Analysis

September 21, 2023

Final Thoughts

Written by Michael Cowden

A big “thank you” to Wolfe Research and Timna Tanners for organizing a lunch today in Chicago with a group of steel industry participants and investors.

I tagged along too. Below are some themes that stood out to me in the discussions. I’ve also added some of my own thoughts.

A Reasonable Bull Case

Steel market participants at the lunch reasoned that we might be at or near a sheet price bottom – as counterintuitive as that might sound with the UAW strike likely poised to expand Friday afternoon. They reasoned along the lines of what I wrote in Final Thoughts on Tuesday.

Namely, demand outside of automotive remains steady on average, even if it’s highly variable from customer to customer. Steel consumers are running inventories lean. And offshore imports are not competitive – unless you’re ordering thin-gauge galvanized. (Note I wrote “offshore.” Imports from Canada and Mexico are competitive – including imports into the Midwest from Mexico, according to folks at the lunch.)

The result: Deals below $600 per ton ($30 per cwt) for HRC are probably out of the market. That figure matters because ~$600/ton was kicked around as a rough breakeven point for some US mills.

There also seemed to be a consensus that the UAW strike would last no longer than approximately 4-6 weeks. And once a deal is within sight, mills probably won’t be shy with price increases. Especially not after the market got used to $100-per-ton price hikes earlier this year.

Our latest survey data broadly reflect that consensus.

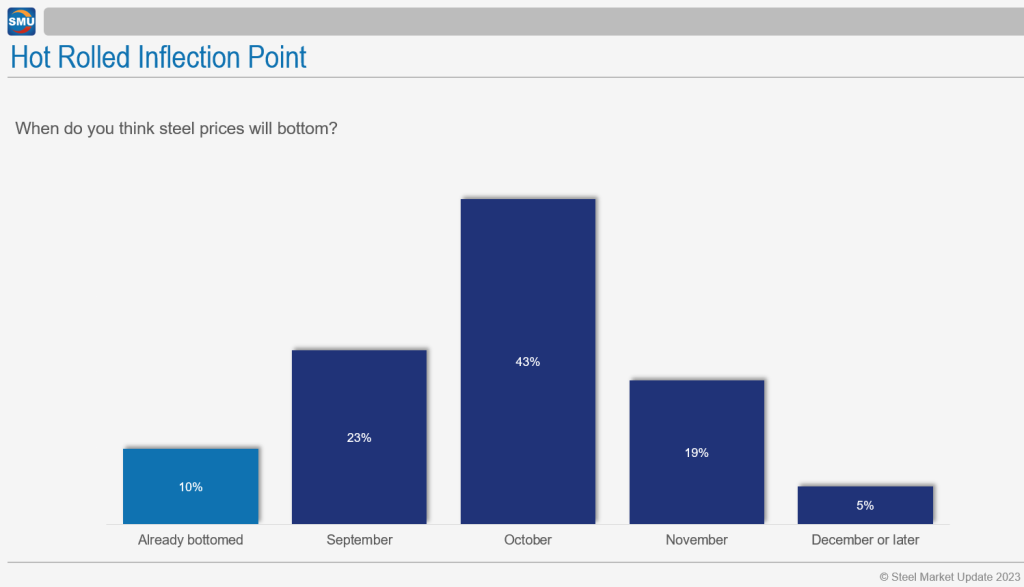

Case in point: 76% of survey respondents think prices have already bottomed, will later this month, or will in October:

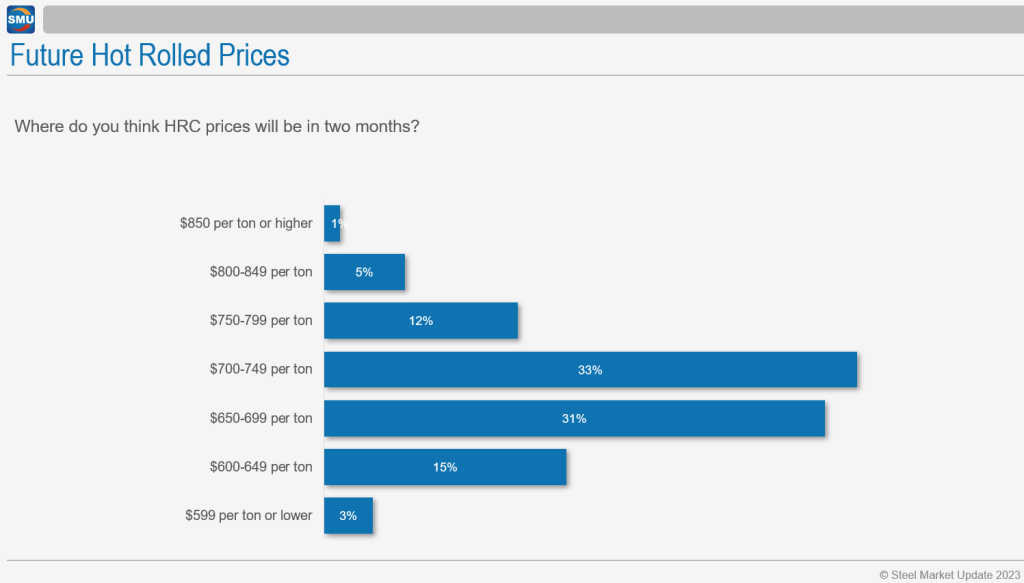

Also, about two-thirds think that prices two months from now will be roughly where they are now (our current average HRC price is $660 per ton) or back into the $700s per ton:

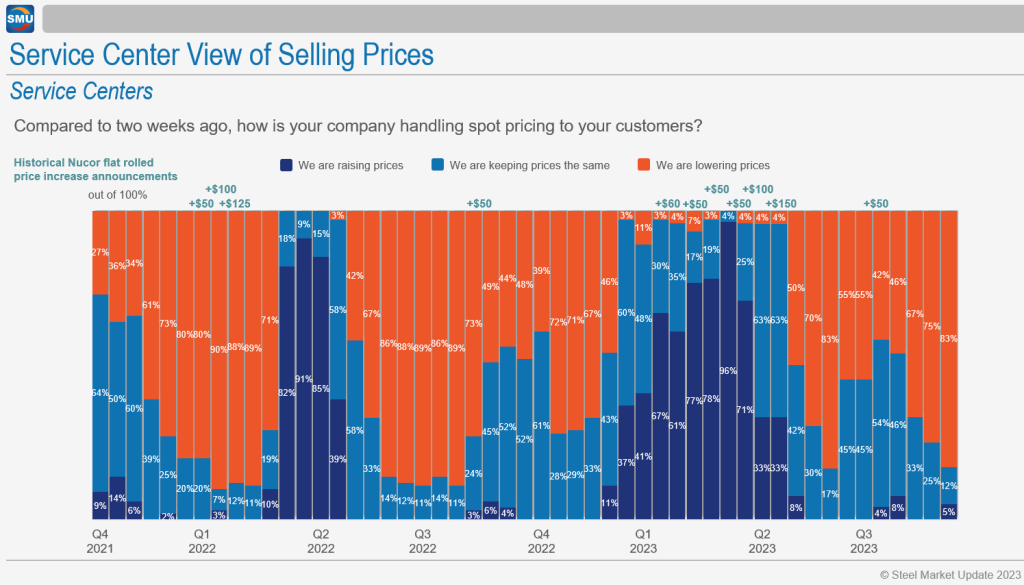

I asked folks at the lunch how to square that mostly constructive outlook, and our own somewhat bullish survey results, with more than 80% of service centers reporting that they continue to lower prices:

The takeaway: Service centers would stop cutting prices as soon as mills did. And, even if we do see a “failed” price hike, it will at least temporarily stabilize tags – akin to what we saw when mills announced price hikes last June.

How Long Will the UAW Strike Last?

I questioned how safe it was to assume that a strike would only last six weeks. That’s how long the UAW struck GM in 2019, the last time the union negotiated a labor contract with the “Big Three.” But history doesn’t usually repeat.

Or does it? Another interesting factoid: Since 1993, and among strikes involving more than 1,000 workers, the average length has been five weeks. That came from a good webinar held Wednesday afternoon by the Institute of Scrap Recycling Industries (ISRI): UAW Strike and Its Impact on the Recycled Metals Industry.

Roughly 13,000 workers are on strike now at three plants. And the UAW, as ISRI noted, has $825 million in its strike fund – enough to support a full strike, not just one at individual plants, for nearly 11 weeks.

So what happens if we were to see a more extended work stoppage? The consensus at the Wolfe lunch was that (a) sticker prices for new cars would go up, (b) another round of discounting might be necessary for mills to tide themselves over, and (c) the snapback in demand and in steel prices would be even more pronounced once automotive production resumed. So let’s say a big price rebound in Q4 if the strike not protracted and a potentially huge price spike in Q1 if negotiations drag on.

Keep in mind, the generally constructive outlook on prices also assumed that fall maintenance outages would be extended. It also assumed that at least one or two more blast furnaces might be idled. Why? For starters, Granite City, which has been temporarily idled, does not have as much exposure to automotive as some furnaces that are still running.

Another interesting wrinkle. The strike will probably extend annual contract negotiations. They unofficially start at Steel Summit in August. Sometimes they are wrapped up as soon as Halloween. But mills aren’t keen to negotiate contracts from what they see as a position of weakness.

That means they’ll probably wait at least until a tentative deal with the UAW is in hand before negotiating pricing contracts. The result: Good luck getting your contracts done my Christmas this year.

Shawn Fain Takes to Twitter (aka X)

We’ll know more about what the future might hold on Friday should the UAW’s noon deadline pass with no new labor agreement.

Automakers might reasonably say that they cannot offer massive wage increases, better benefits, and a shorter work week while also having any reasonable hope of making the investments necessary to transition to EVs.

That argument, however, does not appear to be gaining traction with UAW president Shawn Fain. He on Thursday posted a bargaining update on X, formerly Twitter. It said… Well, I can’t write it in a family publication like ours.

Take a look yourself. It’s a GIF from the 2017 movie The Hitman’s Body Guard featuring Samuel L. Jackson. He is in no mood to bargain.