Analysis

September 18, 2024

Dismal ABI suggests weakness in non-res construction will persist

Written by Brett Linton

The August Architecture Billings Index (ABI) continued to indicate weak business conditions amongst architecture firms through August, according to the American Institute of Architects (AIA) and Deltek.

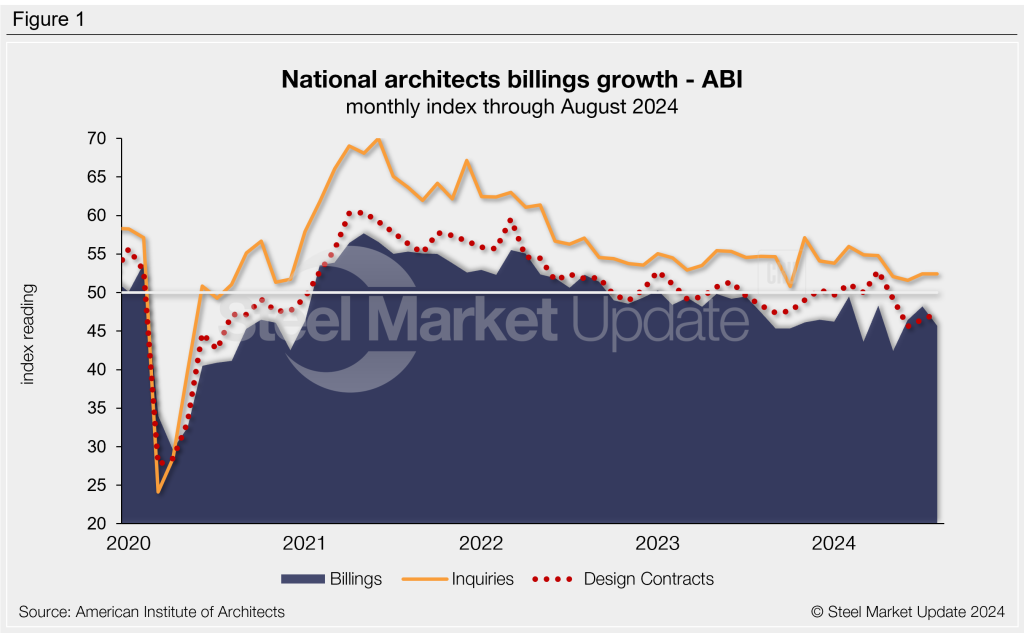

The August ABI eased 2.5 points from July to 45.7, the third-lowest figure recorded this year (Figure 1). The index has indicated contracting business conditions for the last 19 months. At this time last year, the index was 47.5, whereas two years prior, it was 52.3.

The ABI is a leading economic indicator for nonresidential construction activity. It can project business conditions approximately 9-12 months down the road. Any score above 50 indicates an increase in billings, while a score below that indicates a decrease.

“Unfortunately, even the impending interest rate cuts didn’t move the needle on project inquiries or new design contracts at architecture firms,” said AIA chief economist Kermit Baker. “Hopefully, once the trajectory of further cuts gets clarified, delayed projects will restart, and new projects will gather momentum.”

The project inquiries index remained optimistic in August, holding steady at 52.4. However, weakness in the design contracts index continued for a fourth consecutive month, inching up to 47.3.

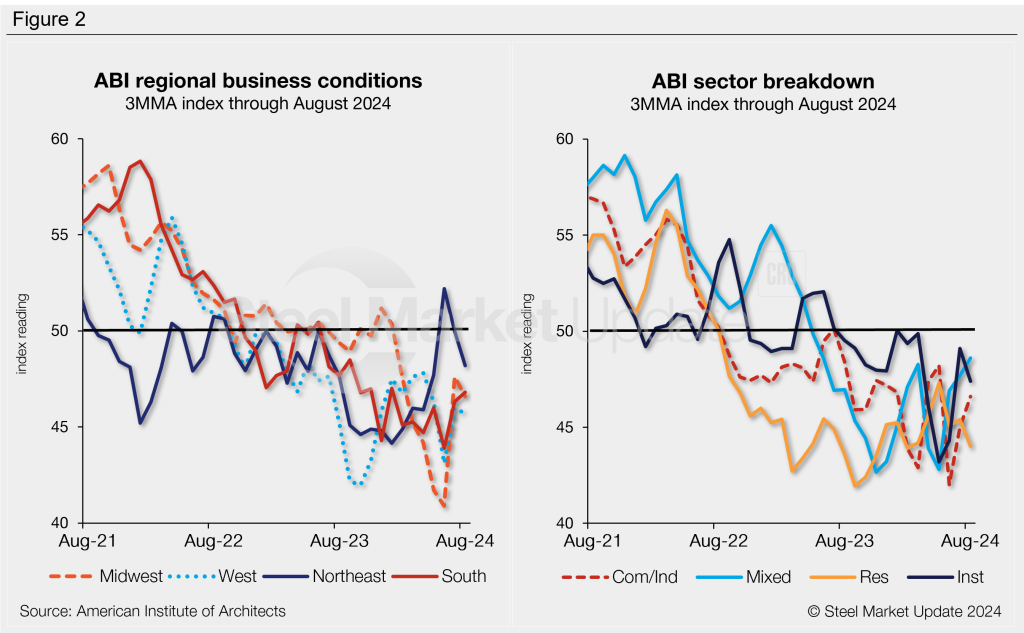

All four regional indices indicated less than stellar business conditions in August (Figure 2, left). The Southern index was the only regional index to move higher from July to August. The Northeastern regional index was the least dismal of the four.

Sector indices also continued to indicate declining billings across the board in August (Figure 2, right). Two sector indices saw some degrees of growth compared to the month prior (mixed practice and commercial/industrial), while two sectors declined further (institutional and multifamily residential).

An interactive history of the August Architecture Billings Index is available here on our website.