Prices

July 18, 2023

SMU Price Ranges: Sheet Prices Slip, Blip or New Trend?

Written by David Schollaert & Michael Cowden

Sheet prices slipped by $20-25 per ton as hot-rolled coil (HRC) failed to break through the $900 per ton threshold some market participants had predicted it would.

SMU’s average hot-rolled coil (HRC) price stands at $870 per ton ($43.50 per cwt), down $20 per ton from a week ago. Numbers at or around that figure were available even for smaller spot orders, sources said.

It was a similar story for cold-rolled coil and galvanized, both of which were down $25 per ton.

On the one hand, the result was not a surprise because HRC prices, for example, have hovered between approximately $870-900 per ton since late June. That stability was created in part by a round of $50-per-ton price hikes announced a month ago.

On the other hand, it is significant because a second round of price increases has been anticipated since late June. That rumored second price hike had been expected by some market participants to lift HR over $900 per ton, perhaps significantly so. But, as of when this article was filed, that second increase had not materialized – and some sources questioned whether it ever would.

Galvalume, prices, in contrast, were up $5 per ton – or effectively unchanged week over week. Plate prices were up $10 per ton week over week.

Our price momentum indicators remain at neutral until a clear direction, up or down, is established.

Hot-Rolled Coil

The SMU price range is $840–900 per net ton ($42.00–45.00 per cwt), with an average of $870 per ton ($43.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range was unchanged vs. one week ago, while the top end was down $40 per ton week on week (WoW). Our overall average is down $20 per ton WoW. Our price momentum indicator for hot-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Hot-Rolled Lead Times: 3–7 weeks*

Cold-Rolled Coil

The SMU price range is $1,010–1,090 per net ton ($50.50–54.50 per cwt), with an average of $1,050 per ton ($52.50 per cwt) FOB mill, east of the Rockies. The lower end of our range moved lower by $40 per ton WoW, while the top end was down $10 per ton compared to a week ago. Our overall average is down $25 per ton WoW. Our price momentum indicator on cold-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Cold-Rolled Lead Times: 5–9 weeks*

Galvanized Coil

The SMU price range is $970–1,050 per net ton ($48.50–52.50 per cwt), with an average of $1,010 per ton ($50.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $20 per ton vs. last week, while the top end of our range moved lower by $30 per ton vs. one week ago. Our overall average is down $25 per ton vs. the prior week. Our price momentum indicator on galvanized steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvanized .060” G90 Benchmark: SMU price range is $1,067–1,147 per ton with an average of $1,107 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks*

Galvalume Coil

The SMU price range is $1,010–1,160 per net ton ($50.50–58.00 per cwt), with an average of $1,085 per ton ($54.25 per cwt) FOB mill, east of the Rockies. The lower end of the range edged higher by$10 per ton vs. last week, while the top end was unchanged WoW. Our overall average increased $5 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,304–1,454 per ton with an average of $1,379 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks*

Plate

The SMU price range is $1,470–1,570 per net ton ($73.50–78.50 per cwt), with an average of $1,520 per ton ($76.00 per cwt) FOB mill. The lower end of our range was up $20 per ton compared to the prior week, while the top end of our range was unchanged WoW. Our overall average was up $10 per ton vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks*

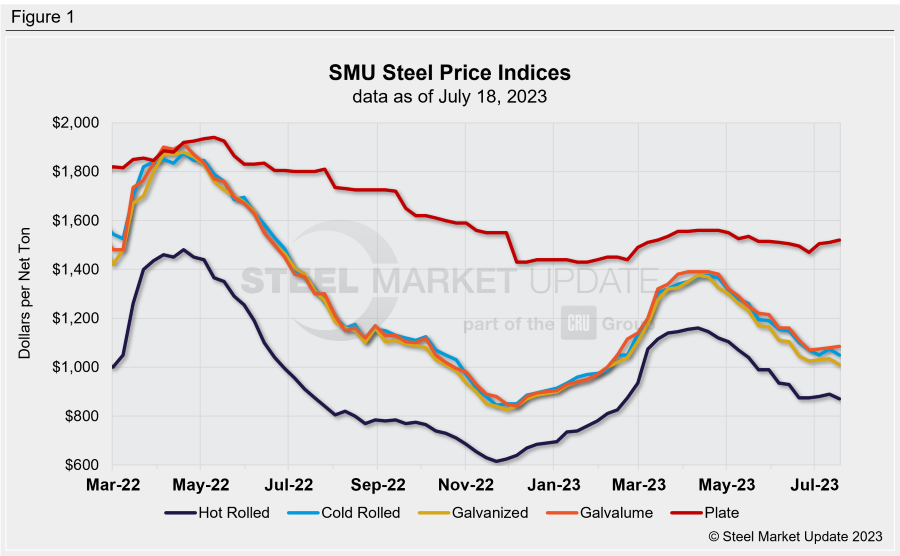

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert