Analysis

August 1, 2023

Final Thoughts

Written by Michael Cowden

Our sheet prices are down again this week. Some of you think it’s a sign of something ominous, others think it’s just a case of seasonality.

It might help to step back and put things in perspective.

Sheet Prices Are Down, But Not as Much as Last Year

We’re down $350 per ton from early April, according to our interactive pricing tool. Compare that to last year. HRC hit a 2022 high of $1,440 per ton in April ’22. It fell to $720 per ton in August of last year – a decline of $720 per ton.

A service center source in the Great Lakes compared that 50% drop in 2022 to losing a limb and the ~28% decline in 2023 to a very painful cut.

I’m not going to weigh in on where demand is going. We saw several mills in earnings calls last week say that Q3 results would not be as strong as Q2. Ryerson this week, and more explicitly, indicated that demand had weakened.

But some of you tell me that things are still good – that July volumes were of course down versus the typically busier spring months, but still above where they were a year ago.

So how to make sense of what one contact said was a crystal ball that is a lot fuzzier than usual.

Let’s start with this: We’re seeing some significant variations by region.

In the Great Lakes region, for example, multiple domestic mills are said to be discounting into the $700s per ton, the low end of our range. That’s also where mills in Eastern Canada are. (We’re told they’re selling hot band at ~$1,000 per ton CAD, which translates to mid-$700s USD.)

Volume discounts, we’re also told, are available in the low $700s per ton. But those aren’t, as best we can tell this week, easily repeatable spot buys. In other words, we’re talking 5,000 to 10,000 tons or more.

Imports Down, Export to Mexico Up

Some of you in the South have said you’re not seeing such low prices. I can see why that might be. SDI Sinton might be up from its unplanned outage. But AHMSA is still down, and it’s not clear when production might resume there.

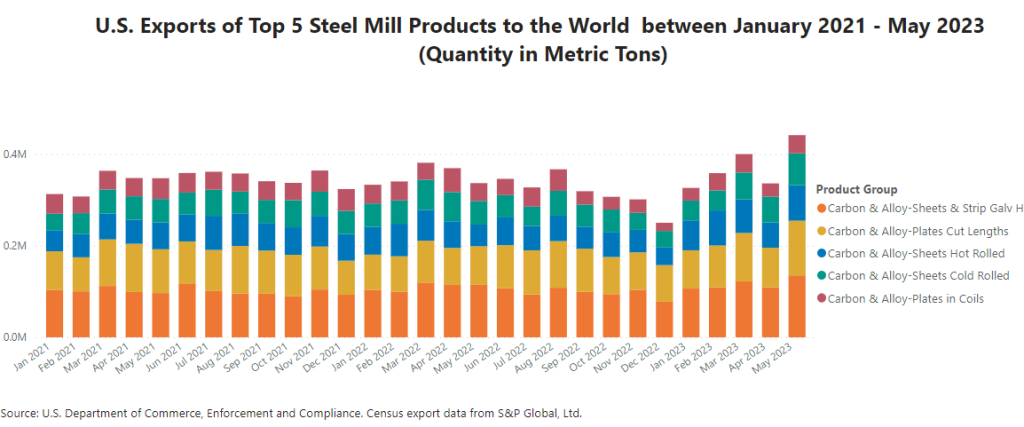

That has created export opportunities for certain domestic producers located in the South. The result: US exports to Mexico in May, the most recent month for which data are available, were the highest they’ve been in a while.

That chart goes back to January 2021. If I stretched it out, you’d see they’re highest since at least May 2012, as far back as that data series goes on Commerce’s trade.gov website.

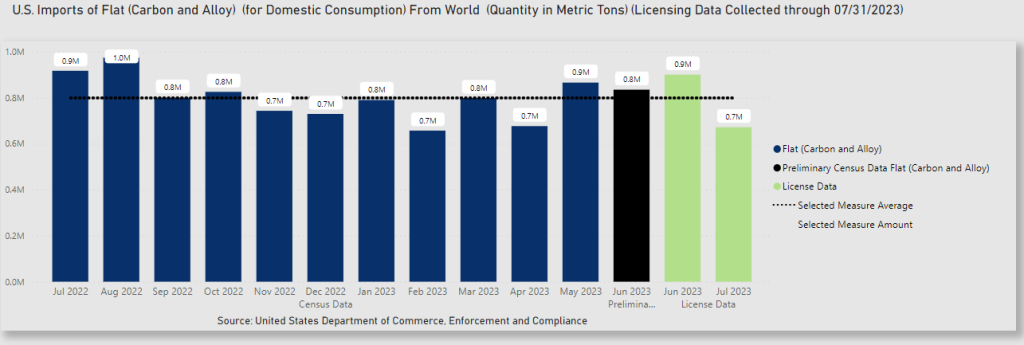

As for imports, they were nearly one million tons in July, according to preliminary figures from the Commerce Department. (The chart below says ~900,000 because the government uses metric tons.)

That’s the highest they’ve been since August of last year. And recall that high import volumes in Aug a year ago were partly what drove prices to ~$600 per ton or lower in the fall of ‘22.

License data for last month, however, indicate that July volumes are well below June levels.

That could support the theory advanced by some of you that imports would be high for a few months and then tail off along with declines in US prices.

Keep in mind that HRC lead times are averaging 4-5 weeks. (We’ll post updated figures on Thursday.) Buying imports in Q1 might have been an easy choice with domestic lead times long and prices high. But it’s not so clear now whether imports will be a good deal compared to domestic prices when foreign material arrives in September/October.

So, yes, sheet prices are declining. Perhaps we’ll see a repeat of last year with prices falling into the fall.

But it’s also worth thinking about whether we might see, as we often do, prices stabilizing, perhaps even rising, as lead time stretch into September/October.

Steel Summit

I’m not banging the drum as loudly about Steel Summit because I’m assuming most of you know of the event by now and have already registered.

That said, if you haven’t – or if people you think might be interested haven’t – please refer them to the webpage for the event. The full agenda and registration information are here.