Prices

November 1, 2022

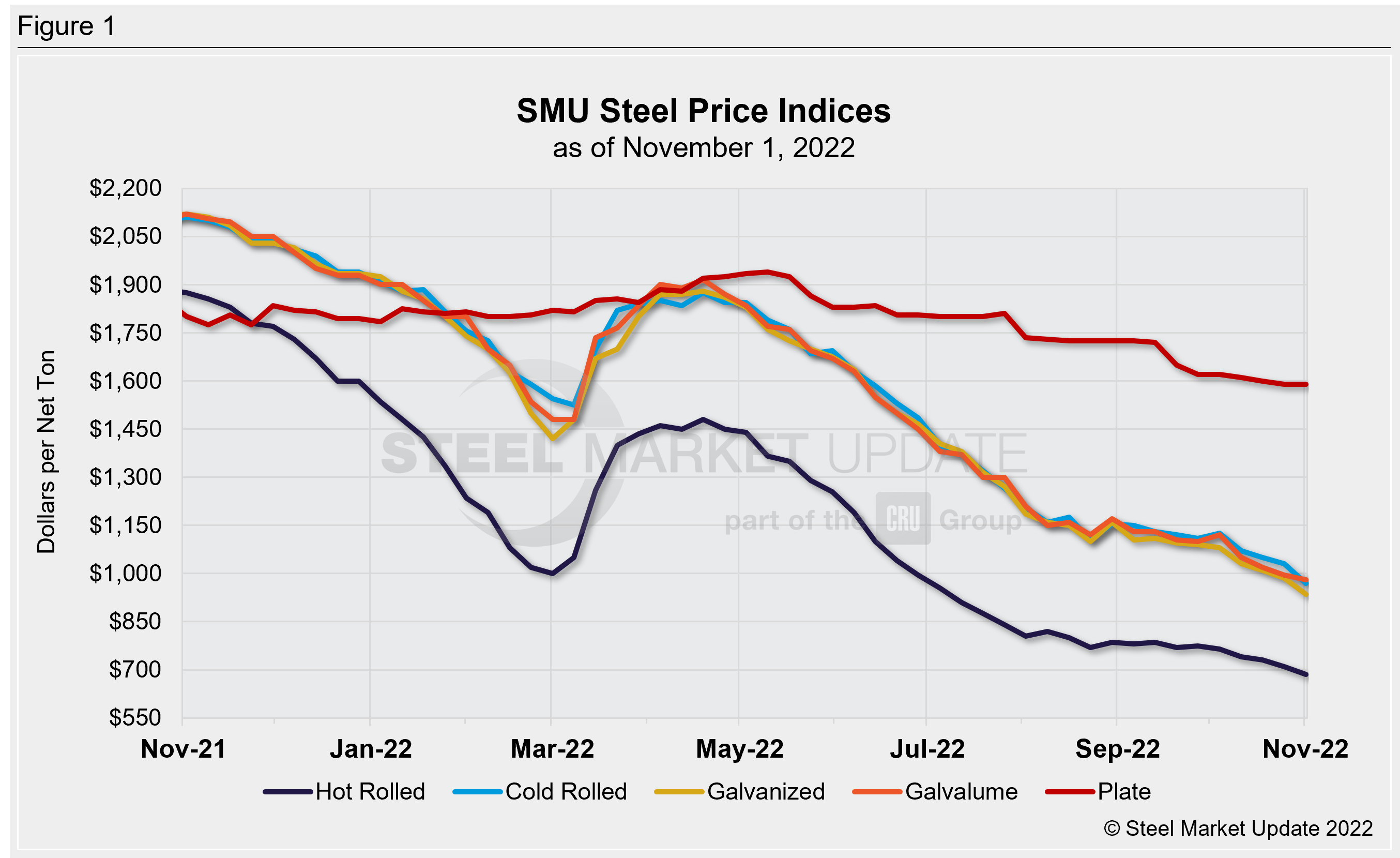

SMU Price Ranges: Pace of Declines Accelerates Into November

Written by Michael Cowden

Sheet and plate prices fell across the board once again this week as market participants continue to question when and where the market might bottom.

Some not long ago predicted that hot-rolled coil prices wouldn’t fall below $800 per ton ($40 per cwt). Our average price is now well below $700 per ton, with some sources predicting that imports, uneven demand, and lower scrap prices could bring steel prices lower still.

SMU’s benchmark HRC price stands at $685 per ton, down $25 per ton from $710 per ton last week and marking the lowest point for HRC prices since late October 2020 — more than two years ago.

Cold-rolled coil (down $60/ton) and galvanized base (down $50/ton) fell more sharply than hot rolled, with sources reporting that mills were willing to undercut one another even for truckload-size orders on the coated side.

Plate held steady this week. But some buyers continue to report that mills are selling below Nucor’s list price — which has become a common point of reference in the market.

All price momentum indicators remain at Lower, with market participants predicting that flat-rolled steel prices could continue to fall into December before perking up as lead times stretch into the first quarter of 2023.

Hot-Rolled Coil: SMU price range is $640–730 per net ton ($32.00–36.50/cwt) with an average of $685 per ton ($34.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on hot-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: SMU price range is $940–1,000 per net ton ($47.00–50.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $60 per ton compared to last week. Our overall average is down $60 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold-Rolled Lead Times: 4–8 weeks

Galvanized Coil: SMU price range is $890–980 per net ton ($44.50–49.00/cwt) with an average of $935 per ton ($46.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $50 per ton compared to one week ago. Our overall average is down $50 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $987–1,077 per ton with an average of $1,032 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks

Galvalume Coil: SMU price range is $940–1,020 per net ton ($47.00-51.00/cwt) with an average of $980 per ton ($49.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $30 per ton. Our overall average is down $15 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,234–1,314 per ton with an average of $1,274 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–7 weeks

Plate: SMU price range is $1,560–1,620 per net ton ($78.00–81.00/cwt) with an average of $1,590 per ton ($79.50/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com