Government/Policy

December 9, 2022

Scrap Prices Rise in December, Higher Expectations for January

Written by Brett Linton

Ferrous scrap prices increased from November to December, according to Steel Market Update sources, breaking the seven-month cycle of price declines. Buyers reported prime scrap prices increased roughly $30 per gross ton, while shredded prices rose $20 per ton.

![]() “Scrap prices are up a minimum $20-30 per ton this month,” reported one scrap executive. He noted that there are quiet deals being done at higher prices, and southern dealers are “insisting on a $30 per ton increase on shredded and HMS”.

“Scrap prices are up a minimum $20-30 per ton this month,” reported one scrap executive. He noted that there are quiet deals being done at higher prices, and southern dealers are “insisting on a $30 per ton increase on shredded and HMS”.

Our scrap prices for November are as follows:

• Busheling at $360–400 per gross ton, averaging $380, up $35 from last month

• Shredded at $380–400 per gross ton, averaging $390, up $20 from last month

• HMS at $300–330 per gross ton, averaging $315, up $10 from last month

Buyers expect prices to continue to rise into January due to supply limitations. “Dealers do not have very much inventory, and with winter and the holidays upon us, no way to improve the flows,” said one source. “If you had scrap, you’d be hesitant to sell now at these prices.”

Another source remarked, “Farther down the scrap food chain shredders are already raising feedstock prices $35-50 per ton.” He added that busheling could increase an additional $50 per ton in January.

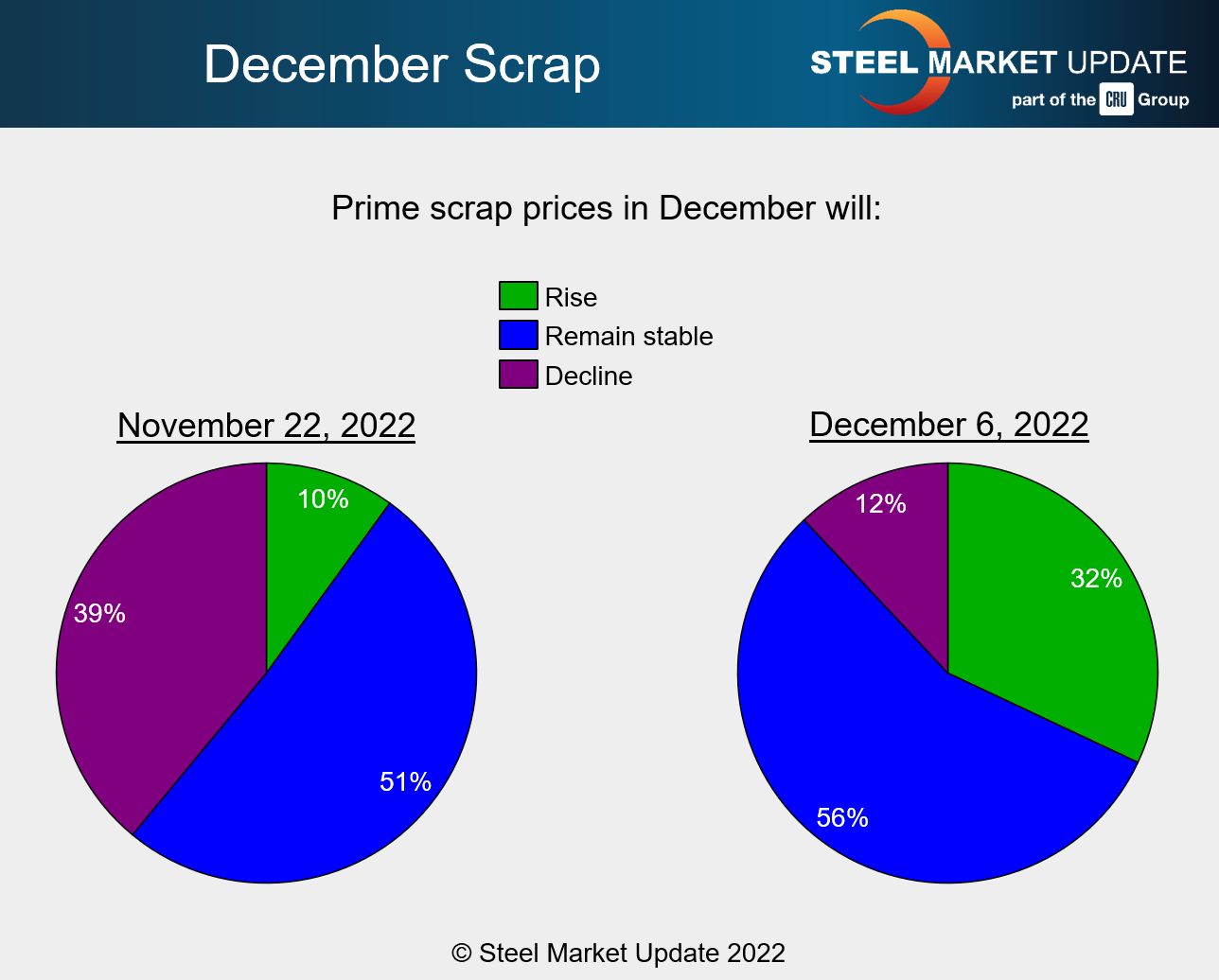

SMU polled steel buyers earlier this week, asking what their expectations were for December scrap prices. Over half expected prices to remain stable, similar to mid-November expectations. Only 32% of those responding expected prices to increase, compared to 10% two weeks prior.

PSA: SMU members can chart various scrap prices as far back as 2007 using our interactive pricing tool.

By Brett Linton, Brett@SteelMarketUpdate.com