Product

January 9, 2023

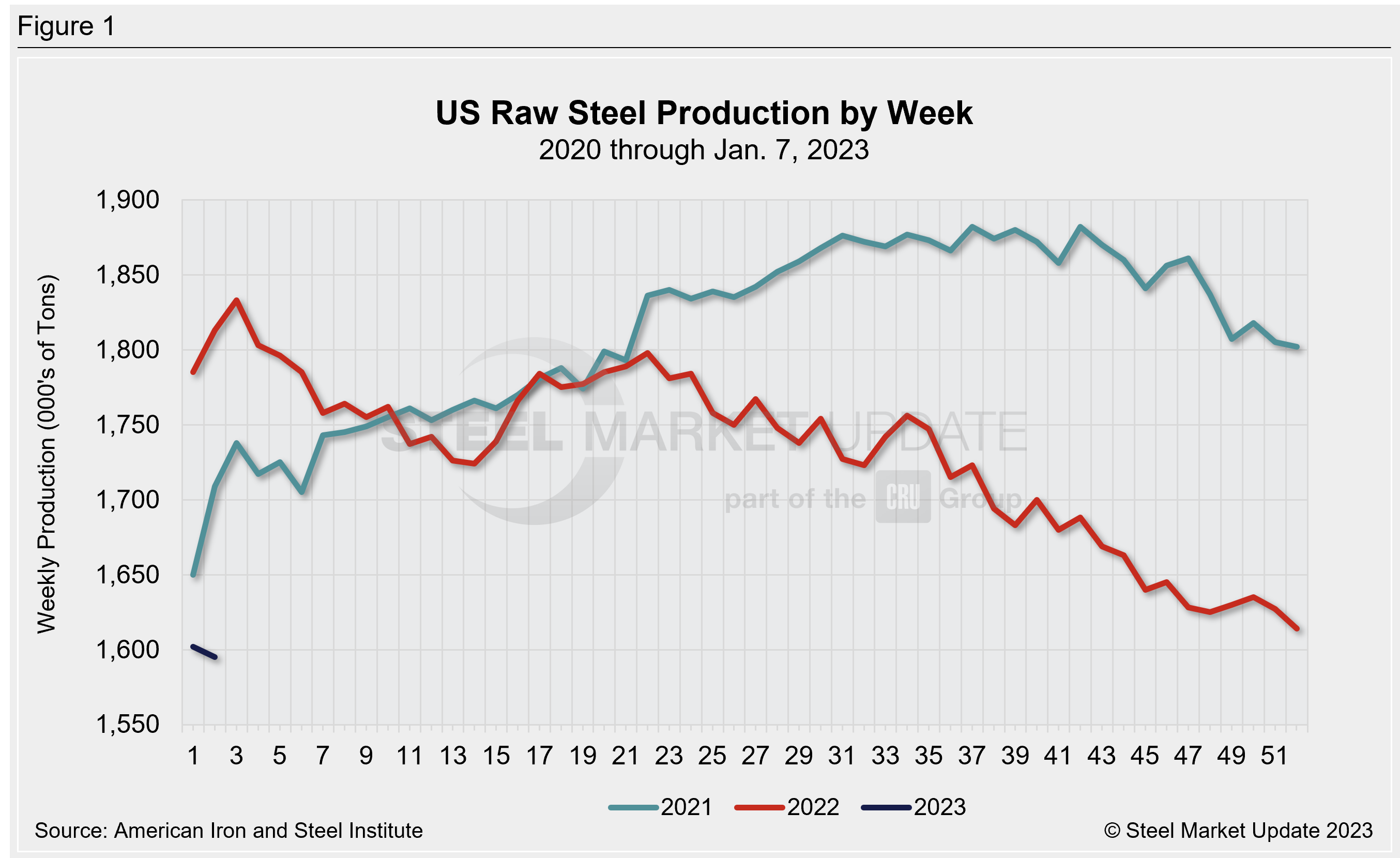

Weekly Raw Steel Output Continues to Fall: AISI

Written by David Schollaert

Raw steel production by US mills fell further last week as capacity utilization slipped to just 71.3%, according to data released by the American Iron and Steel Institute (AISI) on Monday, Jan. 9.

The decline came as production was again impacted by the holidays, with mills in the Great Lakes, South, and West cutting production, even as those in the Northeast and Midwest increased output.

Domestic mills produced 1,595,000 net tons in the week ending Jan. 7, down 0.4%, or 7,000 tons, from the previous week, and down 8.1% from 1,735,000 tons in the same week last year.

Last week’s output was the lowest total since the week of Dec 12, 2020, per AISI figures.

US mills ran at a capacity utilization rate of 71.3% last week, down from 71.8% the week prior, and 79.8% a year ago. Utilization last week was at its lowest total since Nov. 28, 2020.

Adjusted year-to-date (ytd) production through Jan. 7 was at 1,595,000 tons, with ytd capacity utilization at 71.3%. That’s 8.1% below 1,735,000 tons ytd in early January 2022, when ytd capacity utilization was 79.8%, AISI said.

Production by region for the week ending Jan. 7 is below. (Note: week-over-week change is in parentheses.)

- Northeast, 128,000 tons (down 3,000 tons)

- Great Lakes, 541,000 tons (down 3,000 tons)

- Midwest, 200,000 tons (up 5,000 tons)

- South, 654,000 tons (down 9,000 tons)

- West, 72,000 tons (down, 3,000 tons)

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7,” published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of US production capacity.

By David Schollaert, David@SteelMarketUpdate.com