CRU

December 1, 2023

CRU: Baffinland allowed to increase iron ore shipments

Written by Aaron Kearney-Keaveny

The Canadian government has given ArcelorMittal-linked Baffinland Iron Mines permission to dispatch up to 6 million metric tons per year from its Mary River mine in Nunavut territory, higher than the 4.2 million metric tons per year previously permitted.

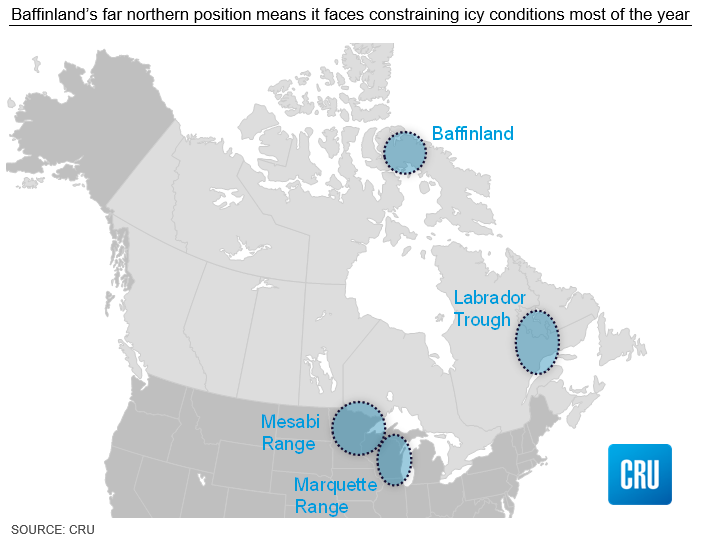

The approval from northern affairs minister Dan Vandal allows Baffinland to make the extra shipments if unexpected circumstances mean ore is stockpiled at Milne Inlet from the previous year, local media reported. Last year heavy ice put an early end to shipping and some ore was left at the port on the northern tip of Baffin Island.

Early this year the company submitted to the government a ‘sustaining operations proposal’ to enable production to continue after Ottawa rejected its application to double output to 12 million metric tons per year and construct a railway to the port.

Baffinland Iron Mines is majority owned by the Energy and Minerals Group, with ArcelorMittal having a 26% stake.

Baffinland to continue looking to expand

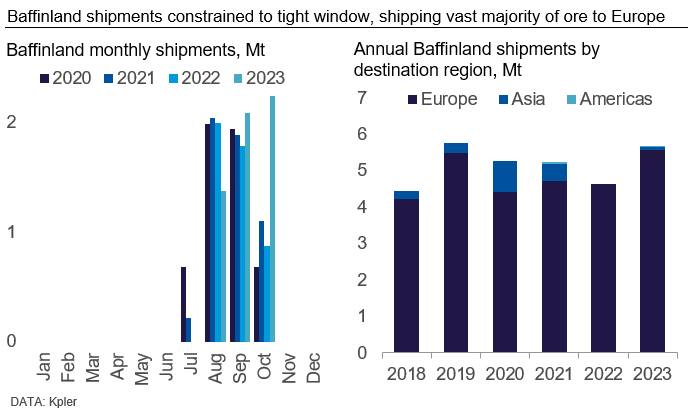

Baffinland had been granted the 6 million metric tons per year allowance since 2018 but this was not guaranteed for future years. The recent allowance will be applied for the coming two years. The company has been denied an expansion to reach 12 million metric tons per year. One of CRU’s market contacts has confirmed that there is already a large amount of idle equipment on site for this. We understand this as being an indication that the company is optimistic about eventually getting approval to expand beyond 6 million metric tons per year. Getting permission for the rail expansion will be necessary as the current transport infrastructure has the potential to deliver over 6 million metric tons per year, but would fall far short from 12 million metric ton per year. This is especially true given the limited port storage space and the constrained shipping window, as icy conditions prevent shipments outside of July–October (though the exact window is different each year).

The expansion proposal has been met with major environmental concern, particularly from the indigenous community. A primary environmental concern is that higher volumes of shipments could disrupt marine life in the area, particularly for narwhals. The company is currently attempting to maximize ore onloading on each ship to minimize the number of vessels needed and restraining boat speed to minimize underwater sound. Beyond taking these environmental measures, the company has also argued that they serve an important role for the local community by providing jobs, which includes employment of indigenous people. When proposing a 6 million metric tons per year allowance before, they stated that they would have to terminate over 1,100 workers if they were restricted to 4.2 million metric tons per year.

For the upcoming two shipping windows, the highest lump grade mine will ship an extra 1.8 million metric tons per year to the market, specifically to Europe which has been the main destination for output. The region will only become more eager for the material as steel production improves in 2024 and returns to a steadier market over our medium-term outlook, after major disruptions from Covid-19 and recent macroeconomic hardship constrained production. The region’s restricted sintering capacity and loss of pellet supply from CIS will exacerbate the desire for lump as a substitutional direct charge product.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com.