Prices

November 8, 2022

SMU Price Ranges: Flat-Rolled Steel Falls (Yet Again)

Written by Michael Cowden

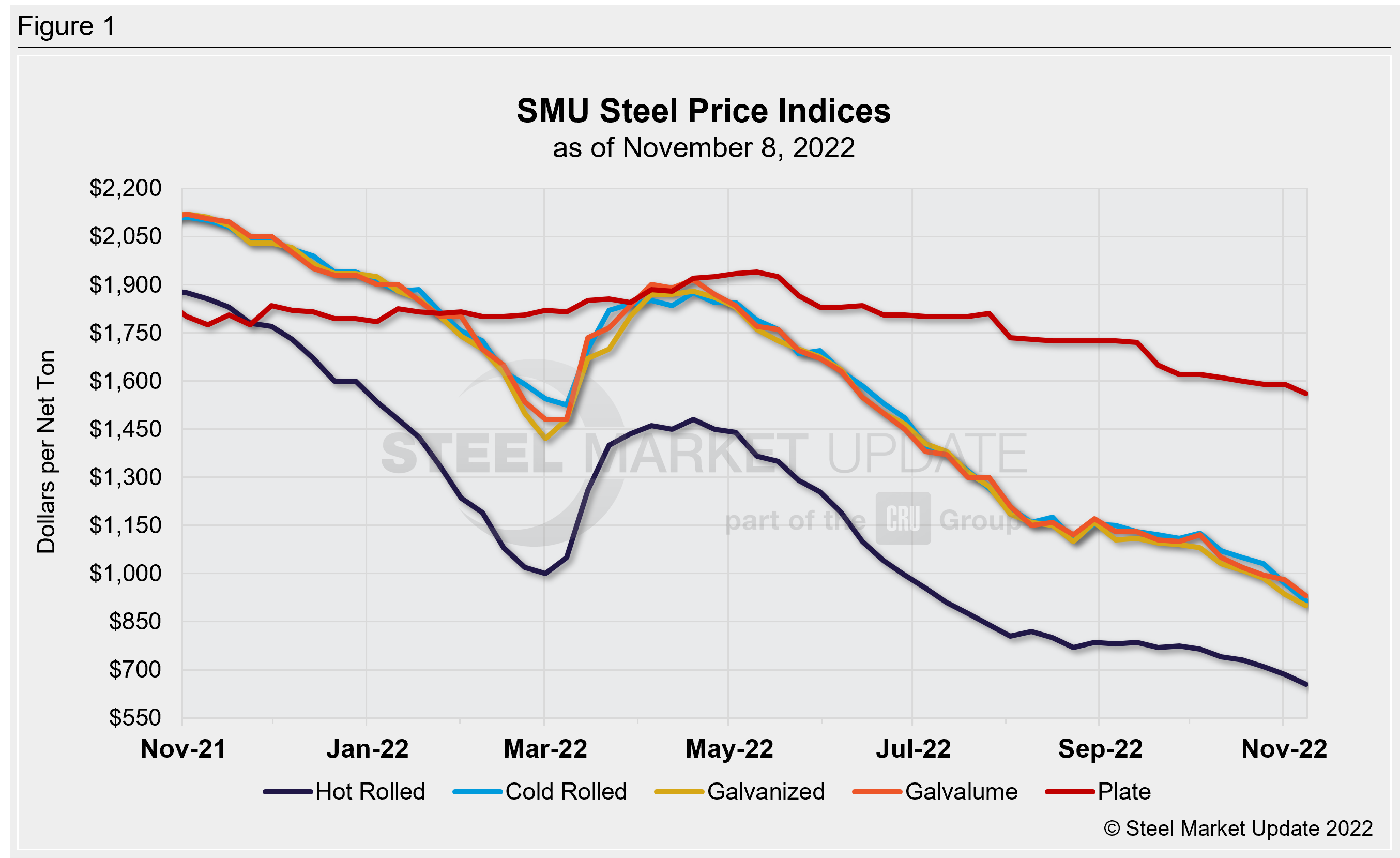

Sheet prices fell across the board again this week as the slow grind lower that we’ve seen since last spring continued to gain speed.

Hot-rolled coil prices fell $30 per ton ($1.50 per cwt) week-over-week. Declines in coated products were more pronounced, with cold rolled down $55 per ton, galvanized down $35 per ton, and Galvalume off by $50 per ton.

HRC prices are at their lowest levels in more than two years. And cold-rolled and coated products are nearing two-year lows as well.

Even plate, which has been remarkably stable compared to sheet, saw prices slip $30 per ton this week. That said, plate prices remain more than double the $670 per ton they were at in November 2020.

Spreads between lows and highs have ballooned, which is not unusual when prices are inflecting higher or lower. And because prices are clearly inflecting lower, we’ve kept all of our pricing momentum indicators pointing that way.

Hot-Rolled Coil: SMU price range is $620–690 per net ton ($31.00–34.50/cwt) with an average of $655 per ton ($32.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $30 per ton from last week. Our price momentum indicator on hot-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: SMU price range is $880–950 per net ton ($44.00–47.50/cwt) with an average of $915 per ton ($45.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to last week, while the upper end decreased $50 per ton. Our overall average is down $55 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold-Rolled Lead Times: 4–8 weeks*

Galvanized Coil: SMU price range is $850–950 per net ton ($42.50–47.50/cwt) with an average of $900 per ton ($45.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $947–1,047 per ton with an average of $997 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks*

Galvalume Coil: SMU price range is $860–1,000 per net ton ($43.00-50.00/cwt) with an average of $930 per ton ($46.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end decreased $20 per ton. Our overall average is down $50 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,154–1,294 per ton with an average of $1,224 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–6 weeks*

Plate: SMU price range is $1,500–1,620 per net ton ($75.00–81.00/cwt) with an average of $1,560 per ton ($78.00/cwt) FOB mill. The lower end of our range decreased $60 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $30 per ton from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com