Analysis

September 19, 2023

Final Thoughts

Written by Michael Cowden

Sheet prices fell again this week, this time not on fears of a United Auto Workers (UAW) union strike but on the actual thing.

And, yes, there is a chance that the strike will be expanded again this week, with the UAW setting a new deadline of noon on Friday for a new deal.

Might the UAW take aim at that the most profitable pickup platforms of the Detroit Three – the Ford F-150, the Chey Silverado, and the Dodge Ram?

I’ll leave that for the automotive press to cover. By the way, hats off to Automotive News for putting together a good map of where the strike is and a table of where negotiations stand. You can find that here.

Talks of a Bottom? Yes, Really.

I realize it’s hard to look past the UAW strike now, especially with the issue becoming a political hot potato. That said, it’s worth considering what the steel market might look like once a deal is reached. I say that because I’ve heard from a surprising number of you this week that you think a price bottom is closer than might be assumed.

A quick recap of where things stand. Our average hot-rolled coil price is at $660 per ton. The top end of our range is $700 per ton, where smaller spot buyers are. The lower end is in the low $600s per ton, where large buyers and some Canadian mills are.

Our average HRC price bottomed out last year at $615 per ton just before Thanksgiving, according to our pricing tool. The low end dipped into the high $580s per ton. I’ve heard some very large deals might have already happened in that range, perhaps as mills looked to secure volumes ahead of the strike. I’ve also heard those deals might be gone from the market now.

Why might that be? Industry sources will tell you that nearly 1 million tons of capacity were slated to come out of the market as a result of planned fall maintenance outages. The amount of capacity that will be out of the market is higher now with Granite City’s sole active furnace being temporarily idled. I’m also told that some of those planned fall maintenance outages have been extended.

Does that mean that 1.5 million tons are now out of the market? I’m not sure. But it’s safe to assume that it’s a higher figure than previously estimated.

Could prices nonetheless drift lower next week? I wouldn’t be shocked if they did. But as we saw last year, domestic mills aren’t keen to let prices slide much lower than $600 per ton. That’s especially true if it looks like scrap prices might increase next month.

The Prices Hikes Might Already Be Written

It’s also worth noting that mills have made no secret that they intend to announce price increases of as much as $75-100 per ton as soon as there is an inkling of the UAW strike being over.

Is it possible we’d then see a sharp rebound in prices? I think there is some logic to that position.

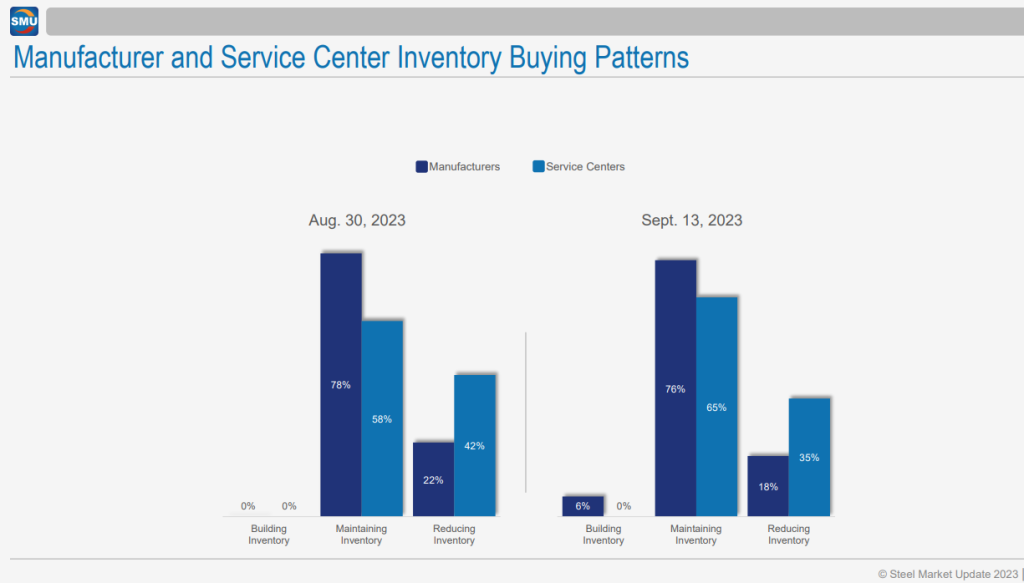

We won’t have September service center inventory data available until next month. But it’s already clear from our latest survey results that buyers have been reducing inventories.

Let’s say an end to the UAW strike is negotiated and automotive production has to catch up for lost time. Let’s also assume that buyers come back into the market all at once, as sometimes happens.

How far might prices go up and lead times move out? I don’t know the answer to that. But it’s worth thinking about as the drama in Detroit plays out.