Prices

March 7, 2023

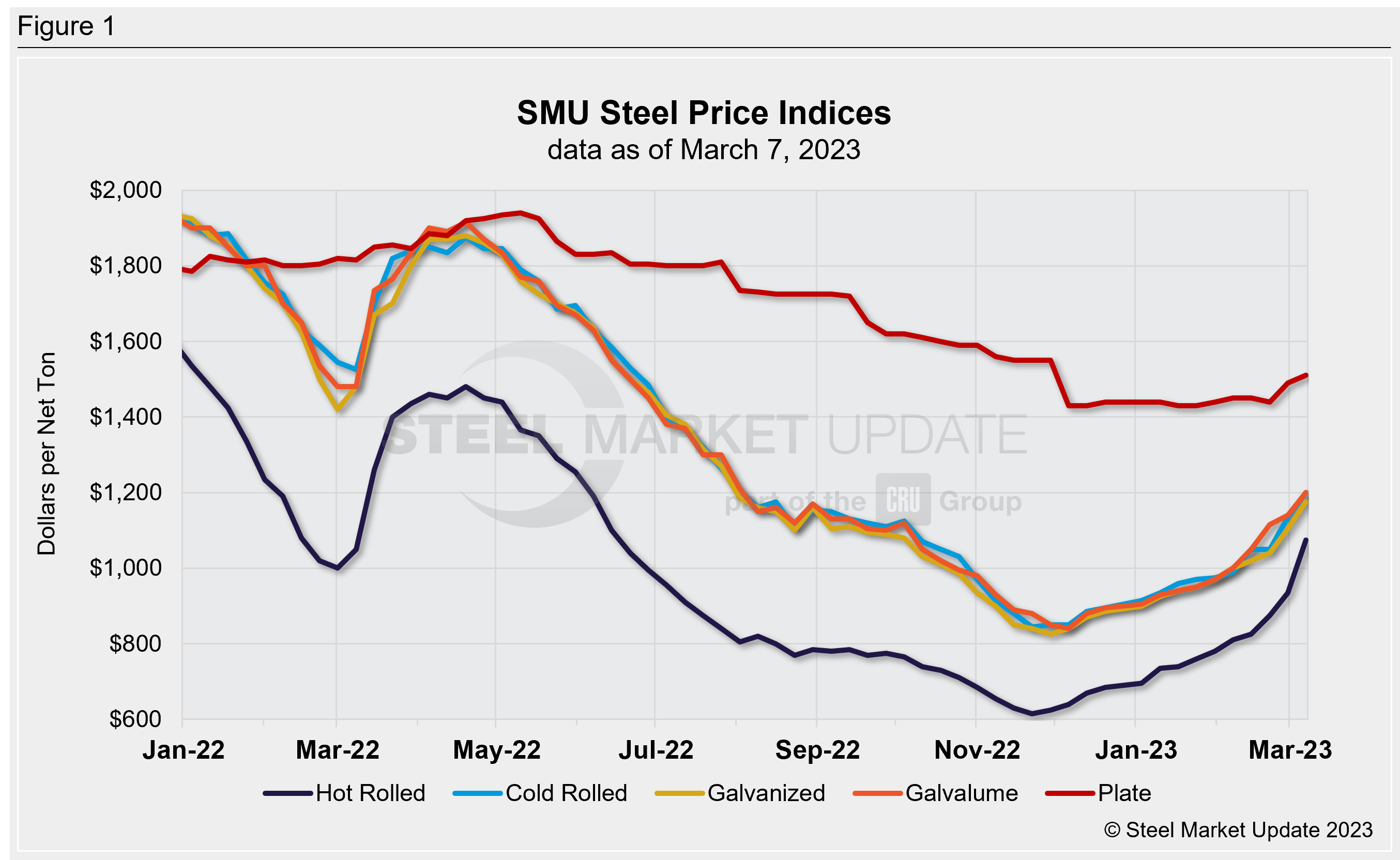

SMU Price Ranges: Led by HRC, Sheet Gains Accelerate

Written by David Schollaert

Aggressive mill price increases are pushing flat-rolled tags up at a sharp clip, rivaling the spike seen in response to the war in Ukraine last March.

On Friday, Nucor came out with yet another notice – up an extra $150 per ton ($7.50 per cwt) and setting a new base price for hot band of $1,150 per ton. ArcelorMittal followed suit shortly afterward, targeting the same base price.

The latest round of price hikes has quickly made its way into the market. With mills aligned and demand steady, there is little near-term indication that pricing will lose momentum.

Steel Market Update’s hot-rolled coil price now stands at $1,075 per ton on average, up $140 per ton from last week. It is the largest week-on-week (WoW) increase since the Ukraine war panic last year, when we went from $1,050 to $1,260 on March 15.

Prices have nearly doubled in less than four months and are nearing levels last seen a year ago.

And it’s not just hot band that’s moving up at a fast clip week. Cold-rolled followed suit (up $65 per ton vs. last week), as did galvanized (up $70 per ton), Galvalume (up $60 per ton), and plate (up $20 per ton).

All our sheet momentum indicators continue to point upward. Our plate momentum indicator is now also pointing upward too. We anticipate more increases.

Hot-Rolled Coil: The SMU price range is $1,000–1,150 per net ton ($50.00–57.50/cwt), with an average of $1,075 per ton ($53.75/cwt) FOB mill, east of the Rockies. The bottom end of our range increased by $130 per ton, while the top end rose $150 per ton vs. one week ago. Our overall average is up $140 per ton week on week (WoW). Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–9 weeks

Cold-Rolled Coil: The SMU price range is $1,100–1,300 per net ton ($55.00–65.00/cwt) with an average of $1,200 per ton ($60.00/cwt) FOB mill, east of the Rockies. The lower end of our range was up by $30 per ton, while the top end rose by $100 per ton compared to one week ago. Our overall average is up $65 per ton WoW. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $1,100–1,250 per net ton ($55.00–62.50/cwt) with an average of $1,175 per ton ($58.75/cwt) FOB mill, east of the Rockies. The lower end of the range rose by $50 per ton WoW, while the top end of our range increased $90 per ton vs. one week ago. Our overall average is up $70 per ton WoW. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,197–1,347 per ton with an average of $1,272 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–10 weeks

Galvalume Coil: The SMU price range is $1,100–1,300 per net ton ($55.00-65.00/cwt) with an average of $1,200 per ton ($60.00/cwt) FOB mill, east of the Rockies. The lower end of the range was up $20 per ton vs. the week prior, while the top end of our range was up $100 per ton compared to one week ago. Our overall average is up $60 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,594 per ton with an average of $1,494 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–9 weeks

Plate: The SMU price range is $1,480–1,540 per net ton ($74.00–77.00/cwt), with an average of $1,510 per ton ($75.50/cwt) FOB mill. The lower end of the range was up $30 per ton WoW, while the top end of our range also rose by $10 per ton compared to one week ago. Our overall average increased by $20 per ton WoW. Our price momentum indicator on steel plate is pointing Higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 4–7 weeks

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com