Market Segment

September 5, 2023

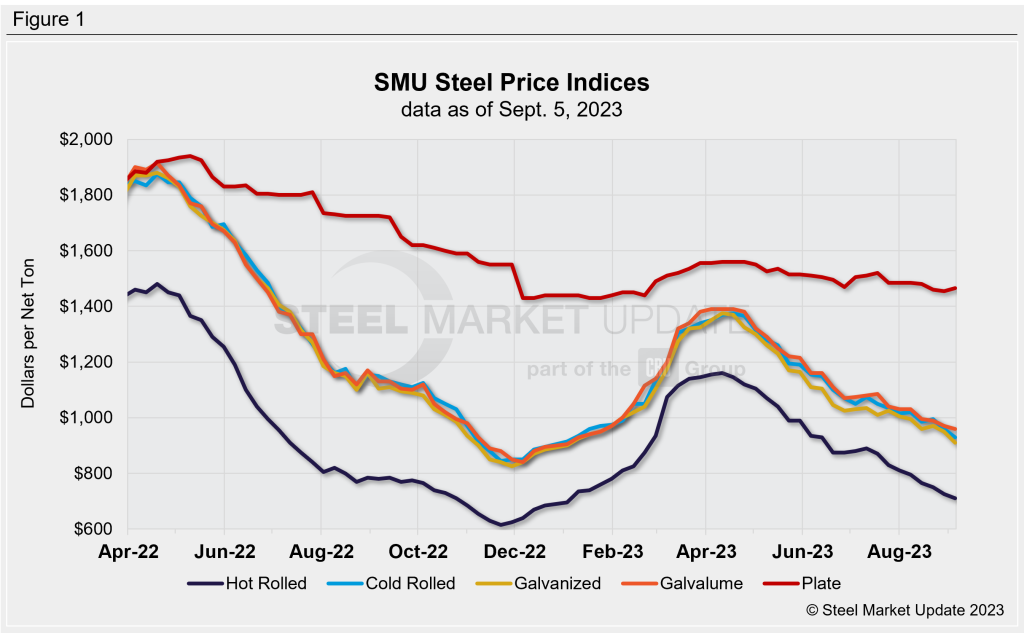

SMU Price Ranges: Sheet Slips Again on Potential Auto Strike

Written by David Schollaert & Michael Cowden

Sheet prices declined again this week amid persistent concerns about a potential strike at union-represented automakers.

Some sources said that maintenance outages or production cuts might stem the declines. But others said the main question remained whether there would be a strike and, if so, how long it might last.

SMU’s average hot-rolled coil price slipped to $710 per ton ($35.50 per cwt), down $15 per ton from last week and marking the lowest point for domestic HRC since $695 per ton at the beginning of the year.

Cold-rolled and galvanized price declines were more pronounced. Cold-rolled coil prices slipped $30 per ton week over week (WoW) to $930 per ton on average. Galvanized tags dropped by $40 per ton to an average of $910 per ton. As with HRC, both are now at their lowest levels since January.

On the plate side, the top end of our range came down following a $40-per-ton price decrease announced by Nucor. Our average price, however, was little changed because the bottom end of our range increased.

Our sheet price momentum indicators remain pointed lower. We have changed our plate price momentum indicator from neutral to lower following Nucor’s price cut.

Hot-Rolled Coil

The SMU price range is $680–740 per net ton ($34.00–37.00 per cwt), with an average of $710 per ton ($35.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $10 per ton vs. one week ago, while the top end of our range was $40 per ton lower week on week (WoW). Our overall average is $15 per ton lower compared to the prior week. Our price momentum indicator for hot-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Hot-Rolled Lead Times: 3–7 weeks

Cold-Rolled Coil

The SMU price range is $900–960 per net ton ($45.00–48.00 per cwt), with an average of $930 per ton ($46.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged WoW, while the top end was down $60 per ton compared to a week ago. Our overall average is down $30 per ton WoW. Our price momentum indicator on cold-rolled coil is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Cold-Rolled Lead Times: 5–8 weeks

Galvanized Coil

The SMU price range is $860–960 per net ton ($43.00–48.00 per cwt), with an average of $910 per ton ($45.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was $40 per ton lower vs. last week, while the top end of our range was also down $40 per ton compared to one week ago. Our overall average is down $40 per ton vs. the prior week. Our price momentum indicator on galvanized steel is pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $957–1,057 per ton with an average of $1,007 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil

The SMU price range is $920–1,000 per net ton ($46.00–50.00 per cwt), with an average of $960 per ton ($48.00 per cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged vs. last week, while the top end of the range was $20 per ton lower WoW. Our overall average was down $10 per ton compared to one week ago. Our price momentum indicator on Galvalume steel is still pointing lower, meaning SMU expects prices will decline more over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,214–1,294 per ton with an average of $1,254 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate

The SMU price range is $1,400–1,530 per net ton ($70.00–76.50 per cwt), with an average of $1,465 per ton ($73.25 per cwt) FOB mill. The lower end of our range was up $50 per ton compared to the week prior, while the top end of our range was $30 per ton lower vs. last week. Our overall average is up $10 per ton WoW. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 3–8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert