Prices

June 30, 2023

Hot Rolled and Galvanized Price Spread Shrinks Further

Written by Laura Miller

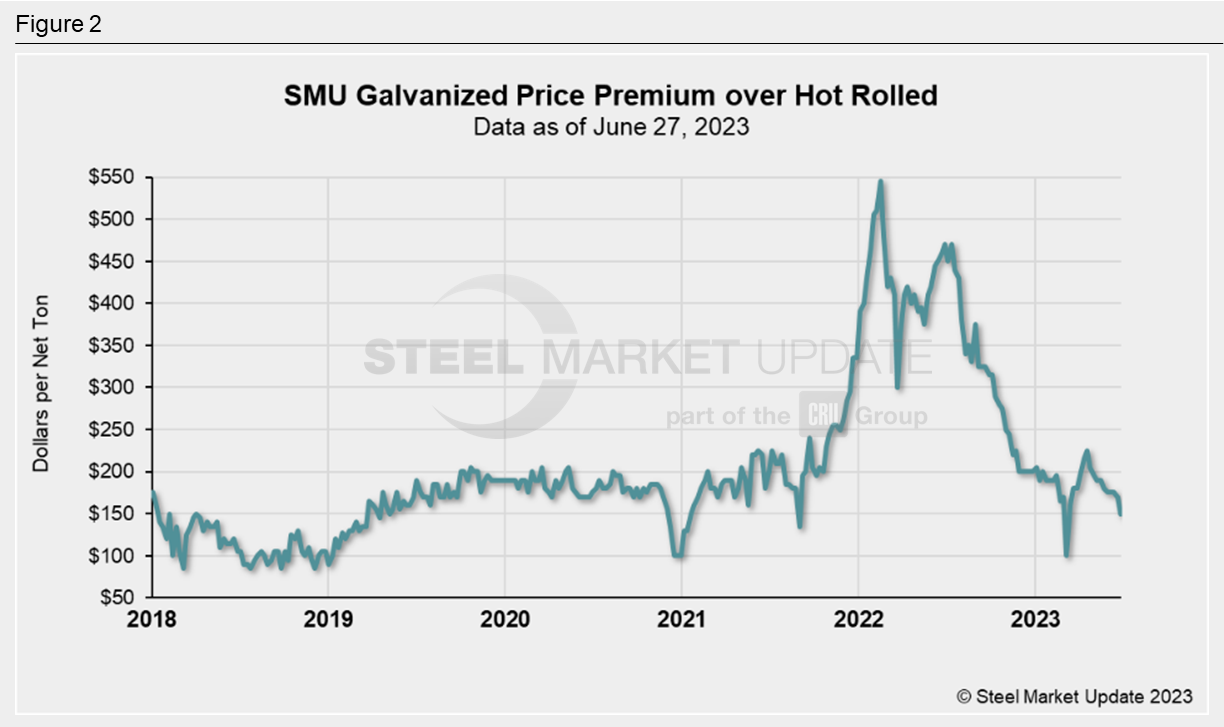

As sheet prices continued to decline throughout June, the spread between hot-rolled coil (HRC) and galvanized coil base prices also shrank further.

Recall that at the end of May, the galvanized premium over hot-rolled coil (HRC) averaged $175 per ton.

As of this week, that premium had fallen to $150 per ton.

Let’s look at the numbers further.

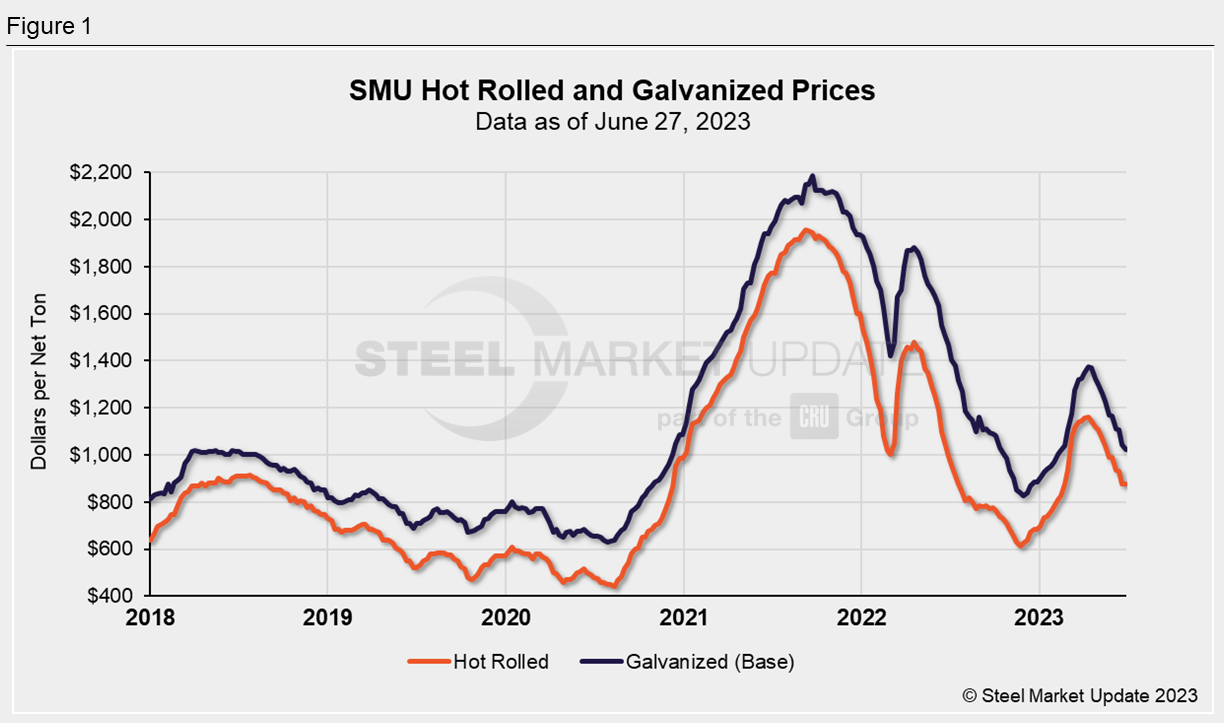

Figure 1 below shows SMU’s HRC and galvanized base prices as of June 27.

The average HRC price was unchanged this week at $875 per ton. That’s down 11.6% from $990 per ton the last week of May and down 24.6% from the highest point so far this year of $1,160 per ton during the week of April 11.

For galvanized sheet, the average price registered $1,025 per ton this week, down 12% from the last week of May and down 24% from this year’s peak of $1,350 per ton mid-April.

Highlighted in Figure 2, the average galvanized price premium over hot rolled fell to $150 per ton this week. That’s down from $175 per ton the last week of May and $205 per ton the last week of April.

That $150-per-ton figure is the lowest the premium has been in 16 weeks. We have to go back to the week of March 7 to see a lower premium – $100 per ton – and that’s the lowest the premium has been in about two years.

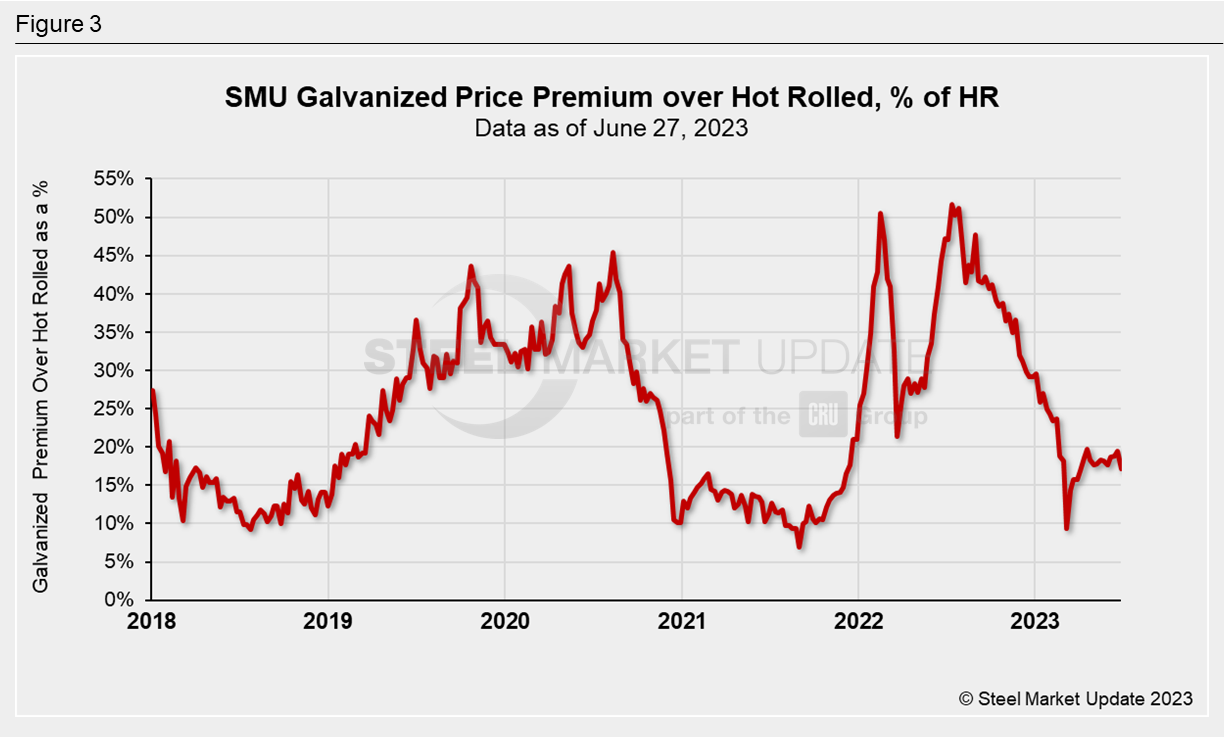

Figure 3 shows the galvanized premium over hot rolled as a percentage of the HRC price.

The premium fell to 17% this week, down one percentage point from a month ago. The premium as a percentage has been fairly steady since March.

By Laura Miller, laura@steelmarketupdate.com