Market Data

January 5, 2024

SMU survey: Steel Buyers Sentiment Indices slump to start 2024

Written by Ethan Bernard

SMU’s Steel Buyers Sentiment Indices both fell this week, with current sentiment taking a large dive to begin the new year, our most recent survey data shows.

Every other week, we poll steel buyers about sentiment. The indices measure how steel buyers feel about their companies’ chances of success in the current market and three to six months down the road. (We have historical data dating to 2008. You can find that here.)

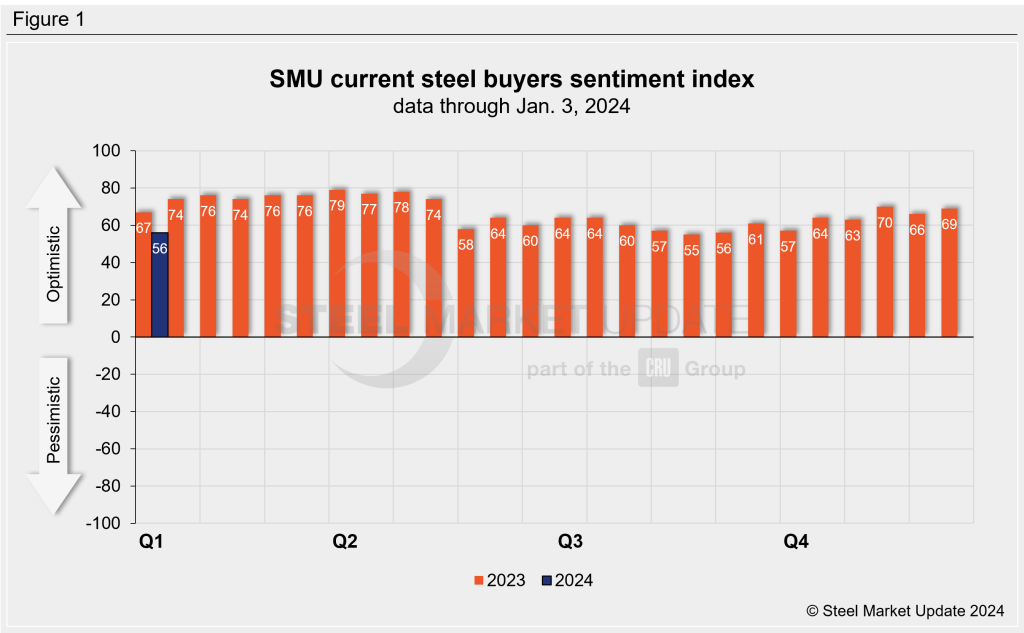

SMU’s Current Buyers Sentiment Index stood at +56 this week, tumbling 13 points from +69 two weeks earlier (Figure 1). It last hit this level in the middle of September and started 2023 at +67.

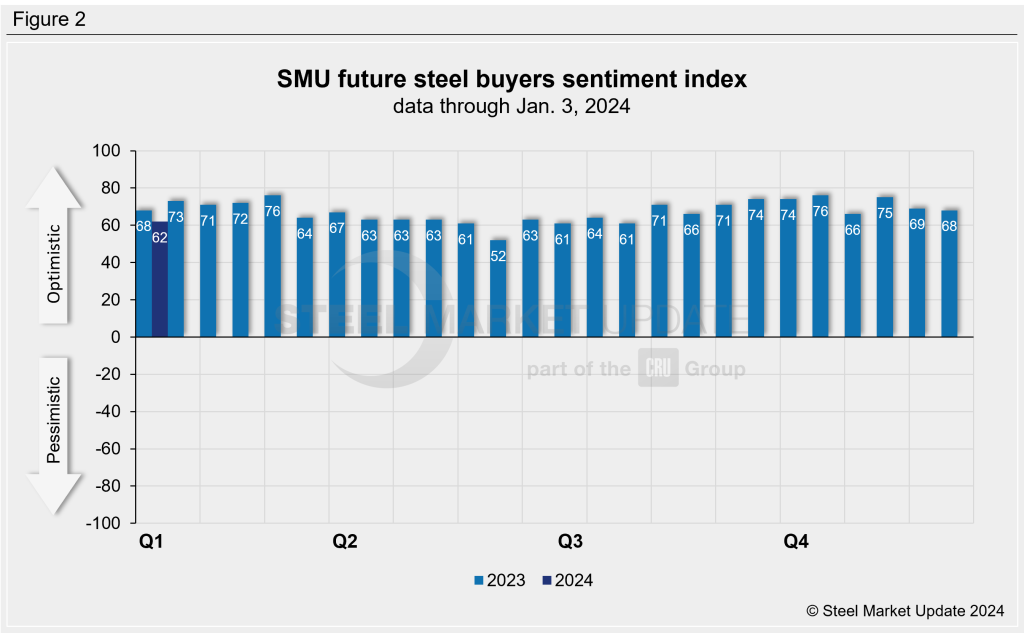

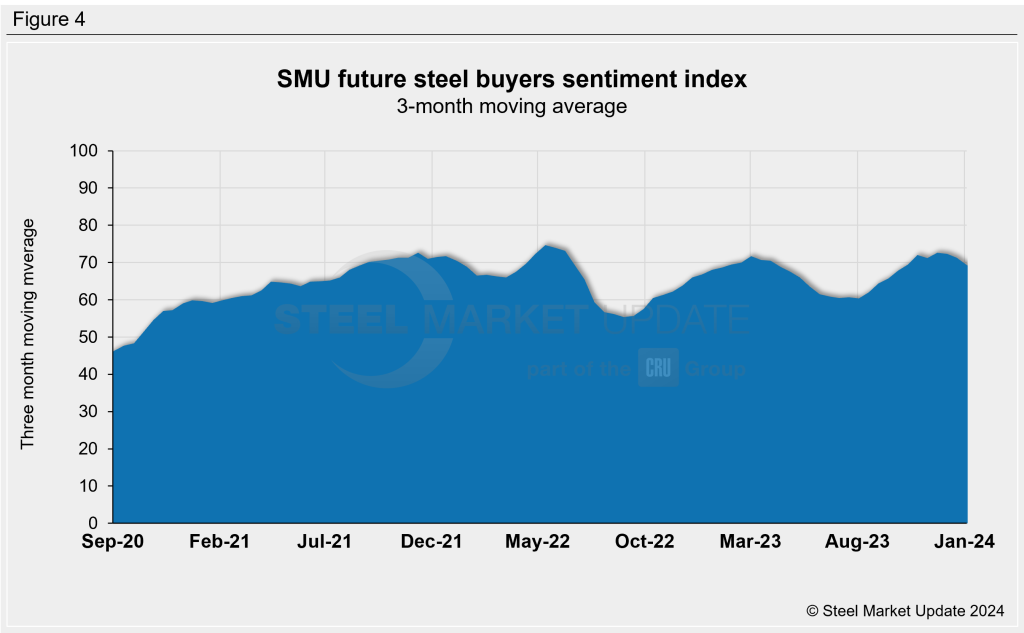

SMU’s Future Buyers Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. This week, the index dropped six points to +62 from the previous market check (Figure 2). This is the lowest reading since the start of August. The Future Sentiment Index stood at +68 at the beginning of last year.

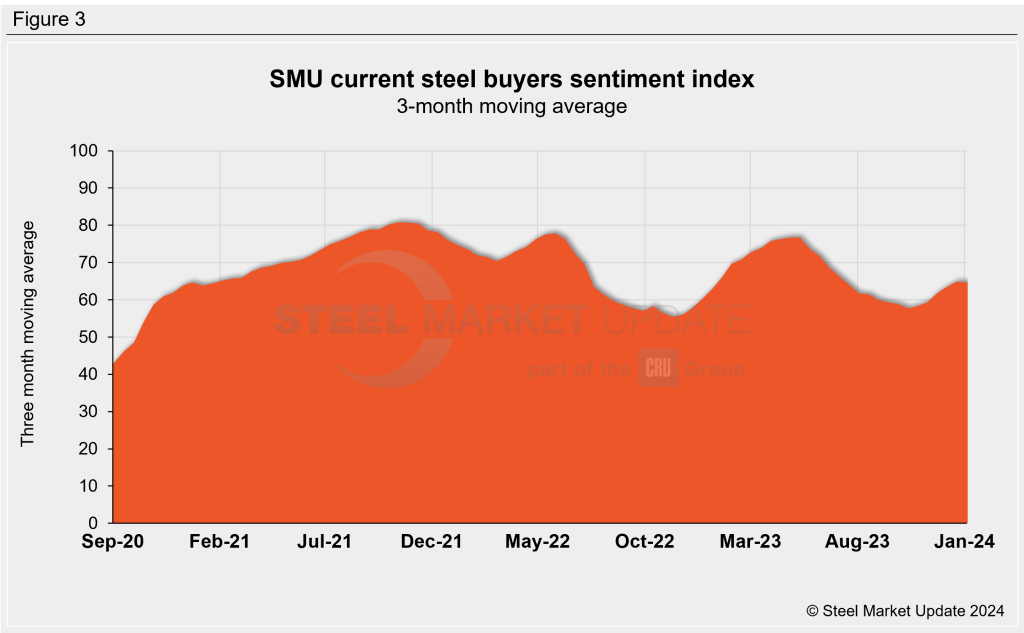

Measured as a three-month moving average, the Current Sentiment 3MMA decreased to +64.67 from +66.40 two weeks prior. (Figure 3).

This week’s Future Sentiment 3MMA fell to +69.33 vs. +71.33 at the previous market check (Figure 4).

What SMU respondents had to say:

“Positioned well for the first quarter of 2024.”

“Rising costs…”

“It’s been a robust spot market.”

“Demand starting January is great, compared to holiday shipments being down.”

About the SMU Steel Buyers Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via SMU surveys twice per month. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.