Prices

November 18, 2022

Steelmaking Raw Material Prices Update: Some Up, Some Down

Written by Brett Linton

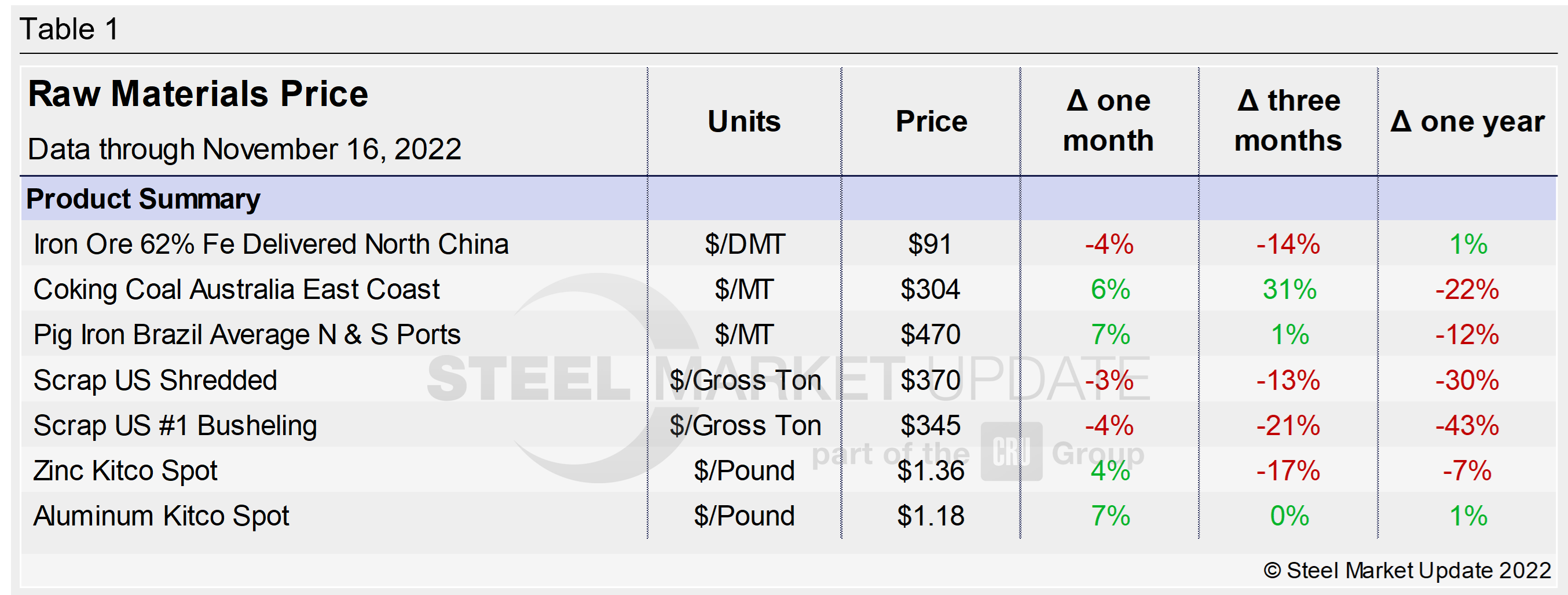

Prices of steelmaking raw materials moved in differing directions over the last 30 days, as they did the month prior, according to Steel Market Update’s latest analysis. Through the latest data available as of Nov. 16, pig iron and aluminum increased 7% in the last month, coking coal prices rose 6%, and zinc prices increased 4%. Iron ore and busheling scrap prices decreased 4%, and shredded scrap fell 3%. Prior to October, we saw consecutive monthly declines for all products following the record-high levels seen earlier this year.

Compared to levels three months prior, prices for four of the seven raw materials in this analysis have declined, one is unchanged, and two increased. Five materials are priced below levels one year ago, with multiple products down by 20% or more.

Table 1 summarizes the price changes of the seven materials considered in this analysis. It reports the percentage change from one month, three months, and one year prior for each product.

Iron Ore

After rising to record-high levels last summer, the Chinese import price of 62% Fe content iron ore fines receded to pre-Covid levels by the end of 2021. Prices increased from late 2021 through April of this year but have since steadily declined. Figure 1 shows the price of 62% Fe delivered North China at $91 per dry metric ton (DMT) as of Nov. 16. Iron ore prices recently reached a 2.5-year low of $82 per DMT in early November. Prior to the last year, iron ore prices were last in this territory in May 2020. Prices have decreased 14% compared to levels three months ago and are 1% higher than prices one year prior.

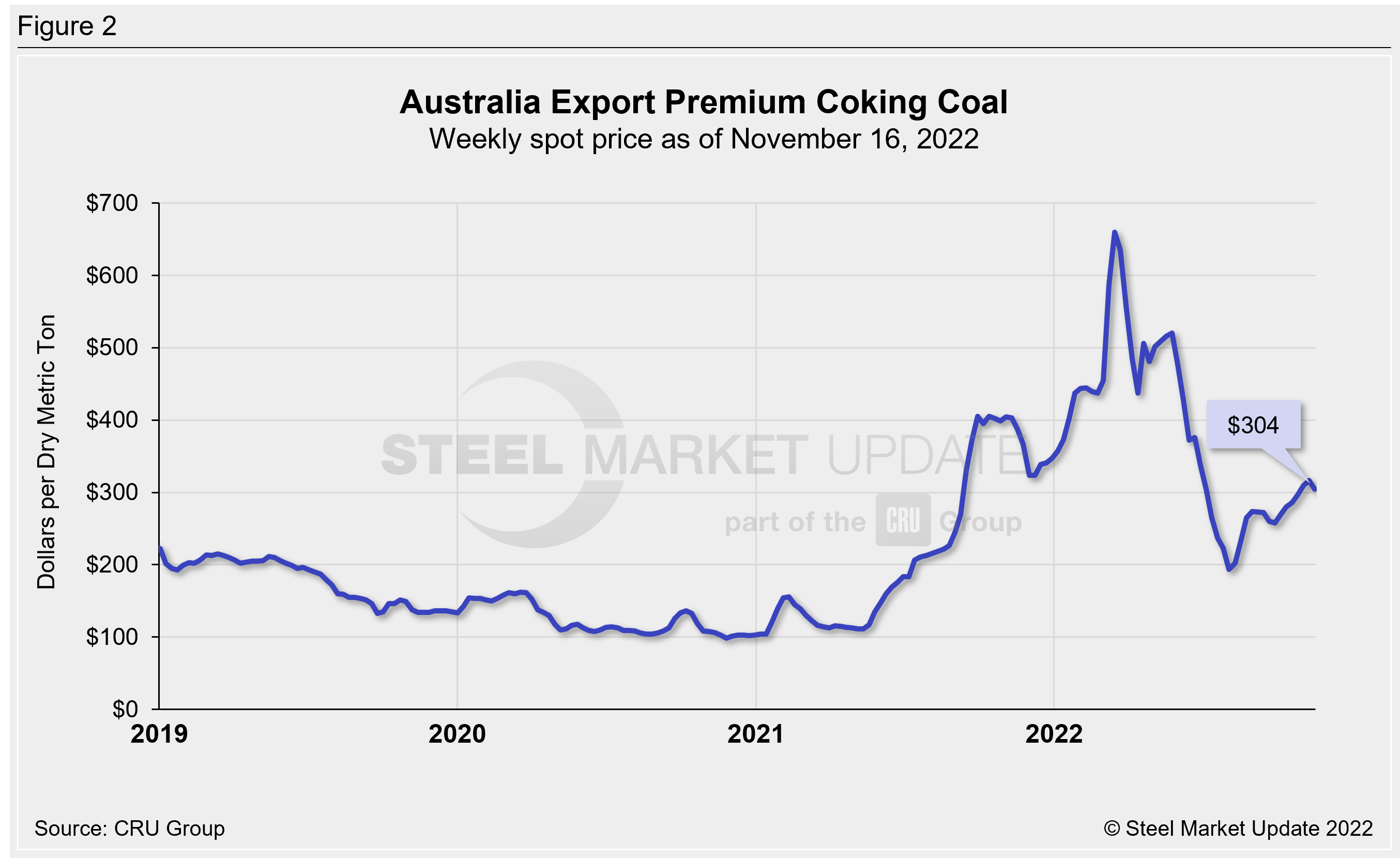

Coking Coal

The price of premium hard coking coal FOB east coast of Australia surged in March of this year to a record high of $660 per DMT. Prices quickly declined in the following months, falling to a 13-month low of $193 per DMT in early August. Prices have since ticked back up; the latest price as of Nov. 16 is $304 per DMT. This is up 57% from the early-August low, but down 54% from the March peak (Figure 2). Prices are up 31% compared to three months prior, but down 22% from prices one year ago. For comparison, the average coking coal price between 2017–2020 was $172 per DMT.

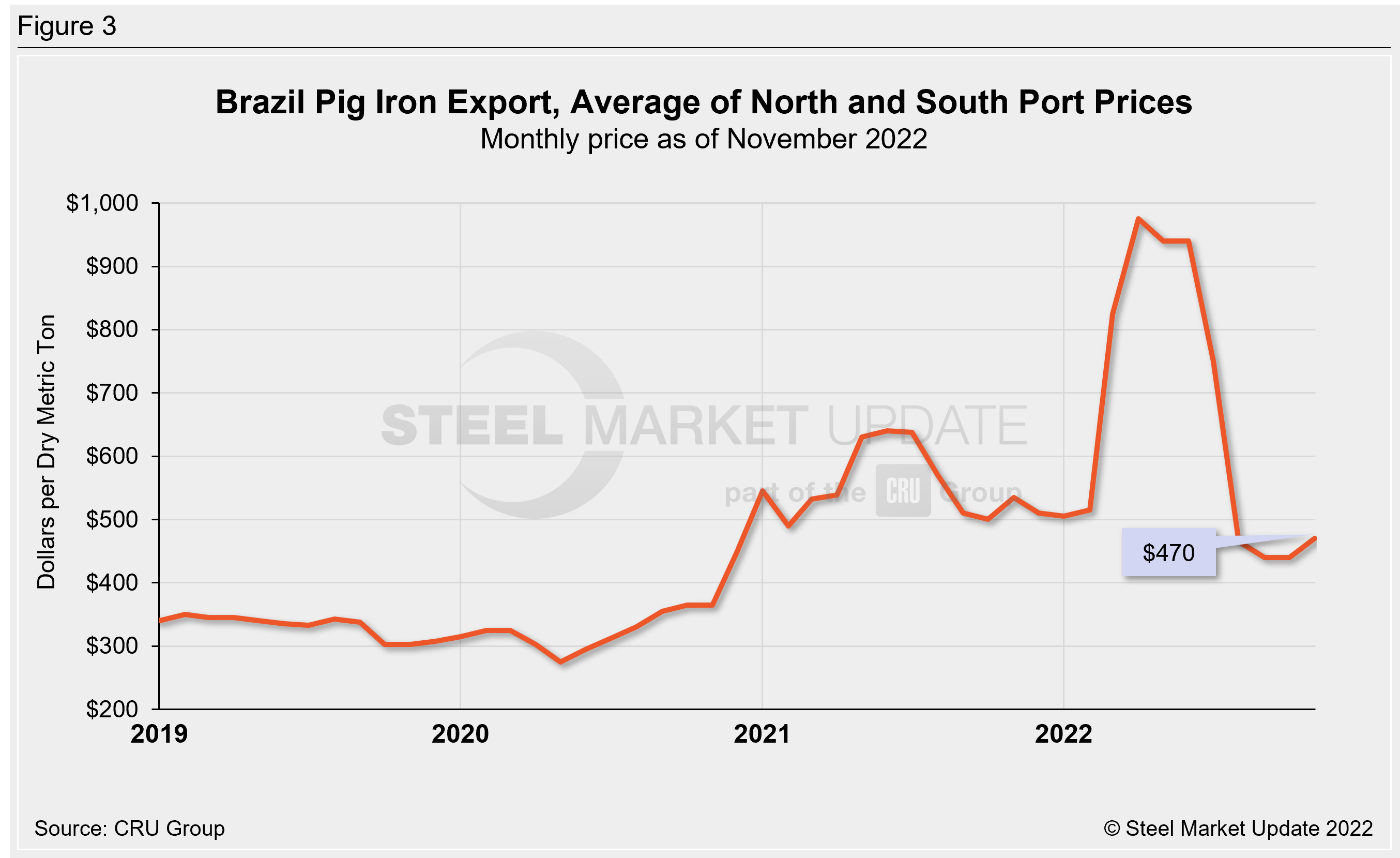

Pig Iron

Most of the pig iron imported to the US had come from Russia, Ukraine, and Brazil. This report summarizes prices out of Brazil and averages the FOB value from the north and south ports.

Pig iron prices had remained elevated but stable for most of 2021 and early 2022. Prices jumped 60% in March following the invasion of Ukraine by Russian forces, which limited or halted supplies from both nations. April saw record-high pig iron prices of $975 per DMT. Prices eased each month throughout September to reach a low of $440 per DMT. Prices through November are up 7% to $470 per DMT, in line with prices three months ago and down 12% from levels one year prior. Recall that pig iron prices reached a multi-year low of $275 per DMT back in June 2020 (Figure 3).

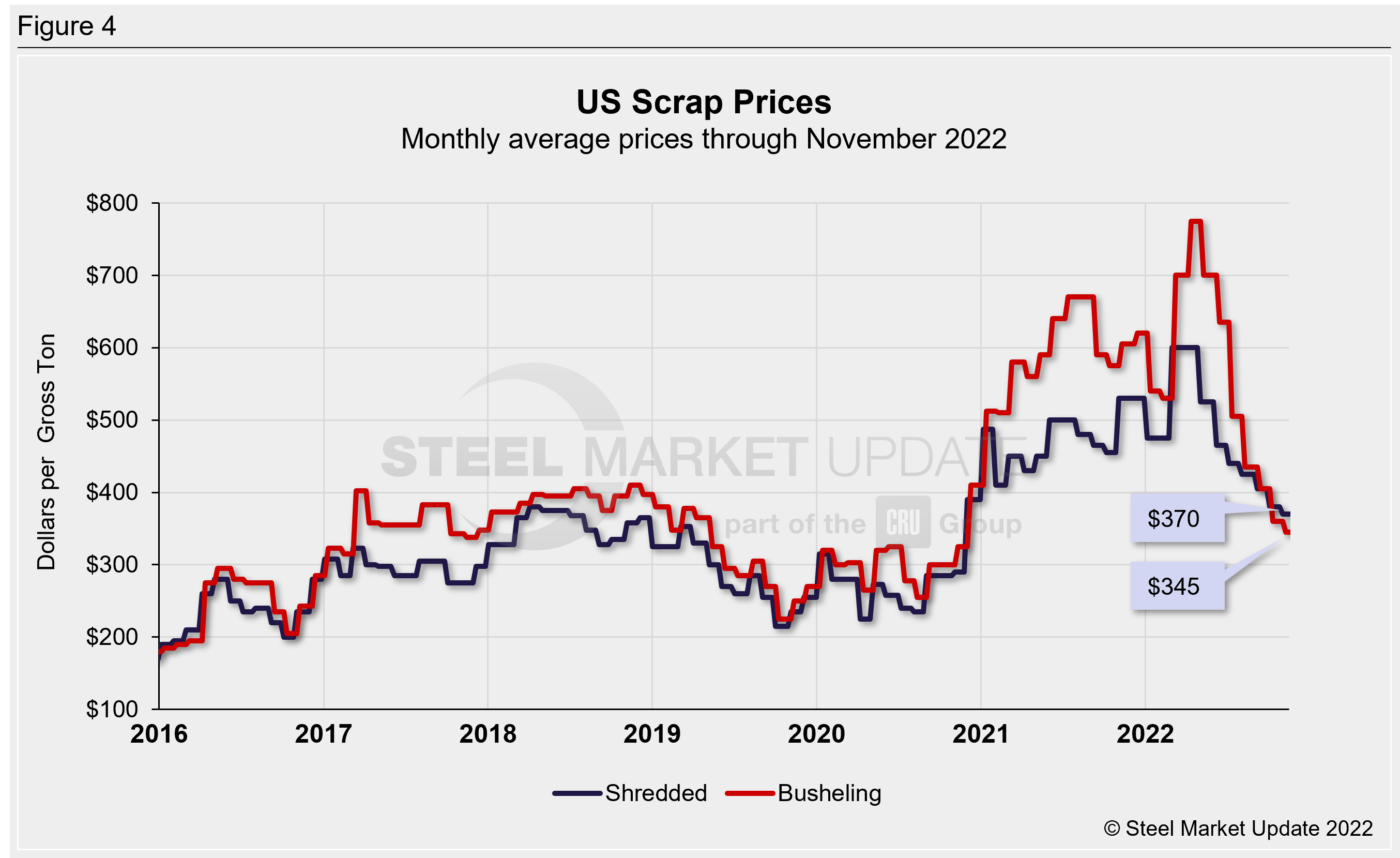

Scrap

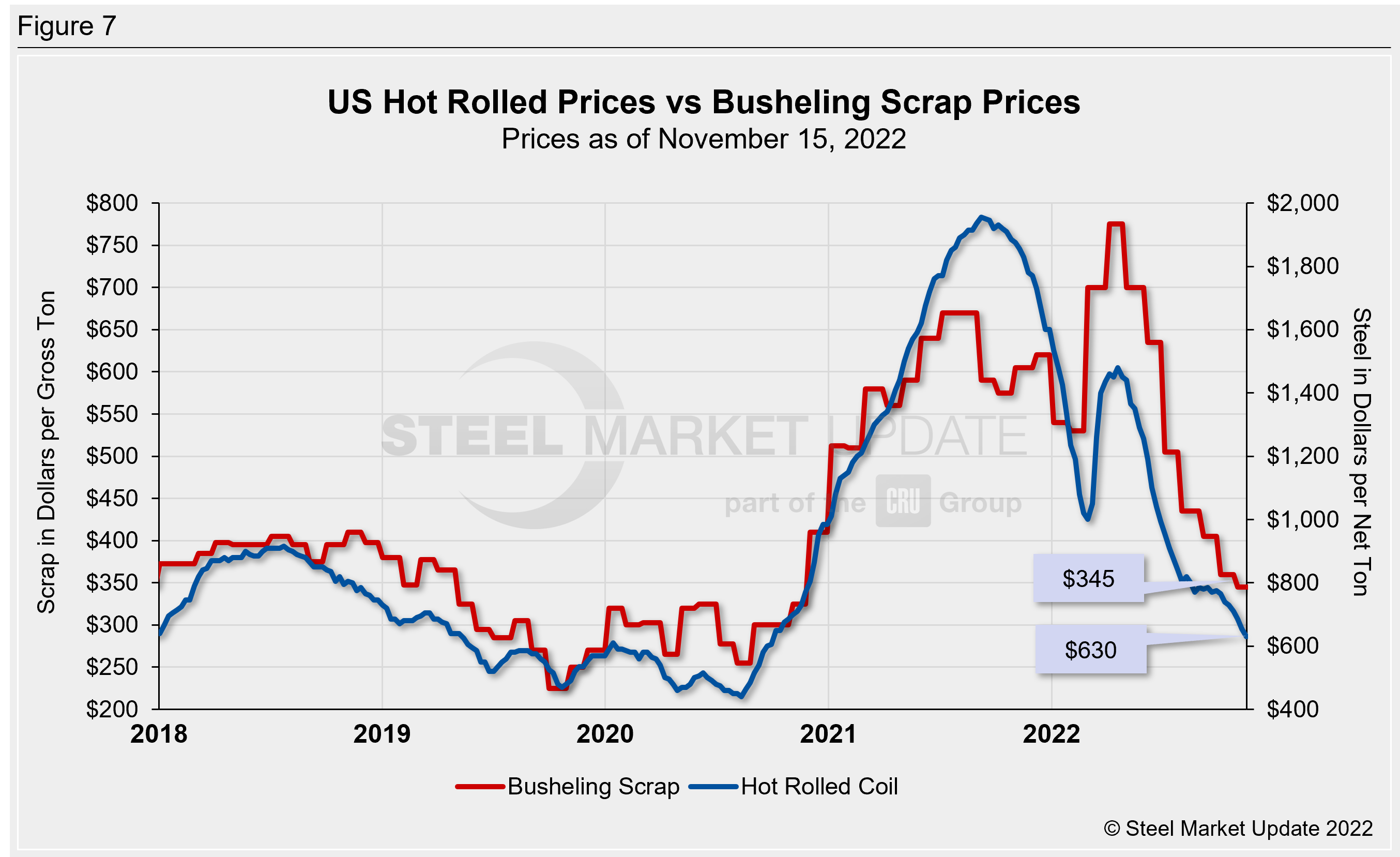

Hot-rolled steel prices fluctuate up and down with the price the mills must pay for their raw materials. Changes in the relationship between scrap and iron ore prices offer insights into the competitiveness of integrated mills, whose primary feedstock is iron ore, compared to minimills, whose primary feedstock is scrap. Figure 4 shows the spread between shredded and busheling scrap, priced in dollars per gross ton in the Great Lakes region.

Scrap prices have declined each of the last seven months. Busheling scrap prices fell $15 per gross ton to $345 per gross ton in October, while shredded scrap declined $10 to $370 per gross ton. It is not often that busheling scrap does not carry a premium price to shred, but that has been the case since September. Recall that March and April saw record-high scrap prices, with busheling reaching $775 and shred hitting $600 per gross ton. Prior to 2021, the highest point for scrap prices over the last decade was $510 per gross ton for busheling in 2011 and $473 per gross ton for shredded in 2012.

Figure 5 shows the prices of mill raw materials over the past four years. Iron ore prices are 58% below the May 2021 peak of $221 per DMT, in line with prices this time last year. Shredded scrap prices are down 38% from the March/April 2022 high, and down 30% versus levels one year ago.

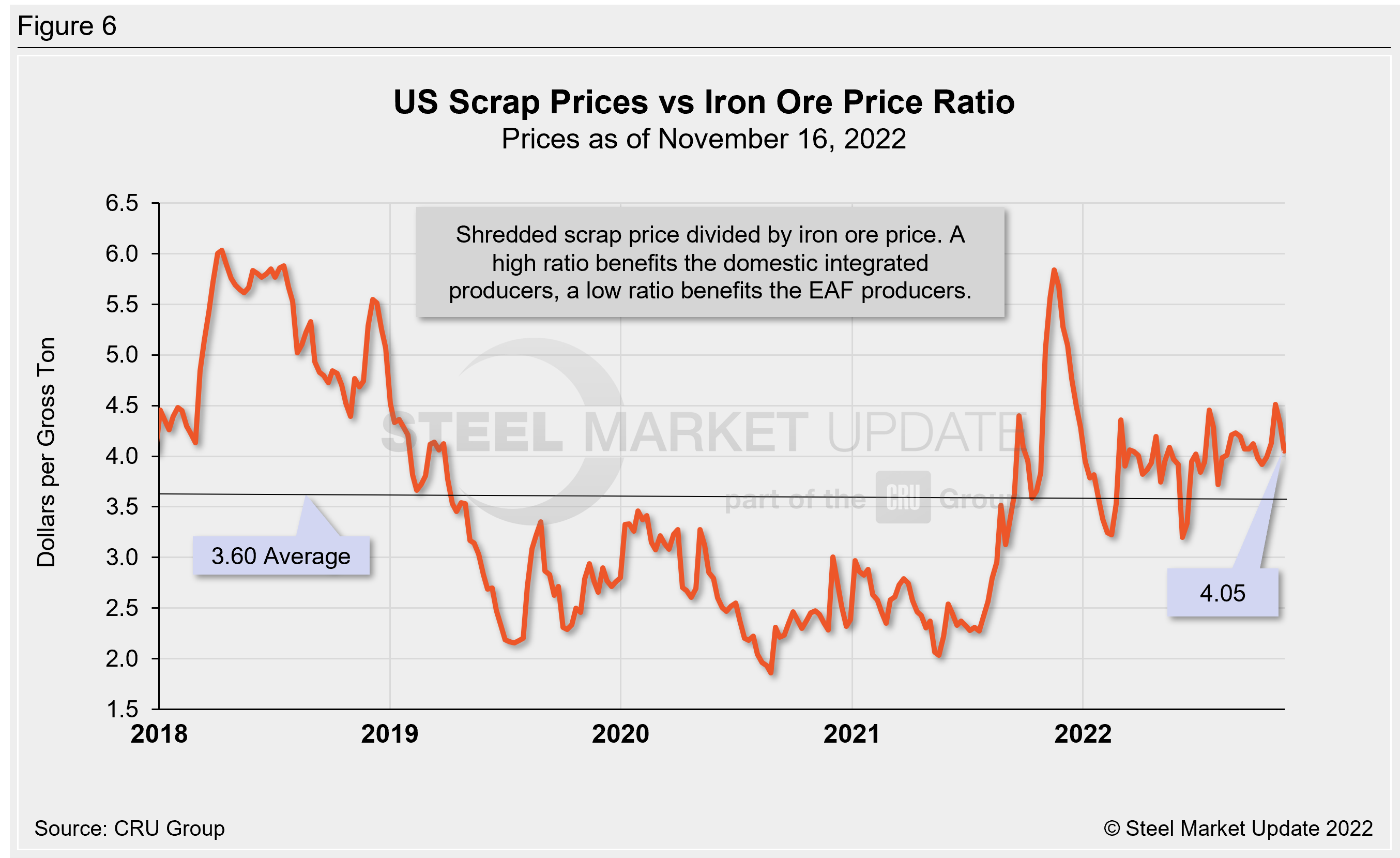

To compare the two, SMU divides the shredded scrap price by the iron ore price to calculate a ratio (Figure 6). A high ratio favors the integrated/BF producers and a lower ratio favors the minimill/EAF producers.

At the current 4.05 ratio shown below, integrated producers have mostly held onto the cost advantage since March. Back in November 2021 we saw a ratio of 5.84, the highest since mid-2018. The scrap-to-iron ore ratio reached a record low (within SMU’s 12-year data history) of 1.86 in August 2020.

Figure 7 shows how the price of hot-rolled steel relates to the price of busheling scrap. Busheling has declined $430 per gross ton (55%) from the April peak and is back in the pre-pandemic ballpark. As of Tuesday, Nov. 15, the SMU hot rolled price average decreased $25 per ton week-over-week to $630 per net ton. This is down $850 per net ton (57%) from the April 2022 peak, and the lowest price recorded since September 2020.

Zinc and Aluminum

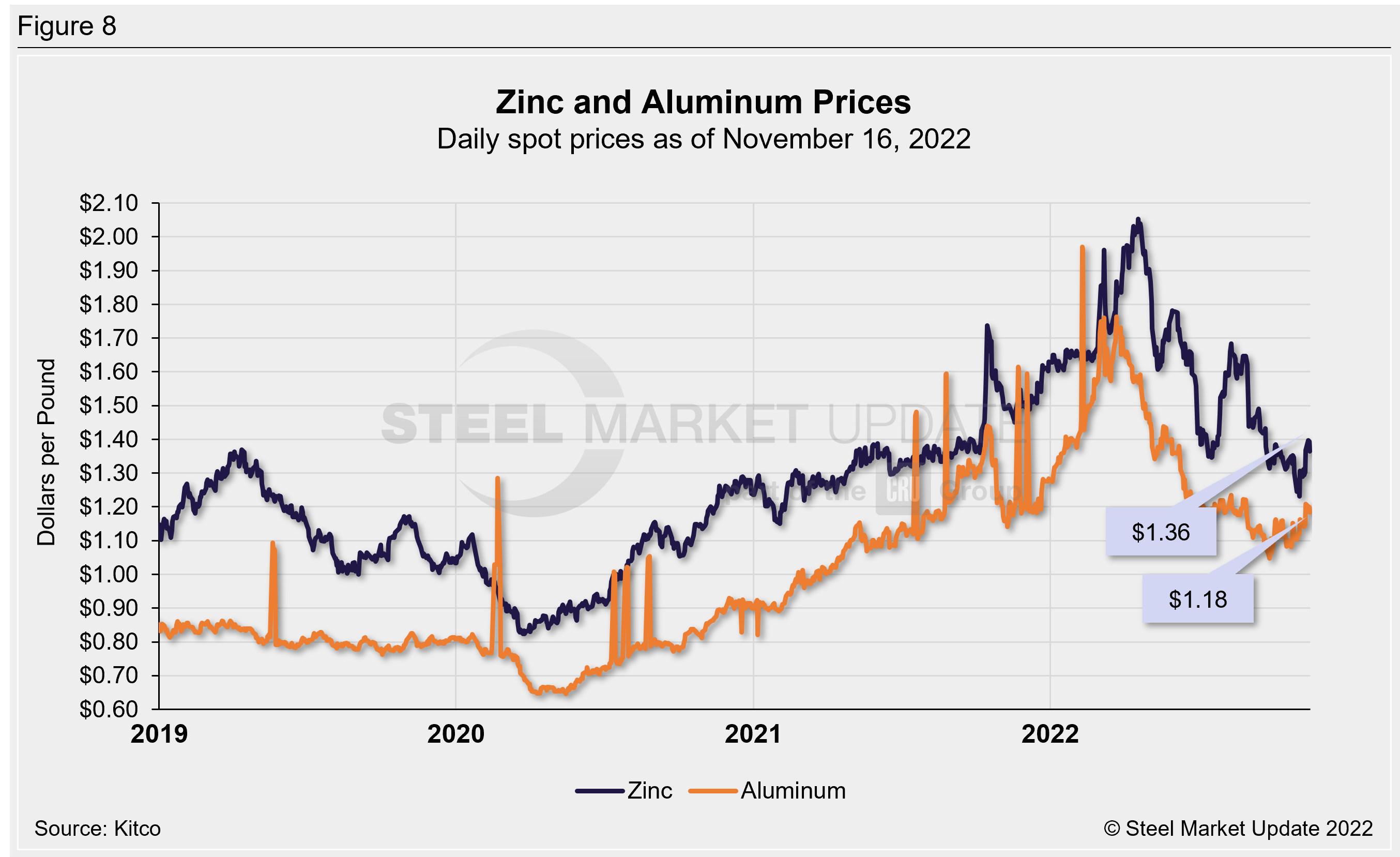

Zinc is used in galvanized and other coated steel products. Spot prices have fluctuated dramatically in the past year; the LME cash price for zinc reached a record high of $2.05 per pound in May, declining through July to reach a ten-month low of $1.35 per pound. Prices picked back up through August to reach a high of $1.68 per pound. After declining through September, prices have increased once again. The latest price as of Nov. 16 is $1.36 per pound, up 4% compared to 30 days prior, down 17% compared to three months earlier, and down 7% from levels one year ago (Figure 8).

Aluminum prices, which factor into the price of Galvalume, had also been on the rise in 2021 and into early 2022, reaching a record-high of $1.76 per pound on March 23. (Note that aluminum spot prices often have large swings and return to typical levels within a few days, as seen in the graphic below. We do not consider those surges in our overall high/low comparisons.) Aluminum prices had been relatively stable since June, though still higher than pre-2021 levels. On Sept. 27 prices reached a 17-month low of $1.05 per pound. The latest LME cash price has risen to $1.18 per pound as of Nov. 16. Aluminum prices are up 7% from one month prior, in line with July levels, and up 1% from prices one year prior.

By Brett Linton, Brett@SteelMarketUpdate.com