Analysis

May 7, 2024

March exports ease 5% from previous month's high

Written by Brett Linton

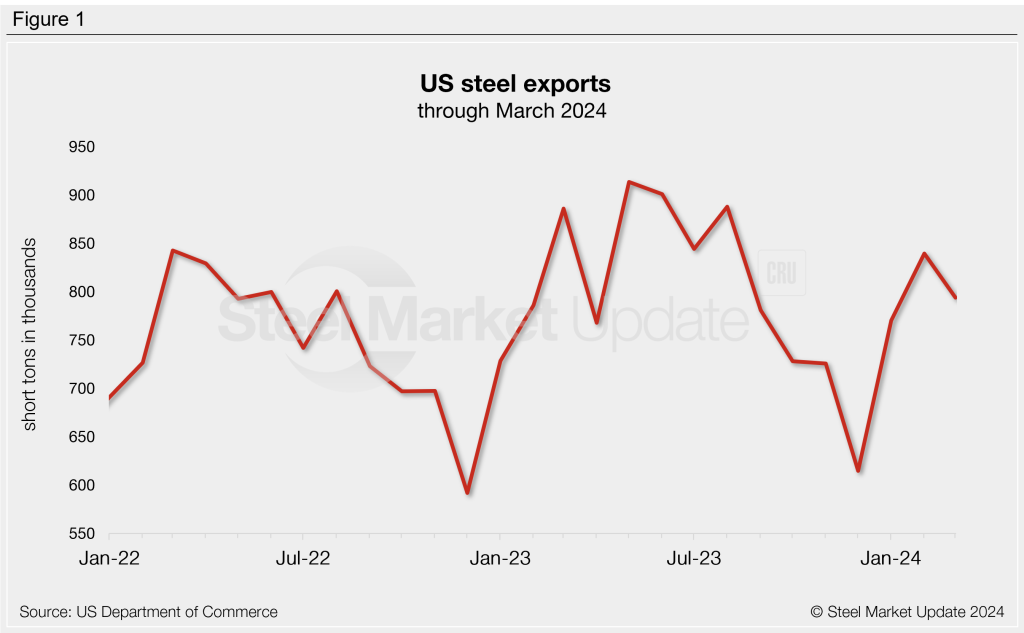

US steel exports eased through March but remain healthy, having reached a six-month high in February. The latest US Department of Commerce data shows 794,000 short tons (st) of steel were shipped out of the country in March, down 5% from February. Exports have had a strong start to 2024, jumping 25% month on month (m/m) in January and another 9% in February.

Monthly averages

Looking at exports on a 3-month moving average (3MMA) basis can smooth out the monthly fluctuations. Shipments had trended downward throughout the second half of 2023, falling to an 11-month low in December. The 3MMA changed course as it entered this year, rising each month since. The latest 3MMA through March is up to 802,000 st, an 8% increase from February and now at a six-month high.

Exports can be annualized on a 12-month moving average (12MMA) basis to further dampen month-to-month variations and highlight historical trends. From this perspective, steel exports have steadily trended upwards since bottoming out in mid-2020. The 12MMA reached a five-and-a-half-year high in February. In March, this measure declined slightly to 798,000 st but remains very strong historically.

Exports by product

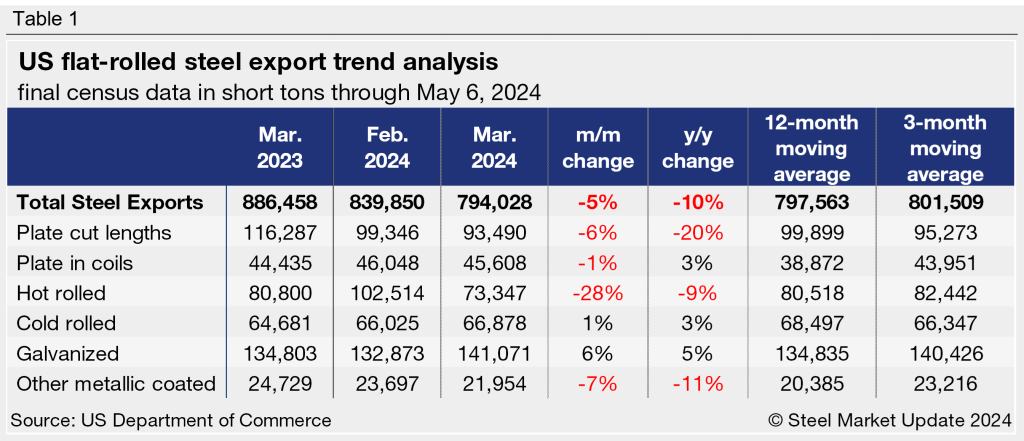

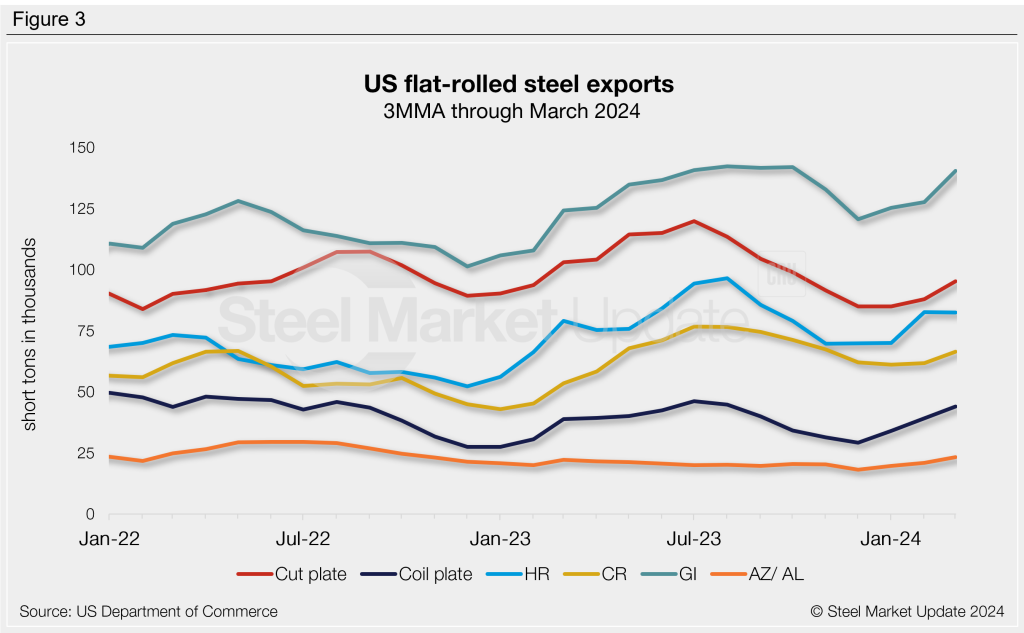

Exports of most major flat-rolled steel products were flat to down in March. The biggest monthly mover was hot-rolled sheet (-28%), reversing the gains seen in February. Declines were also seen in other metallic coated products and plate cut lengths. Galvanized exports increased m/m to the second-highest level seen over the past seven months. Exports of cold-rolled and coiled-plate products were relatively flat m/m, with coiled-plate shipments hovering at the second-highest level seen in the last eight months.

March exports are 10% lower than levels one year prior. Notable year-on-year (y/y) decreases were seen in exports of plate cut lengths, other metallic coated, and hot rolled.

On a 3MMA basis, all but one of the steel product exports we track saw increases from February to March. The largest movers were coiled plate (+12%), other metallic coated (+11%), and galvanized (+10%).

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico. Out of all exports, 50% in March went to Mexico, followed by 44% to Canada. The next largest recipients were Brazil and China at less than 1% each.