Market Data

October 3, 2022

ISM: US Manufacturing Slowed in September

Written by David Schollaert

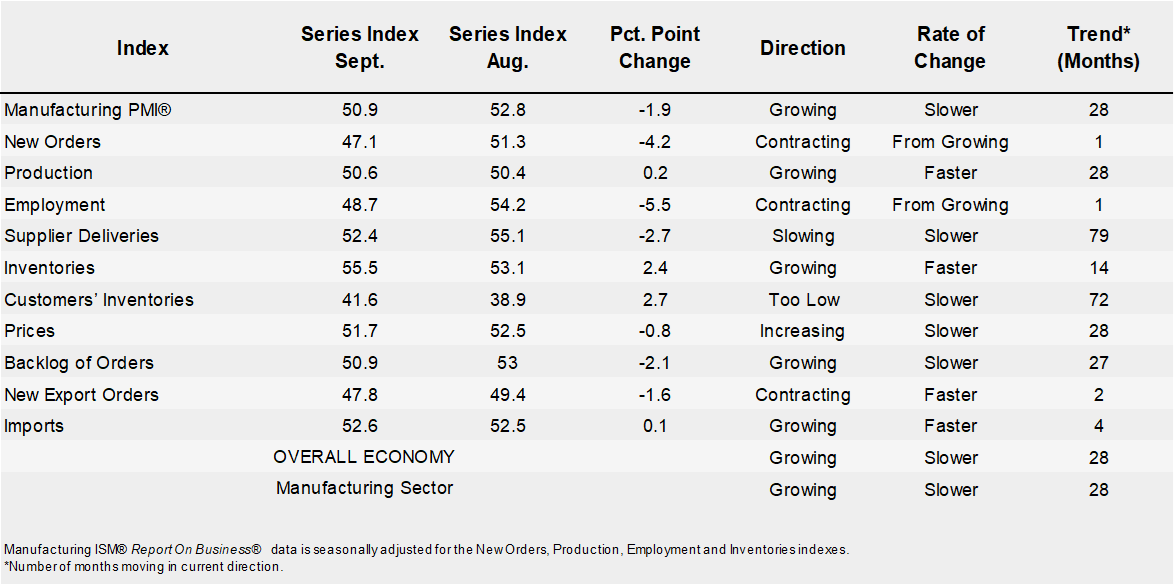

US manufacturing activity grew at its slowest pace in nearly two-and-a-half years in September, according to the Institute for Supply Management (ISM). Though still expanding last month, manufacturing was slowed as new orders contracted amid aggressive interest rate increases from the Federal Reserve meant to cool demand and tame inflation.

The ISM’s report also showed a measure of manufacturing employment contracted last month for the fourth time this year. A gauge of inflation at the factory gate decelerated for a sixth straight month.

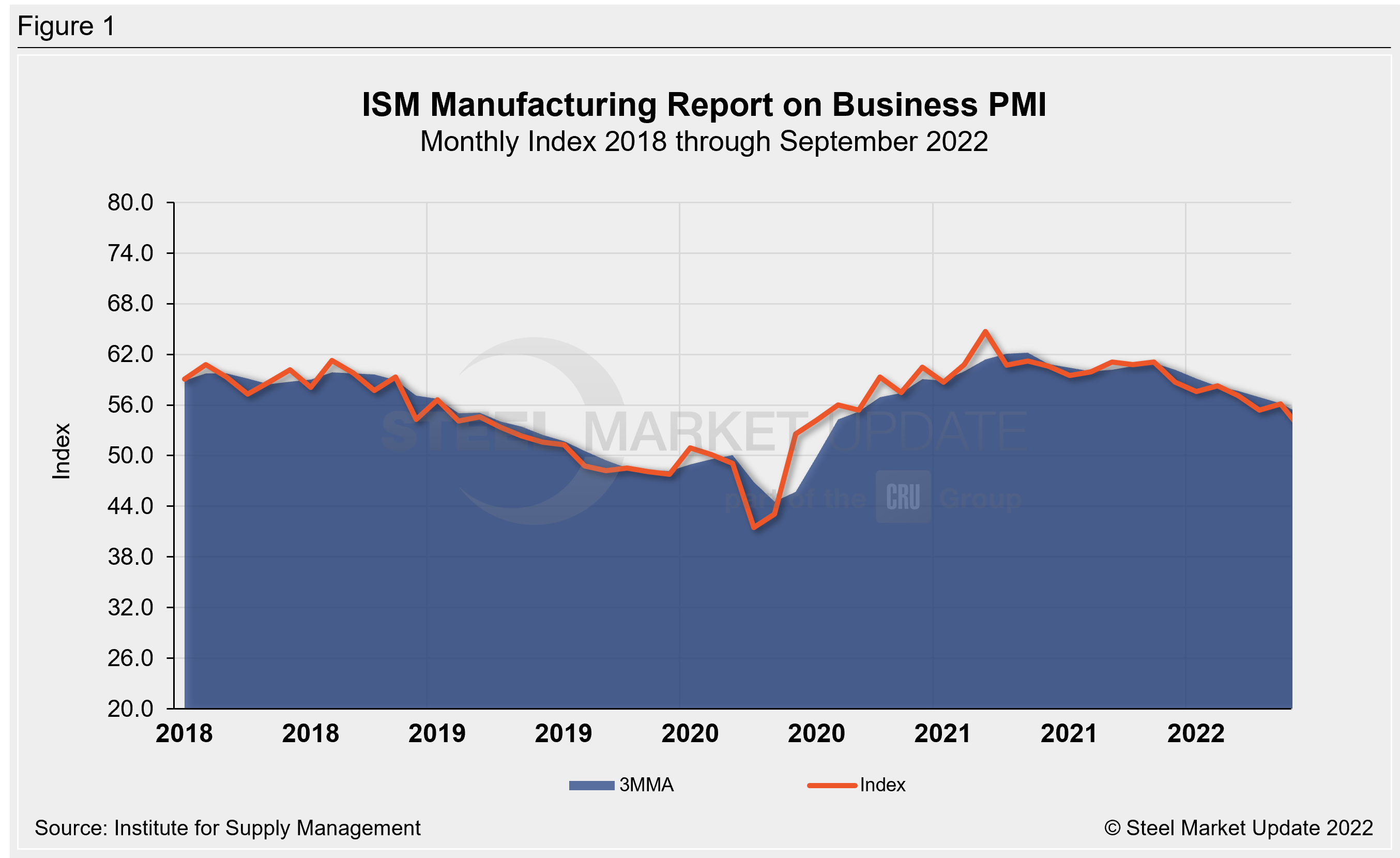

September’s Manufacturing PMI fell to 50.9%, down from 52.8% in August and the lowest reading since May 2020. Despite the month-on-month decline, September’s result marked the 28th consecutive month of expansion, as any index reading above 50% indicates growth in the manufacturing sector.

“The US manufacturing sector continues to expand, but at the lowest rate since the pandemic recovery began,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “Companies are now managing headcounts through hiring freezes and attrition to lower levels, with medium- and long-term demand more uncertain.”

Fiore, however, noted that firms didn’t provide feedback on large-scale layoffs, indicating that “companies are confident of near-term demand.”

Nine manufacturing industries, including machinery, transportation equipment, and computer and electronic products reported growth. Furniture and related products as well as textile mill and wood products were among the seven industries reporting a contraction.

The report’s forward-looking new orders sub-index fell to 47.1 in September, down from 51.3 the month prior and the lowest reading since May 2020. It was the third time this year that the index has contracted.

An interactive history ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com