CRU

July 12, 2024

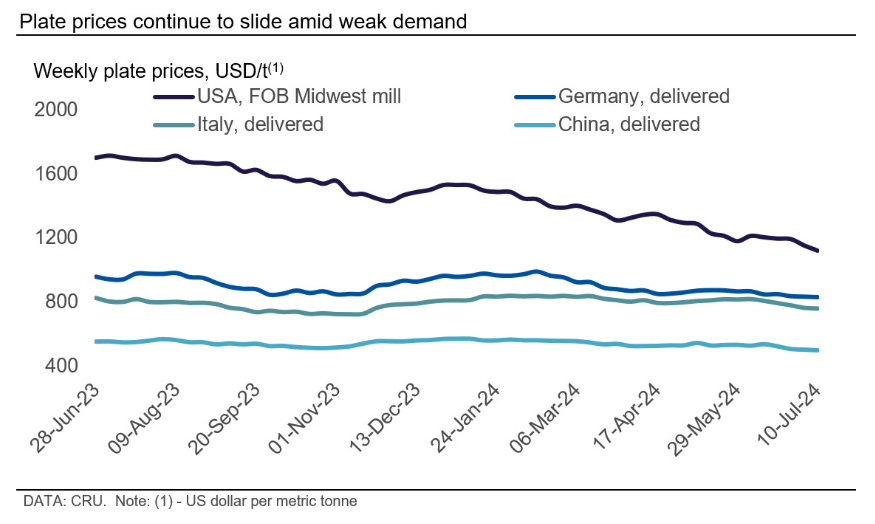

CRU: Sluggish plate demand weighs on prices

Written by Estelle Tran

Global

Plate prices declined in all regions this week amid slow seasonal demand. With bearish outlooks on demand in the near term, market participants are watching how mills will react to low order entry levels and short lead times. In the US and China, production has been steady, but in Europe, steel mills are contemplating extended maintenance outages.

Europe

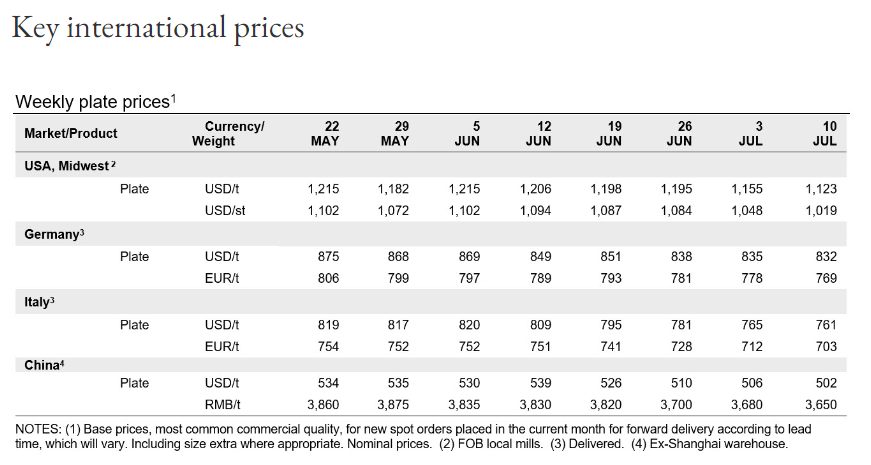

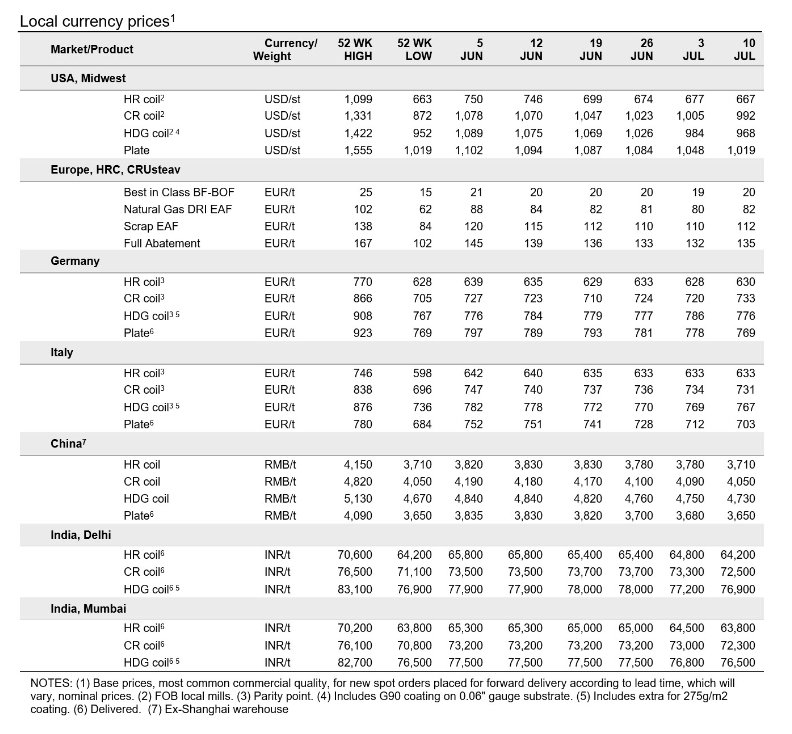

European plate prices remained under pressure over the past week due to subdued demand, with German and Italian prices falling €9/metric ton ($9.81/mt) w/w to €769/mt ($839/mt) and €703/mt ($767/mt), respectively. Purchases by stockholders have been sparse, with buyers only securing small volumes where needed due to weak end-use demand and sufficient inventories. Although stock levels are not high compared to recent years, they remain high relative to current demand. As a result, stockholders are still trying to reduce their stocks.

In Czechia and Poland, some domestic producers began cutting production this month and plan to extend summer maintenance outages in August to rebalance supply with demand. In Germany, mills are closing for summer maintenance, with one mill already stopped and another larger one set to follow. There has been chatter among market participants that one mill may extend its August outage beyond the usual two weeks.

US

The plate market in the US remains bearish, and prices fell w/w by $29/short ton to $1,019/st. Market participants report that inventory levels remain too high relative to demand, orders from OEMs are slowing, and more infrastructure projects are being put on hold. Mill orders are also thin, and deliveries are happening within a couple of weeks in some cases. Mills have had to remain price competitive in this environment, and ongoing market conditions seem unlikely to change until at least the end of the year, given that sellers can meet any sudden increases in demand.

China

Domestic Chinese plate prices fell by RMB30/mt ($4/mt) w/w. Demand remains weak as high temperatures and heavy rainfall continue to affect releases downstream. Production continues to be stable, with no substantial change in shipment volumes. Traders have been motivated to move material with little inclination to raise prices, resulting in a slight decrease in inventory w/w. Overall, transactions remain tepid, though. Market participants are adopting a wait-and-see approach and remain cautious.

This article was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.