Prices

October 6, 2022

SMU Price Analysis: Galvanized Premium Over Hot Rolled Shrinking

Written by Brett Linton

The spread between hot-rolled coil and galvanized base prices has narrowed further since our September update, now standing at a 28-week low. This is now the second lowest level seen in the past 10 months, just behind the March 2022 low of $300 per net ton.

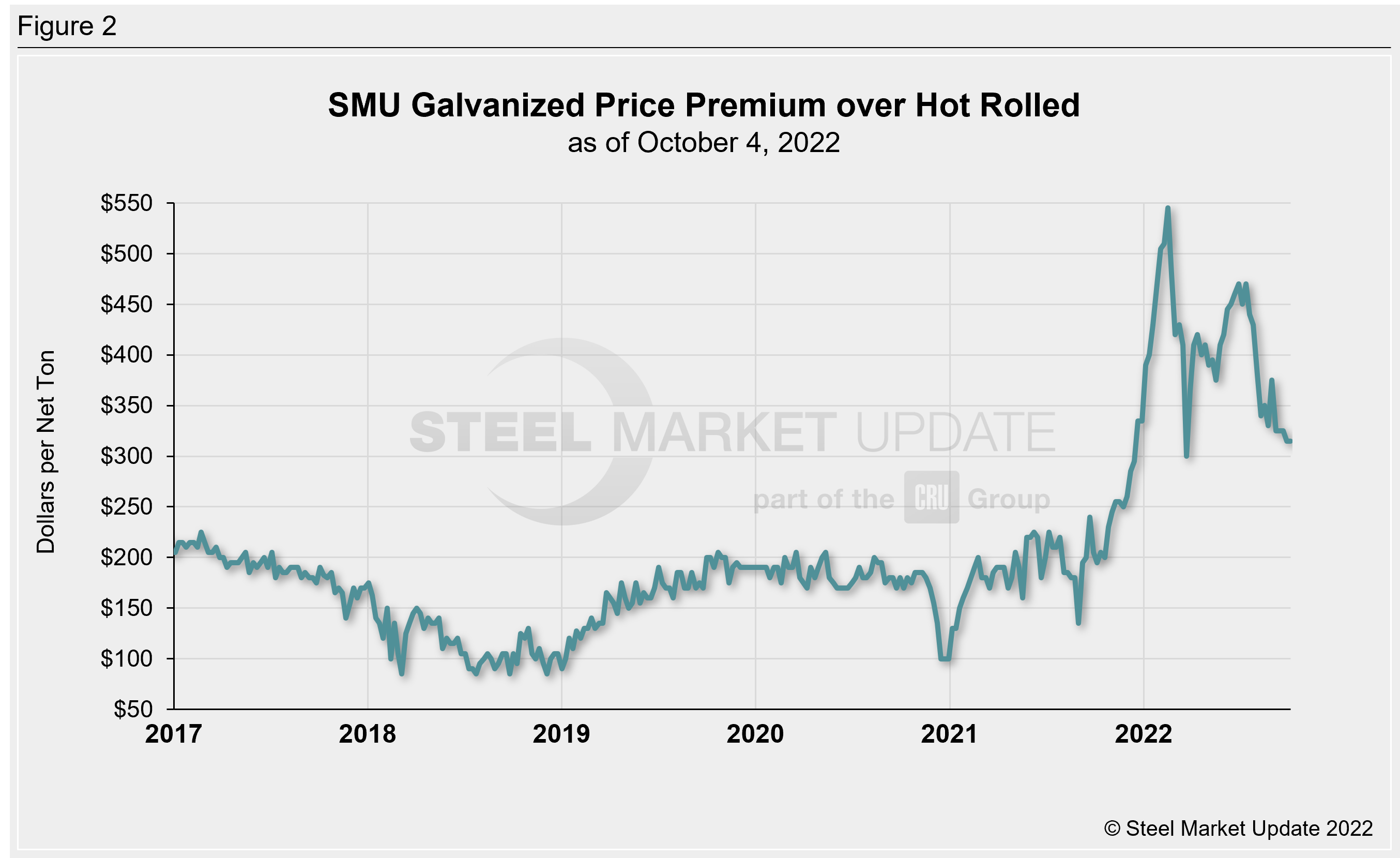

The relationship between hot rolled and galvanized prices has been volatile since late 2021. In the last year, galvanized has sold at a premium of as little as $195 per ton over hot rolled to as much as $545 per ton ($9.75-$22.25 per cwt) higher. The premium reached a record high in February, quickly narrowed in March, and has bounced around since then.

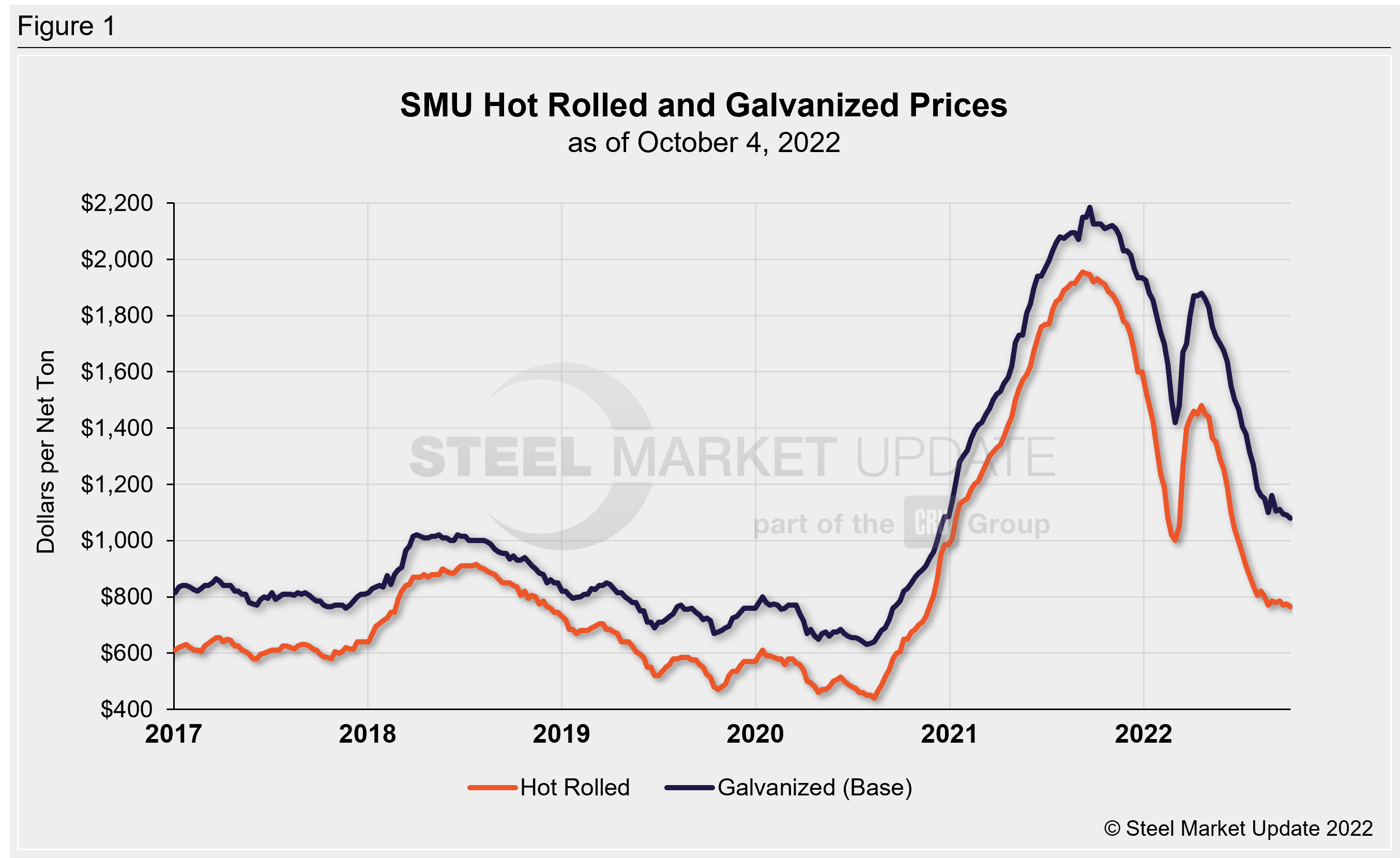

SMU’s hot-rolled coil price averaged $765 per ton ($38.25 per cwt) on Tuesday of this week, the lowest level seen since Nov. 2020. Recall our index had reached a record-high of $1,955 per ton in Sept. 2021. Our latest galvanized price index averaged $1,080 per ton ($54.00 per cwt) this week and has decreased 22 of the past 24 weeks. Galvanized prices are now at a 21-month low, having peaked at $2,185 per ton last September.

As shown in the graph below, galvanized held a premium of $80-$220 per ton over hot rolled for the last few years, exceeding that range in late 2021. Recall the premium rapidly rose to a peak of $545 per ton in mid-February, falling almost as quickly thereafter to reach a low of $300 per ton on March 22. The premium this week is $315 per ton, a 27-week low. The premium average in September was $323 per ton, down from $355 per ton in August and down from $448 per ton in July.

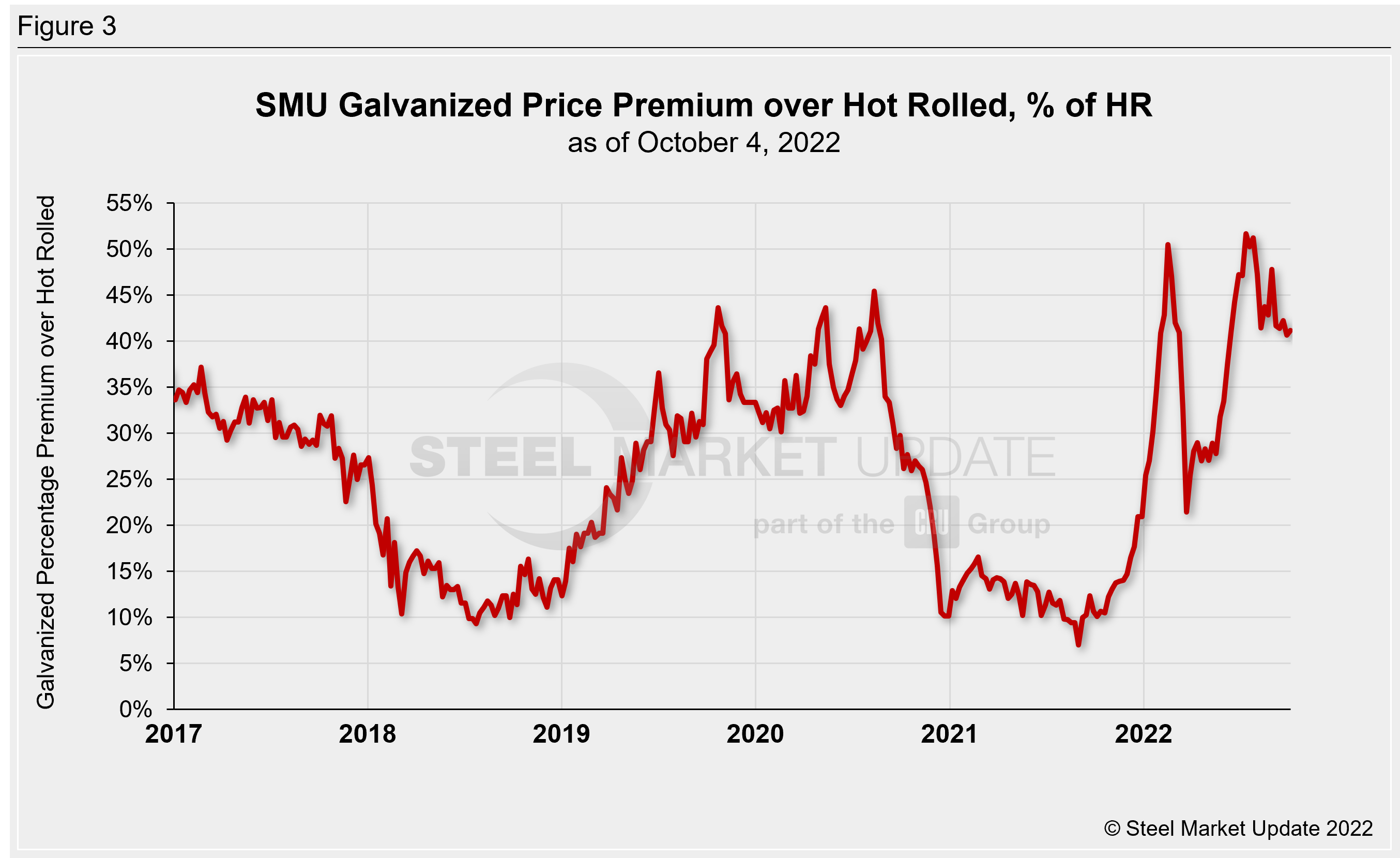

To better compare this price spread, we graphed the galvanized price premium over hot rolled as a percentage of the hot rolled price. This is an attempt to paint a clearer comparison against historical pricing data. As shown in the graphic below, the percentage premium is not as alarming compared to the dollar value premium, but it is still significantly higher compared to most past cycles. Galvanized prices held an average premium of 24% above hot rolled prices from 2017 through the end of 2021. In 2021, that premium averaged just 13%, while 2022 YTD now averages 38%. The premium rose to a (then) record high of 50% in February 2022. We surpassed that high in July at 52%. The latest premium has eased to 41% but remains historically high. The average premium in September was 41%, down from 45% in August and 50% in July.

By Brett Linton, Brett@SteelMarketUpdate.com