Analysis

October 7, 2022

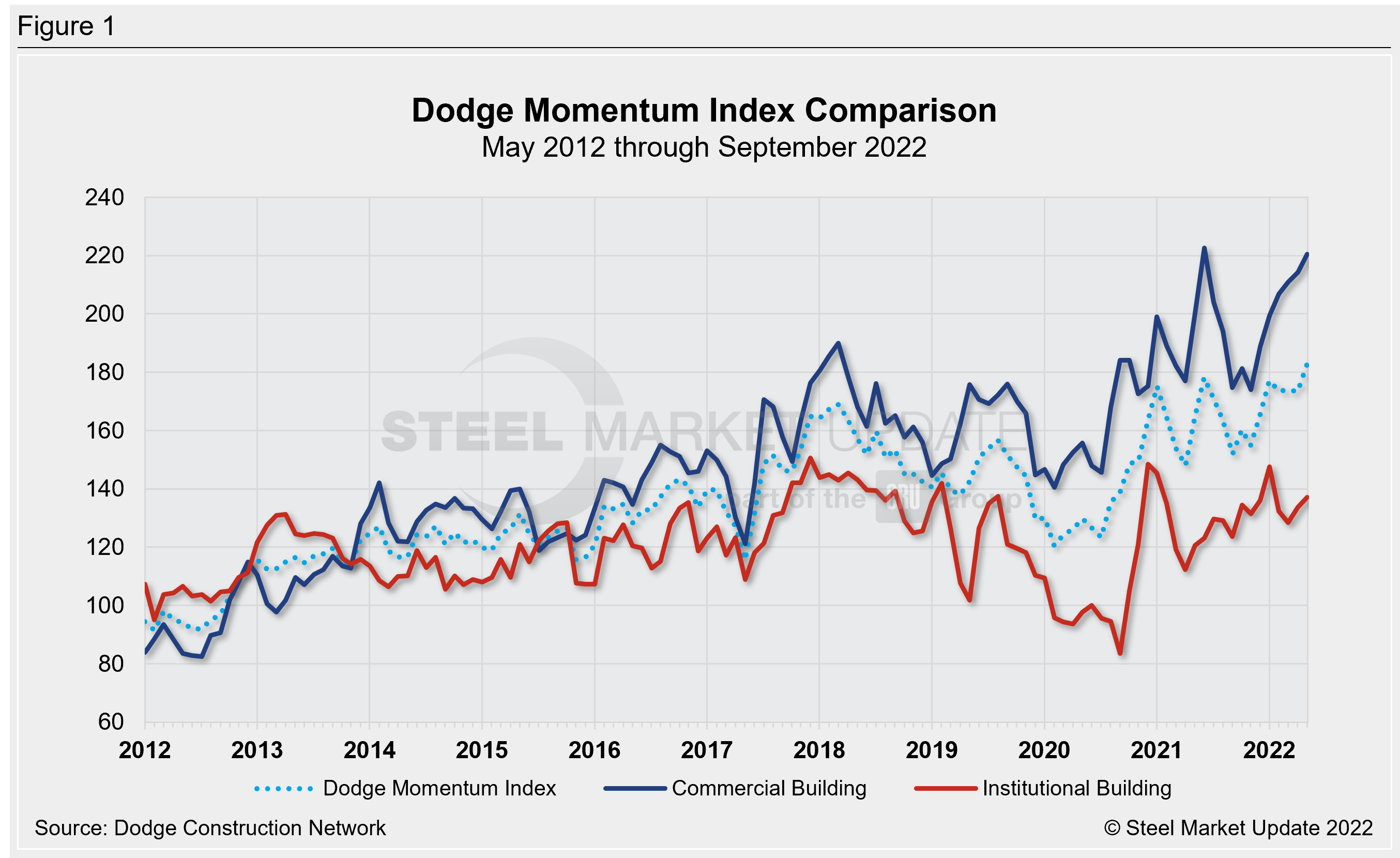

Dodge Momentum Index Rebounds in September

Written by David Schollaert

The Dodge Momentum Index saw a sizable increase in September, accelerating by 5.7% last month over the upwardly revised reading for August, according to data and analytics from the Dodge Construction Network. The index registered 183.2 in September, up from 173.4 in August.

The leading index for commercial real estate measures data about planned nonresidential building projects to track spending in the sector. For September, the subcomponents move in parallel, with the institutional component of the Momentum Index rising 11.7% while the commercial component increased by 2.9%.

September’s increase in the headline index, according to the report, was bolstered primarily by an influx of data centers entering the planning queue. The institutional component saw a notable increase in research and development laboratory projects in education, with solid contributions from healthcare and recreation projects entering the planning process as well.

September’s gain places the total within 5% of the headline index’s all-time high.

Compared to September 2021, the overall Momentum Index was 26% higher last month. The institutional component was up 28%, while the commercial component was 25% higher on a year-over-year basis.

The report noted that a total of 39 projects with a value of $100 million or more entered planning in September, with a pair of $500 million commercial projects in Virginia and Upstate New York topping the list, followed by a $311 million casino in Idaho and another $300 million laboratory project in the Boston suburbs.

“The gain in the Momentum Index and its components in September reassures us that despite whispers of recession, owners and developers are still looking to move forward with projects to meet demand,” said David Reaves, Dodge’s senior economist.

Although certain subsectors have shown resilience since the pandemic’s onset, such as data center projects, and continue to stream into the planning pipeline, looming challenges remain. They include supply shortages and the rising cost of materials, which Reaves says, “could chip away at the flow of new projects if inflation is not tempered.”

An interactive history of the Dodge Momentum Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com