Analysis

November 17, 2022

NAHB: October Housing Starts Fall on Rising Costs

Written by David Schollaert

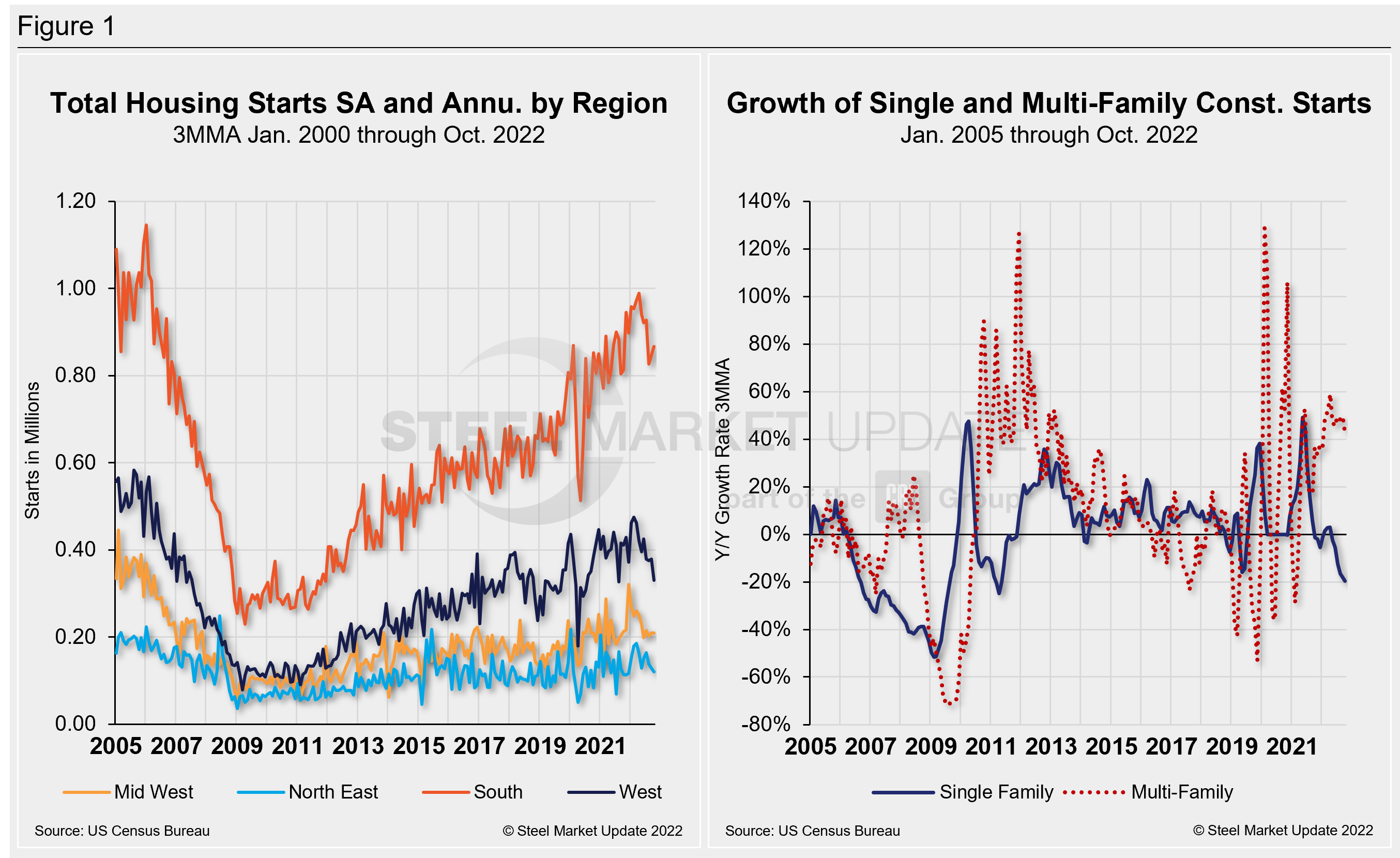

Housing starts fell by 4.2% in October to a seasonally adjusted annual rate of 1.43 million units, according to a report from the US Department of Housing and Urban Development and the US Census Bureau.

The decline came as elevated mortgage rates, rising construction costs, and waning demand stemming from high home costs drag on single-family housing production, the National Association of Home Builders (NAHB) said.

The October reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Single-family starts, a component of this total, decreased 6.1% to an 855,000 seasonally adjusted annual rate. Year-to-date (YTD), single-family starts are down 7.1%, while multi-family — including apartment buildings and condos — decreased 1.2% to an annualized 570,000 pace.

“Mirroring ongoing falloffs in builder sentiment, builders are slowing construction as demand retreats due to high mortgage rates, stubbornly elevated construction costs, and declines for housing affordability,” said Jerry Konter, NAHB’s chairman and a home builder and developer from Savannah, Ga.

On a regional YTD basis, combined single-family and multi-family starts varied. The Northeast and South regions were up 2.9% and 2.6%, respectively. The Midwest and West declined over the same period, down 1.5% and 5.1%, respectively.

“This will be the first year since 2011 to post a calendar year decline for single-family starts,” said Robert Dietz, NAHB’s chief economist. “We are forecasting additional declines for single-family construction in 2023, which means economic slowing will expand from the residential construction market into the rest of the economy.”

Overall permits slipped 2.4% to a 1.53-million-unit annualized rate in October. Single-family permits were down 3.6% to an 839,000-unit rate. Multi-family permits edged down 1.0% to an annualized 687,000 pace.

Looking at regional permit data on a YTD basis, permits are up 0.2% in the Midwest and up 1.1% in the South. In the Northeast, permits are 2.8% lower, while in the West they are down 4% over the same period.

The number of apartments under construction climbed again in October to 928,000, the highest tally since December 1973.

By David Schollaert, David@SteelMarketUpdate.com