Analysis

January 3, 2024

Import licenses bounce back to five-month high in December

Written by Laura Miller

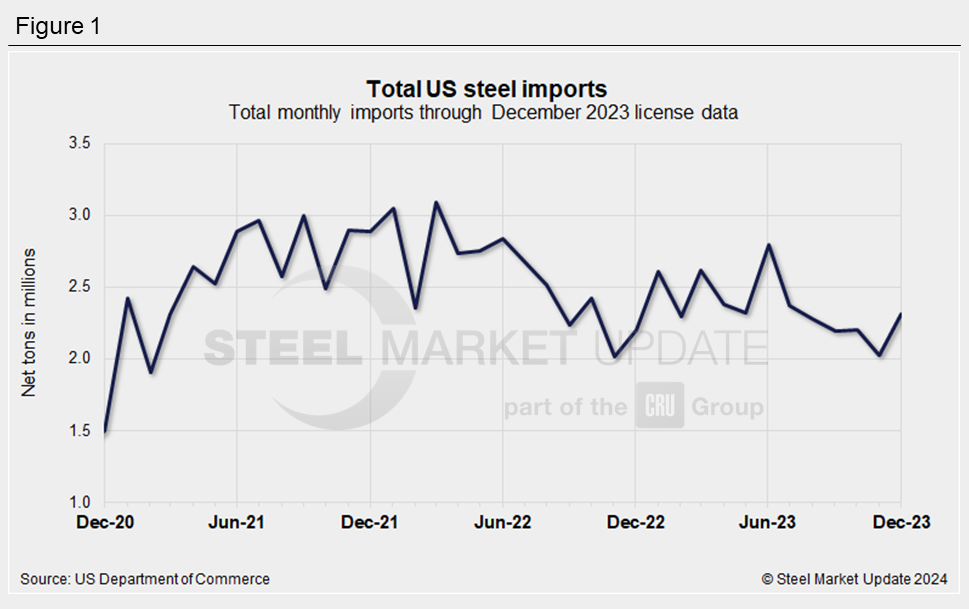

After falling in November, steel imports appear to have bounced back to a five-month high in December.

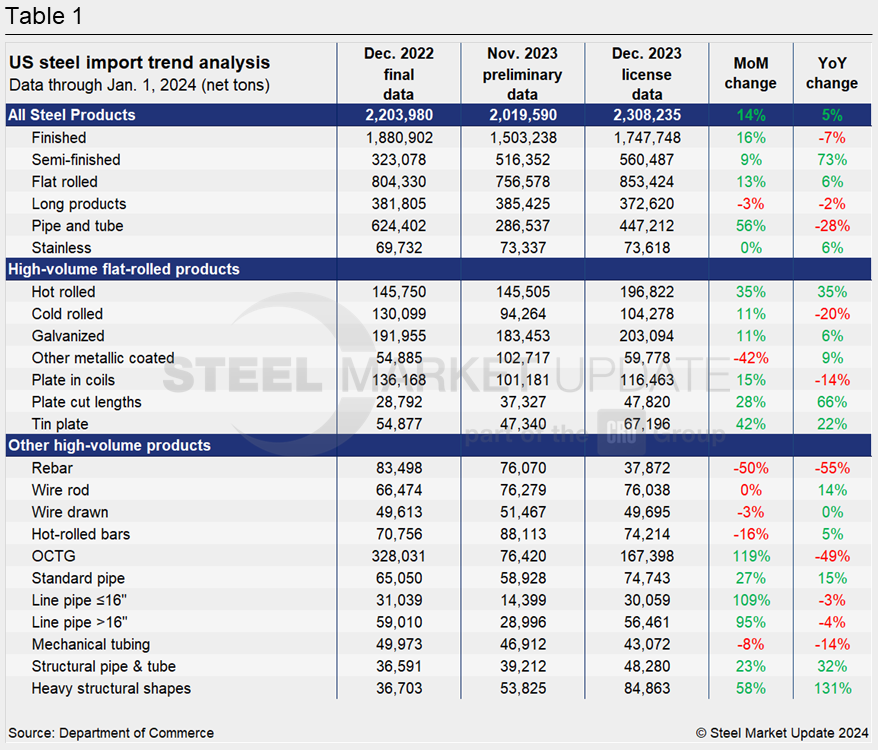

Licenses to import steel into the US totaled 2,308,235 net tons, according to a license count from the US Department of Commerce’s International Trade Administration as of Jan. 1.

Note that license counts can differ from preliminary and final figures, as import licenses are required to be obtained before actual importation occurs.

December’s license count is 14% higher than November’s preliminary count of 2,109,590 tons. For 2023, the fewest amounts of imports came in during the month of November.

Compared to the same month last year, December licenses are 5% higher than December 2022’s imports of 2,203,980 tons.

Semi-finished steel imports rose 8.5% month on month (MoM) to 560,487 tons – the highest monthly amount in the final quarter of 2023. The license count shows Brazilian slab shipments remaining high and slab shipments from Canada and Mexico rising.

Finished steel import licenses, meanwhile, rose 16% from November to 1,747,748 tons. Compared to the last month of 2022, however, December’s finished steel import license count was 7.1% lower.

The flat-rolled and pipe and tube product categories showed significant MoM increases.

December flat rolled licenses of 853,424 tons were 12.8% higher MoM and 6.1% higher year on year.

Pipe and tube imports of 447,212 tons jumped from November’s recent low of 286,537 tons to 447,212 tons of licenses for December. While the December license count was at a six-month high, it was still 28% lower than December 2022’s final tally.

We’ll take a closer look at December imports when preliminary figures are released later this month.