Analysis

October 6, 2023

September Import Licenses Steady, Flat Rolled Permits Rise

Written by Laura Miller

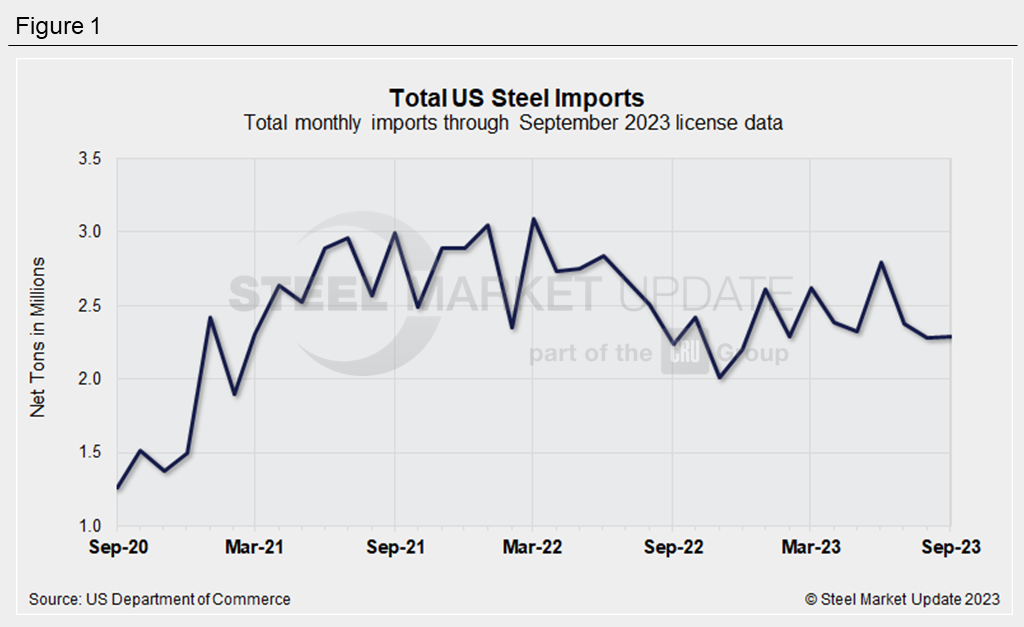

A significant slowdown in US steel imports has yet to be seen, as total import licenses in September were about even with August’s import levels.

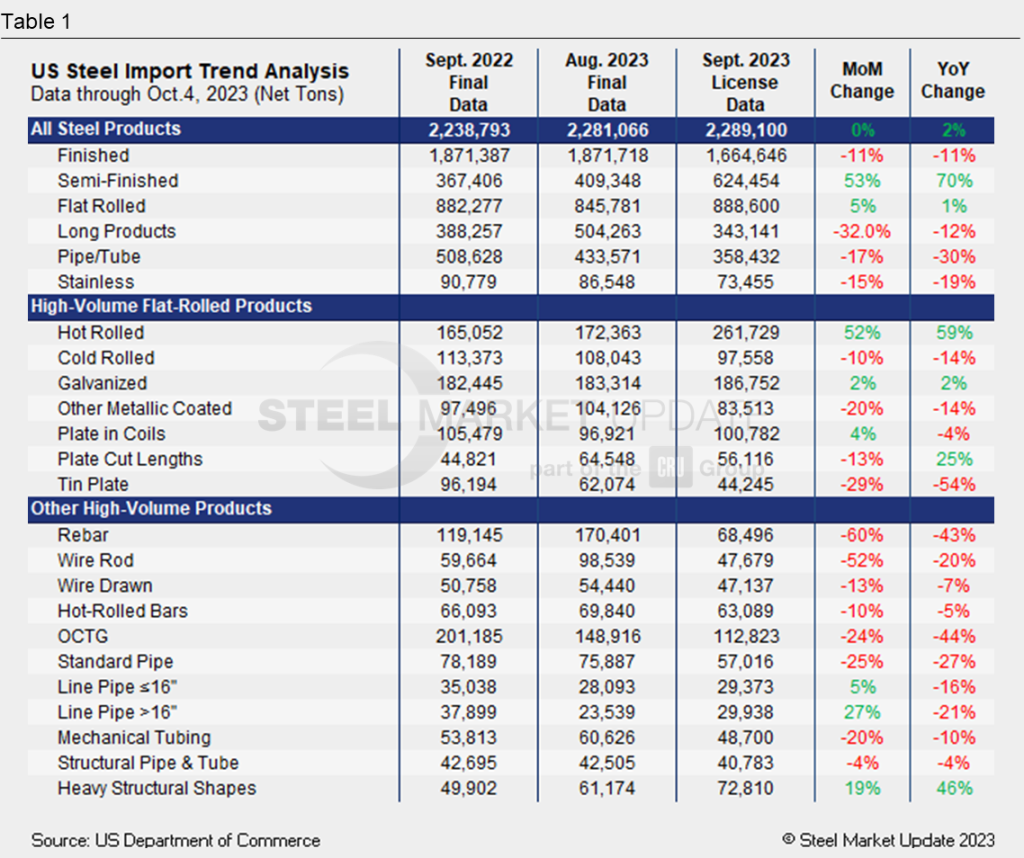

The latest data from the US Department of Commerce shows 2,289,100 net tons of import licenses for the month of September. That’s flat from 2,281,066 tons in August and just 2.2% higher than September 2022’s imports of 2,238,793 tons.

After falling for two consecutive months, licenses to import semi-finished steel jumped in September. Slab licenses surged, with Brazil sending nearly three times as many slabs: 328,944 license tons in September vs. 115,142 tons of imports in August.

Finished steel licenses, meanwhile, declined 11% both month on month (MoM) and year on year, with 1,664,646 tons of permits in September.

Licenses for flat-rolled steel, at 888,600 tons in September, were 5% higher than August imports, thanks to a spike in hot-rolled sheet imports. HR imports from South Korea surged from 17,424 tons in August to 94,641 September license tons. Licenses to import HR from Japan were also noticeably higher, at a recent high of 29,930 tons.

Hot-dipped galvanized sheet is one of the most imported sheet products. Total HDG imports were fairly steady during the summer months, and September licenses crept 1.9% higher MoM to 186,751 tons. Canada is the top exporter of HDG to the US, and its shipments slipped 13% MoM to 79,371 tons of September licenses. Those tonnages appear to have been replaced by South Korea and Brazil. HDG licenses for South Korean product jumped to a recent high of 25,997 tons, while those for Brazilian-origin HDG were also at a recent high of 23,162 tons.

As SMU has been reporting, domestic hot-rolled coil (HRC) prices are now nearly even with imported material. Because of this, a slowdown is expected in imports in the coming months. But with domestic mills pushing to raise prices, planned and unplanned mill outages, and steel demand and production in flux due to the ongoing UAW strike, domestic prices could soon rise again. This could result in more attractive import offers in the near future.

Note that license counts can differ from preliminary and final figures, as import licenses are required to be obtained before actual importation.

We’ll take a deeper look at September imports when preliminary figures are released later this month.