.13 million units, unadjusted. But last month’s total was an 11.6% decline year-on-year (YoY), the US Bureau of Economic Analysis (BEA) reported.

The YoY decline would have been steeper if it weren’t for the fact that sales were already lower than anticipated in July 2021 because of the chip shortage.

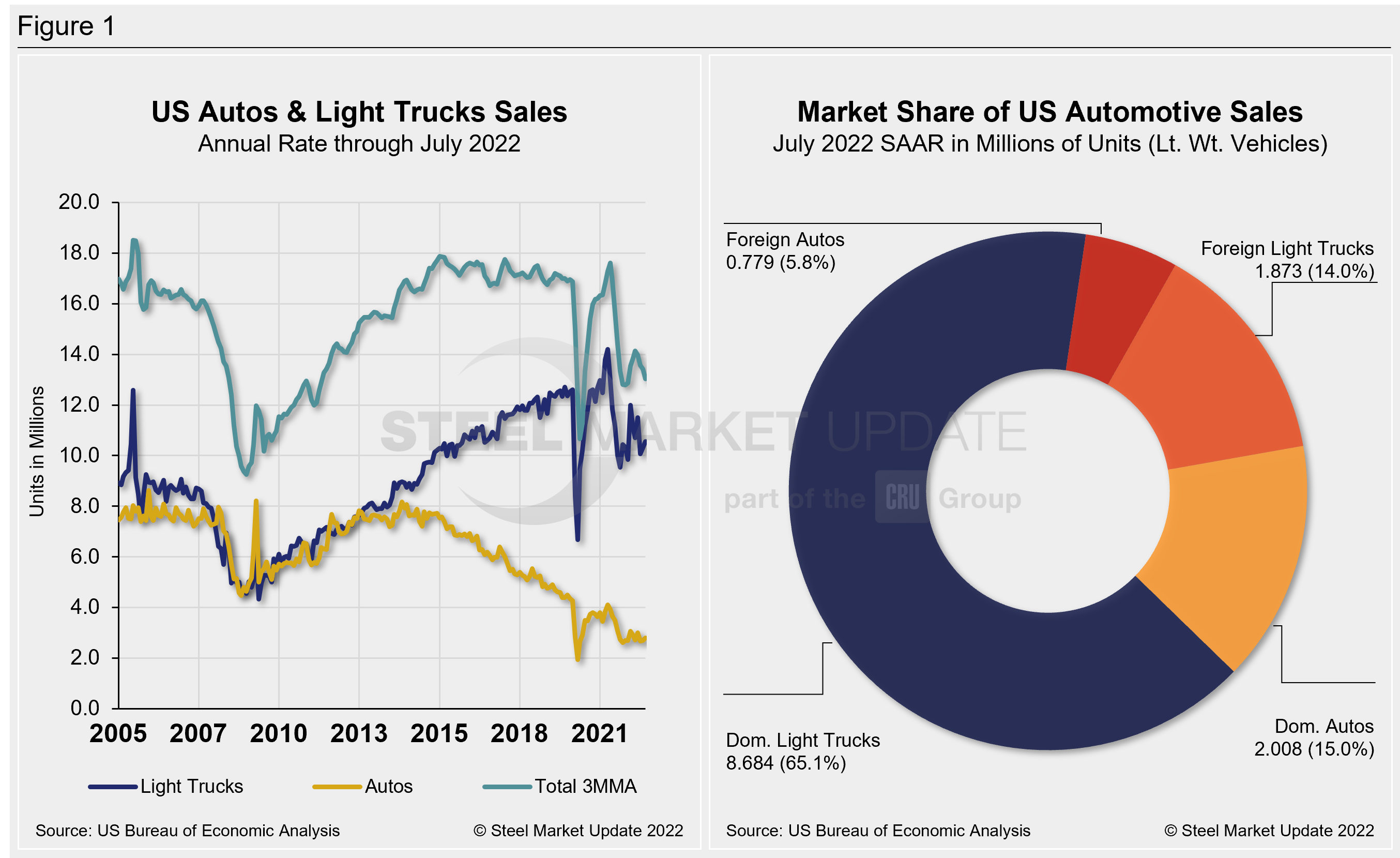

Annualized, last month’s results brought US vehicle sales up 2.5% month-on-month (MoM) to 13.4 million, though the reading came in slightly below the consensus forecast of 13.5 million.

The daily selling rate was 43,437 units, down from a reading of 47,437 last year. Through the first seven months of the year, sales have totaled 7.9 million—down 17.4% from last year’s tally.

The market remains supply constrained, but North American production is showing some promising signs of improvement. Year-to-date auto production is currently up 8.5% compared to last year. The current market supply is sitting around 28 days—up from February’s low of just 24 days.

Sales of both light trucks and passenger vehicles were higher in July, up 2.4% and 3.0%, respectively. Light trucks accounted for 79% of last month’s sales—up 2.8 percentage points from July 2021.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through July 2022, as well as the market share sales breakdown of July’s 13.35 million vehicles at a seasonally adjusted annual rate.

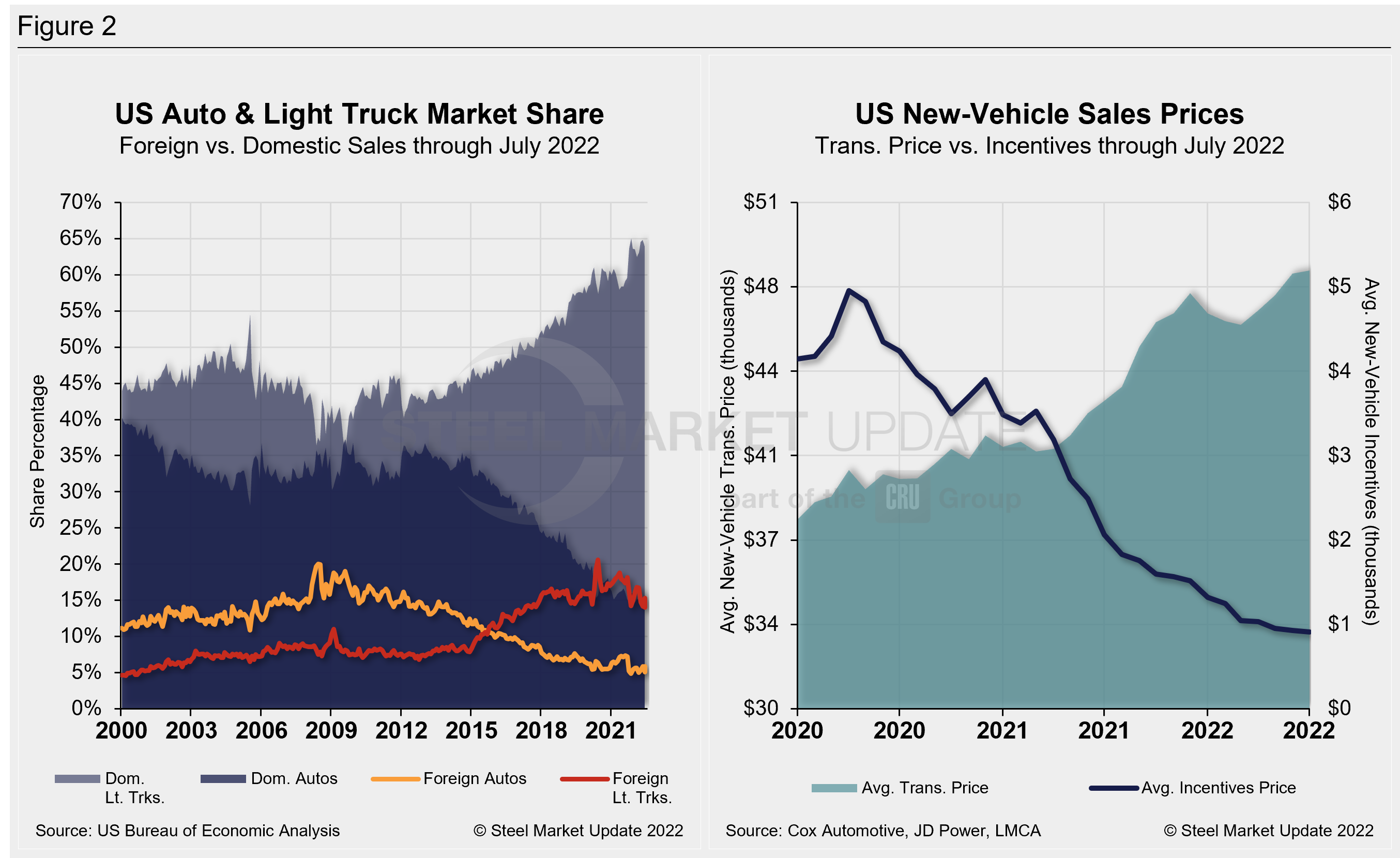

The modest improvement in inventories has so far done little to stem the tide on new vehicle prices. They are presently up over 11% YoY. The run-up in the average transaction price (ATP) continues to coincide with historically low incentives.

The combination of elevated prices, rising interest rates, and record low incentive offers have put a serious dent in buyer affordability. While pent-up demand remains, current conditions will almost certainly lead to some demand destruction.

New-vehicle ATPs rose to $48,182 in July, rising for the fourth straight month and hitting a new record high. Prices were up just 0.3% (+$139) in July versus the prior month and are 12.7% (+$5,419) above the year-ago period, according to Cox Automotive data.

Incentives dropped to a record low of $911 in July, remaining below the $1,000 mark for the third straight month, just roughly 1.9% of the average transaction price. Incentives are down 55.9%, or $1,154, YoY.

In July, the annualized selling rate of light trucks was 10.557 million units, up 2.4% versus the prior month but down 5.5% YoY. Auto annualized selling rates were similar during the same periods: up 3.2% and down 20.2%, respectively.

Figure 2 details US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Canada and Mexico saw varying dynamics in June. In Canada, LV sales are estimated to have declined by 5.8% YoY in July to 147,000 units. The selling rate grew to 1.58 million units annualized, but the underlying picture is still of a downbeat environment in which supply is squeezed and demand is being hampered by rising interest rates.

On the other hand, Mexican auto sales grew by 1.2% YoY in July to 83,000 units. The selling rate decelerated, though, to 1.04 million units annualized, the worst rate since January.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. Specifically, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com