Market Data

September 21, 2023

ABI Index Drops in August

Written by Becca Moczygemba

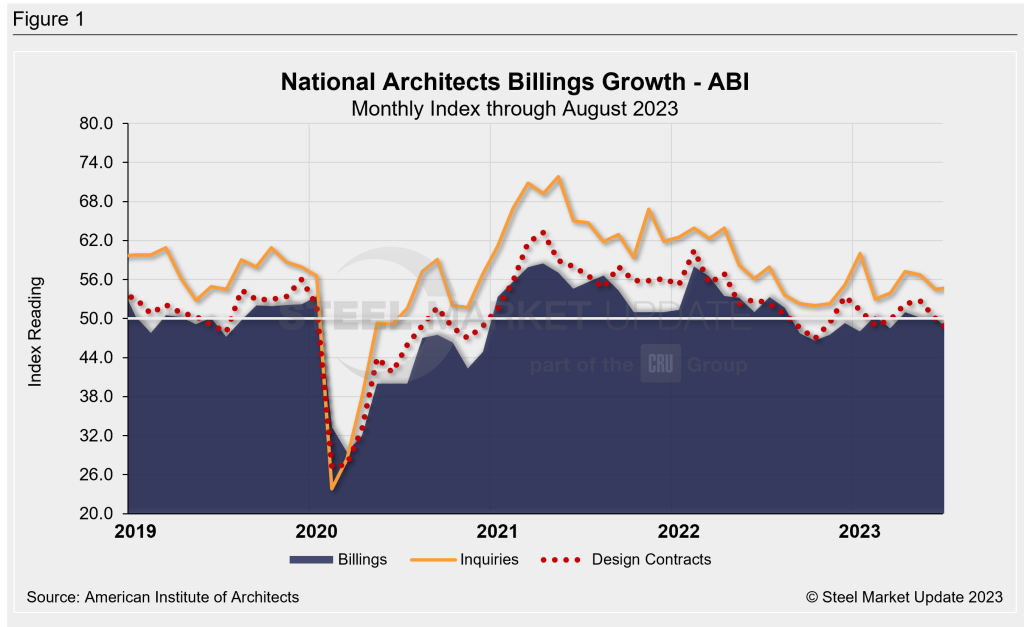

August’s Architecture Billings Index (ABI) reading from the American Institute of Architects (AIA) and Deltek showed a moderate decrease.

The index fell to 48.1 in August, just below July’s reading of 50.0. The reading had been at or above 50.0 since May of this year. August was the first dip below that level.

The ABI is a leading economic indicator for nonresidential construction activity with a lead time of 9-12 months. Any score above 50 indicates an increase in billings. A score below 50 indicates a decrease.

Fewer clients signed new design contracts in August compared to the previous eight months, with the new contract index falling to 47.9 from 50.0 the month prior.

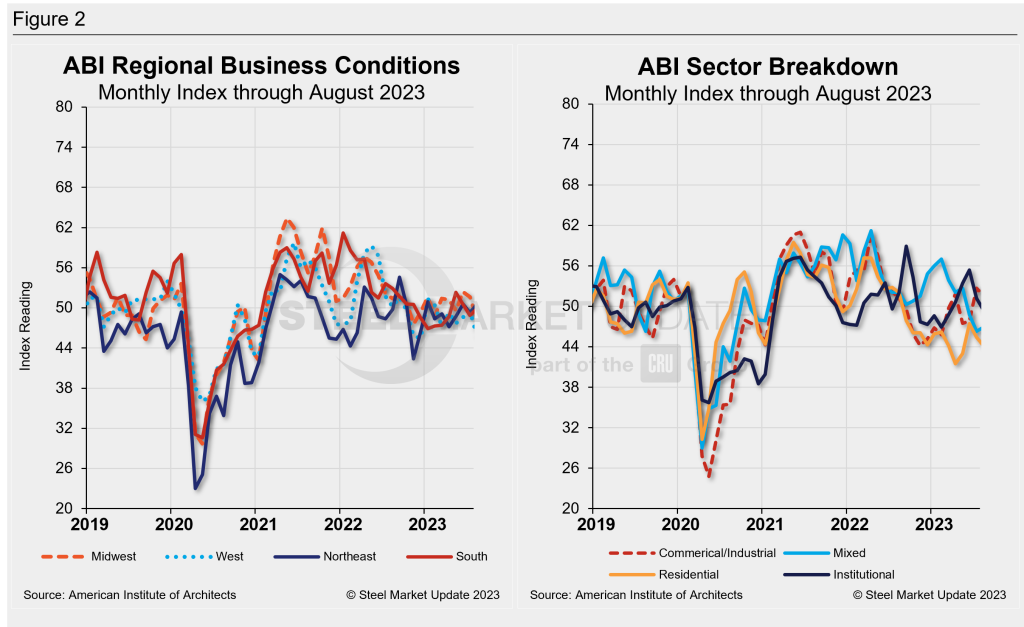

Billings declined for the 11th consecutive month at firms in the Western region, dropping to 45.8 from 49.6. Those in the South remained roughly flat, inching up to 49.9 in August from 48.9 in July. Billings in the Northeast rose to 50.6 from 49.3. Those in the Midwest declined from 51.6 in in July to 48.1 in August, after reporting the strongest billings in the country for the past nine months, the AIA report said.

Firms with a commercial and industrial focus reported a drop from 52.7 in July to 51.5 in August, while residential firms went from 45.4 to 44.1. Invoices from firms with a specialty in institutional projects were flat.

Employment continues to be a problem for many architecture firms, however.

“With many firms continuing to report difficulties finding enough qualified staff, this month we asked them about outsourcing domestic design work offshore (e.g., subcontracting work to individuals or firms in other countries that are not part of their company),” AIA said.

Of responding firms, 16% noted that their company is outsourcing domestic design work to overseas companies, according to AIA. The highest being for multifamily residential specialization. Overall, those firms report a high level of satisfaction for the work that is being done offshore.

One firm in the Midwest with an institutional specialization noted that business has softened to a degree, and its clients are slowly paying their invoices.

A small firm in the South with a commercial/industrial specialization said that business remains strong. “We have received quite a few preliminary scope projects, which could generate strong utilization in the fourth quarter and a strong start to 2024,” reported the firm.

An interactive history of the AIA Architecture Billings Index is available on the SMU website.