Prices

September 12, 2022

Apparent Steel Supply Ticks Up 2% in July

Written by Brett Linton

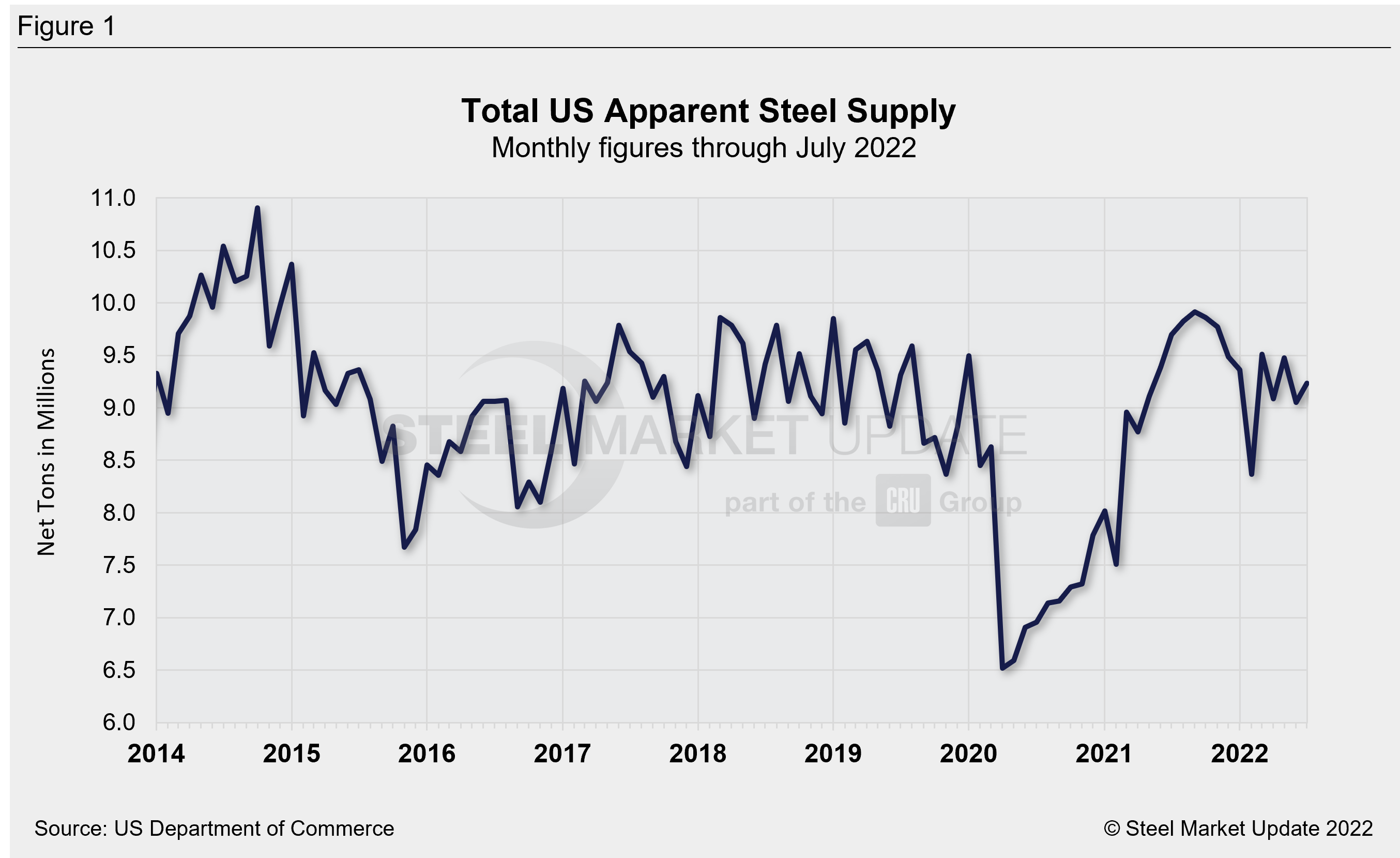

US apparent steel supply recovered 2% in July to 9.23 million net tons, according to the latest US Department of Commerce and American Iron and Steel Institute data. July supply levels are 2% below the average monthly rate across the past year of 9.41 million tons. Recall that supply reached a six-year high last September at 9.92 million tons, declining each month through February to a one-year low of 8.37 million tons.

Apparent steel supply, a proxy for demand, is determined by combining domestic steel mill shipments and finished US steel imports, then deducting total US steel exports.

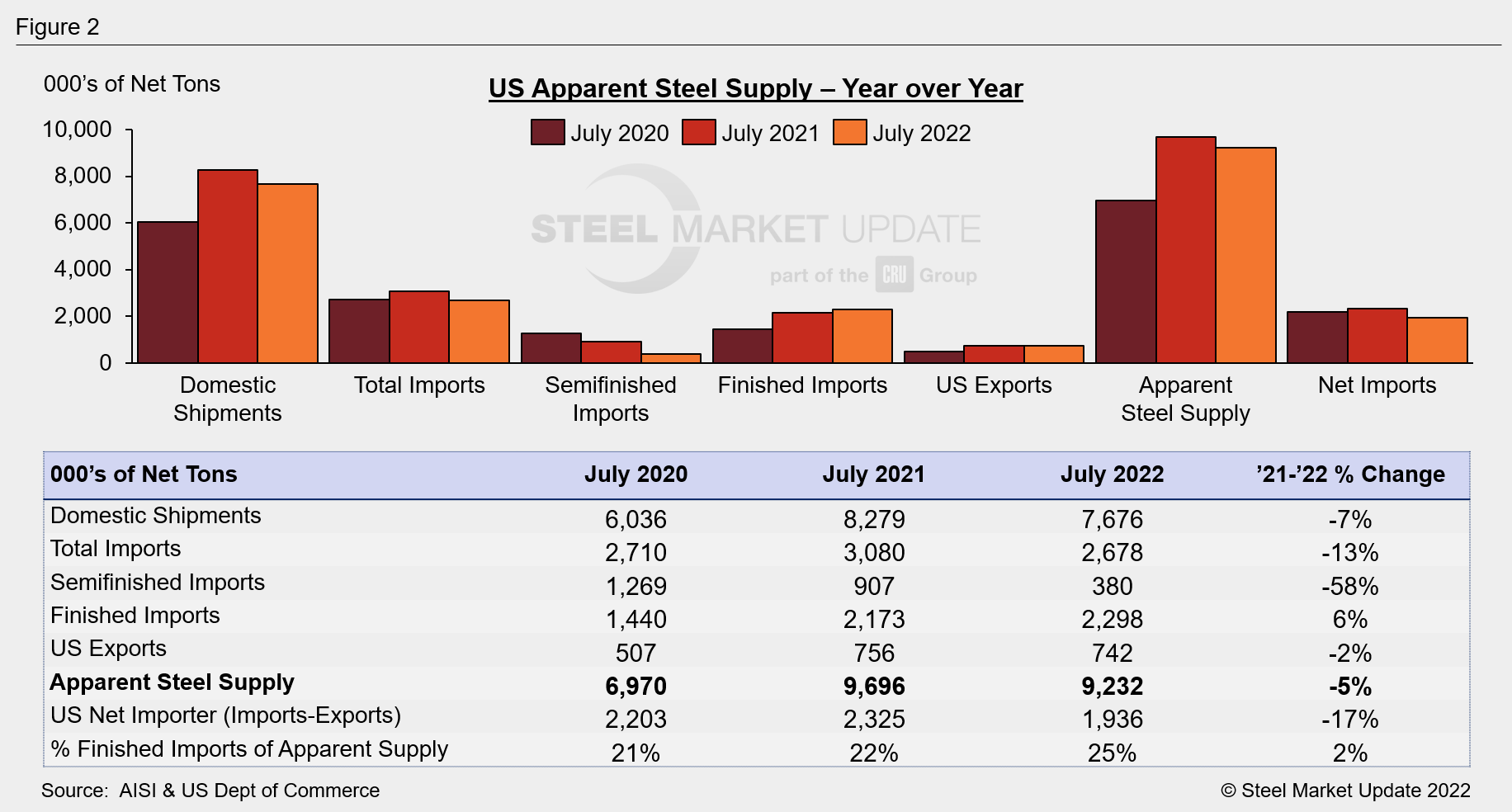

July apparent supply was 465,000 tons lower than the same month one year ago when supply was 9.70 million tons. This 5% decline was primarily due to a 603,000-ton decrease in domestic shipments, reduced by a 124,000-ton increase in finished imports and a 14,000-ton decrease in exports. The net trade balance between US steel imports and exports was at a surplus of 1.94 million tons imported in July, 17% less than levels one year prior. Finished steel imports accounted for 25% of supply in July, up from 22% this time last year. The graphic below shows July trade statistics for each of the past three years.

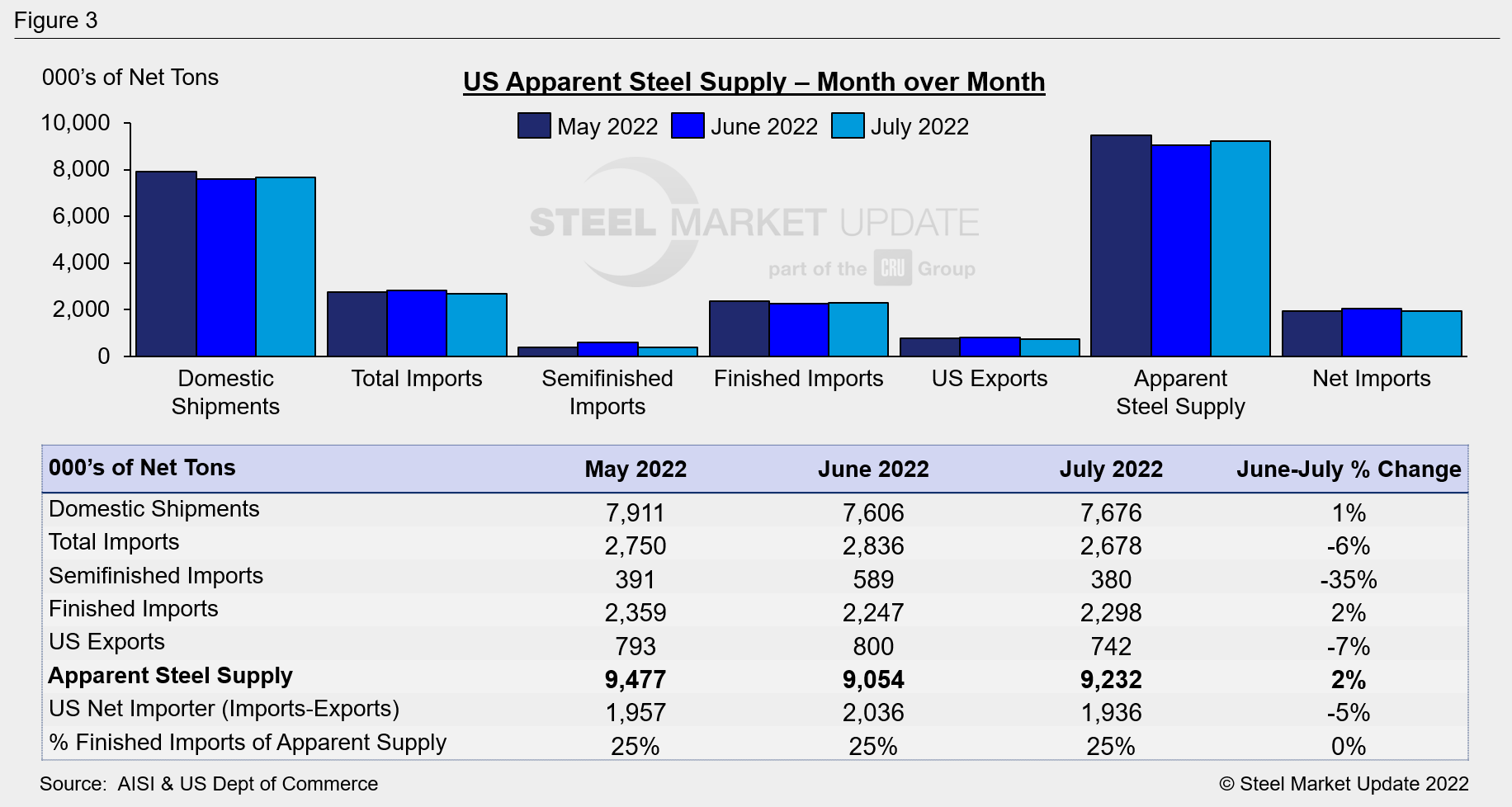

Compared to June when apparent supply was 9.05 million tons, July’s supply increased by 178,000 tons. This 2% rise was primarily due to a 70,000-ton increase in domestic shipments, followed by a 58,000-ton decline in steel exports and a 50,000-ton increase in finished imports. The net trade balance between imports and exports in July fell 5% from June. The percentage of apparent steel supply composed of finished steel imports remained steady at 25%. The graphic below shows monthly statistics over the last three months.

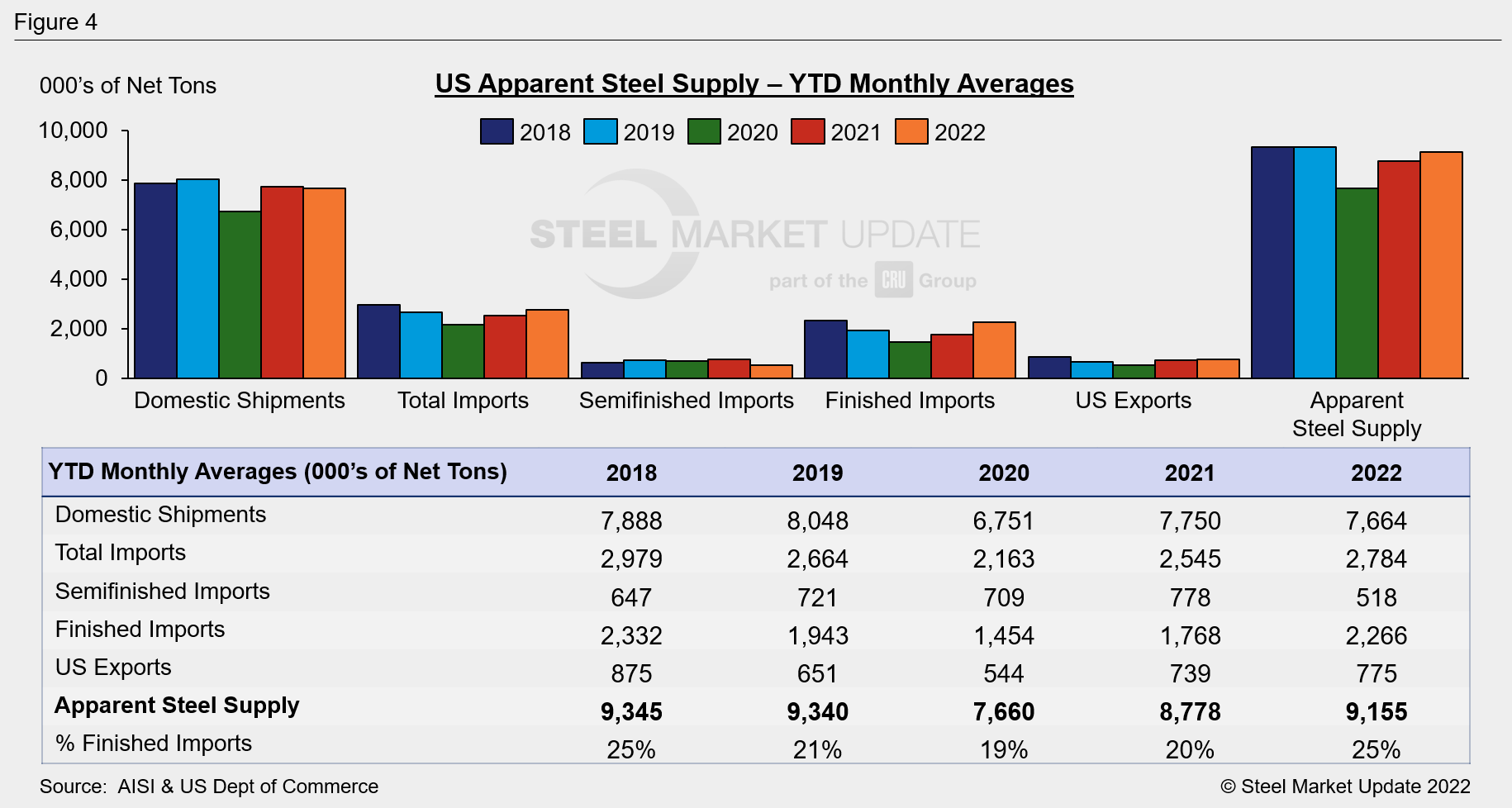

The figure below shows year-to-date monthly averages for each statistic over the last five years. The average monthly apparent supply level for the first seven months of 2022 continues to improve compared to the same periods in 2020 and 2021. It is now back in line with the monthly averages of most previous years shown.

Apparent supply for the entire year of 2021 totaled 110.3 million tons, up 22% from 90.3 million tons in 2020, and up 1% from 109.5 million tons in 2019. In Steel Market Update’s 13-year data history, 2014 holds the annual record at 119.5 million tons.

To see an interactive graphic of our Apparent Steel Supply history, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com