Market Data

November 1, 2022

ISM: US Manufacturing Still Easing in October

Written by David Schollaert

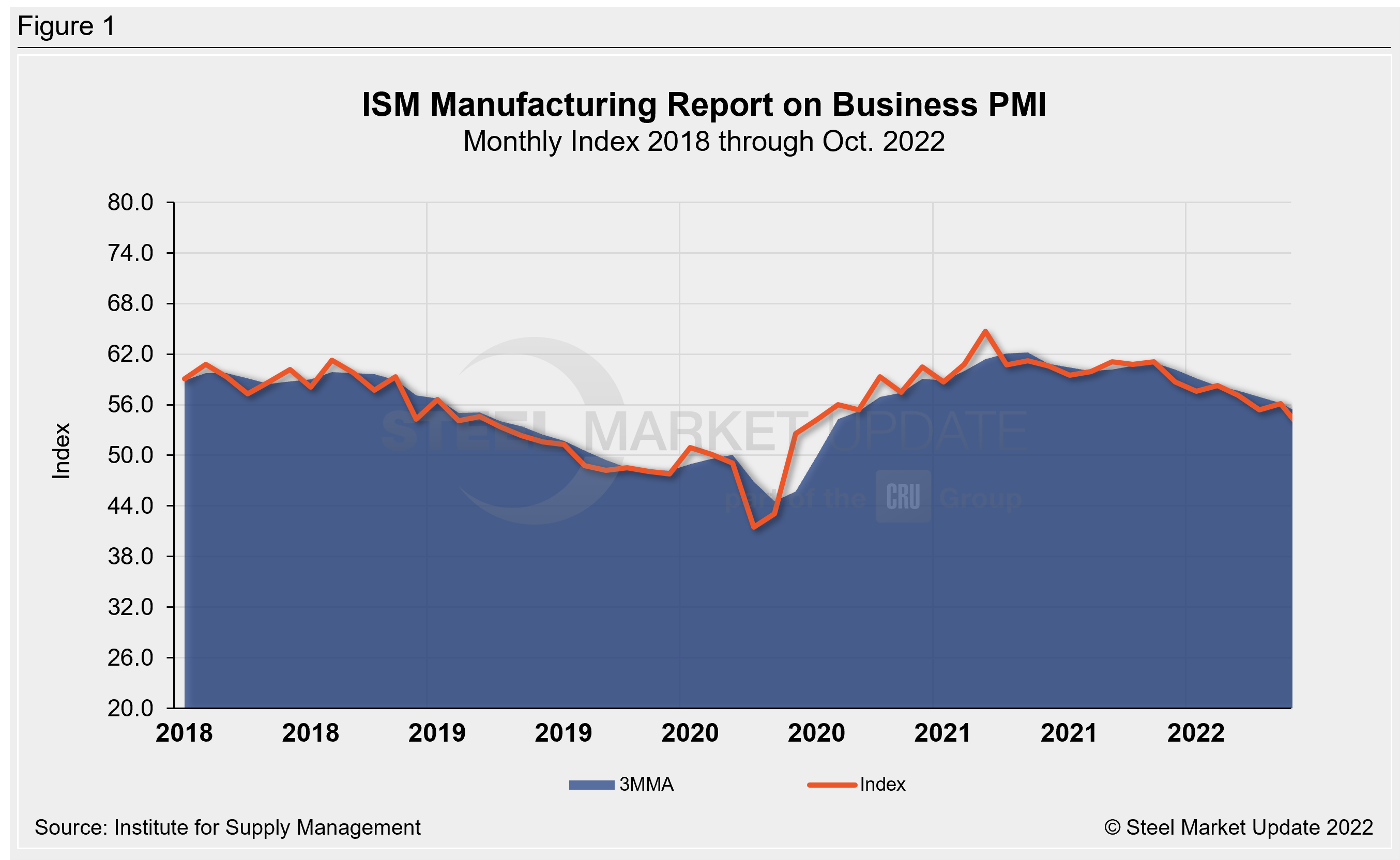

US manufacturing activity grew at its slowest pace since May 2020, nearly falling in October to the neutral 50.0 mark — the level that typically divides expansion from contraction, according to the Institute for Supply Management (ISM). The latest update was slightly ahead of consensus forecasts of a neutral reading amid rising borrowing costs and continued inflationary pressures.

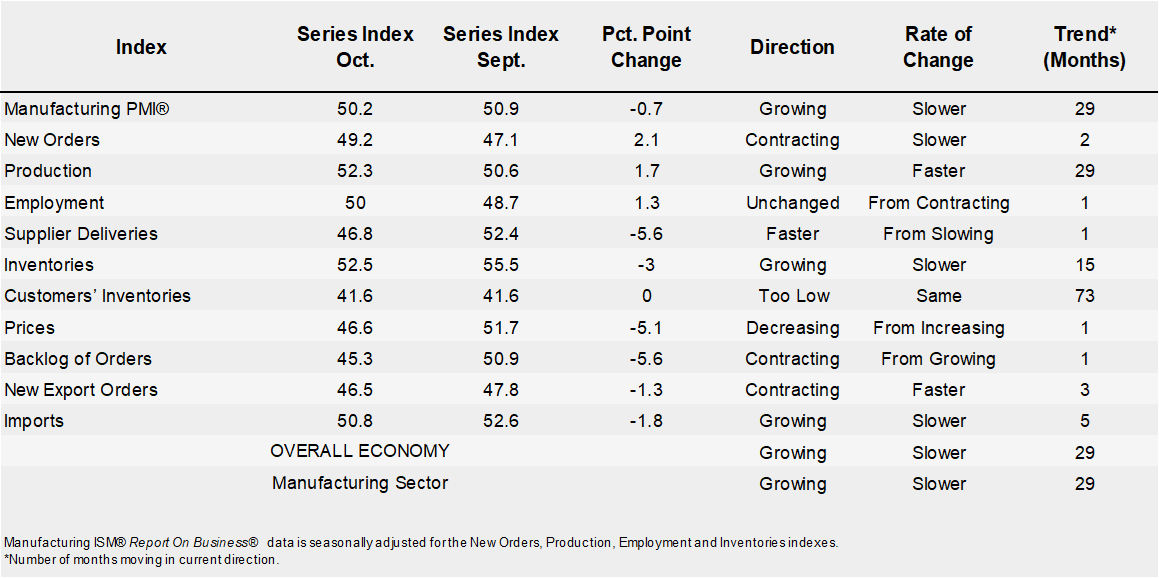

October’s manufacturing result was slowed as new orders remained in contraction territory, while prices also contracted — falling 5.1 percentage points month-on-month (MoM) to their lowest level in two and a half years.

The ISM’s report focused on the steady decline in the number of people quitting their jobs. The important gauge of wage growth fell for the second straight month, representing weakening wage inflation pressure.

October’s Manufacturing PMI fell to 50.2%, down from 50.9% in September, to the lowest reading since May 2020 when the pandemic recovery began. The latest reading, though down for the second straight month, marked the 29th consecutive month of expansion, as any index reading above 50% indicates expansion in the manufacturing sector.

“The US manufacturing sector continues to expand, but at the lowest rate since the pandemic recovery began,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “Like in September, mentions of large-scale layoffs were absent from panelists’ comments, indicating companies are confident of near-term demand. As a result, managing medium-term head counts and supply chain inventories remain primary goals.”

Fiore added that the backlog of orders declined, indicating that “buyers and sellers will begin to shore up order books and order streams to reduce share loss in the medium-to-long term.”

Eight manufacturing industries, including apparel, leather and allied products, machinery, transportation equipment, electrical equipment, and appliances and components reported growth. Furniture and related products, as well as textile mill and wood products, were among the seven industries reporting a contraction.

The report’s forward-looking new orders sub-index remained in contraction territory in October despite increasing to a reading of 49.2, up from 47.1 the month prior. It was the fourth time this year that the index has contracted.

An interactive history ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com