Market Data

September 27, 2024

SMU survey: Steel Buyers' Sentiment Indices remain optimistic

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices ticked higher this week, following multiple months of volatility. We have seen fluctuations in our Current Steel Buyers’ Sentiment Index since June, but only more recently in our Future Sentiment Index. The indices remain in positive territory and continue to indicate optimism amongst steel buyers.

Every two weeks, we survey hundreds of steel buyers on their companies’ chances of success in today’s market and their expectations for business three to six months from now. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, measures we have tracked since 2008.

Key takeaways

SMU’s Current Sentiment Index continues to show optimism among buyers about their business’s chances of success, although maybe not as much as they had at the beginning of the year. Our Future Sentiment Index indicates buyers maintain hope for favorable business conditions in the future.

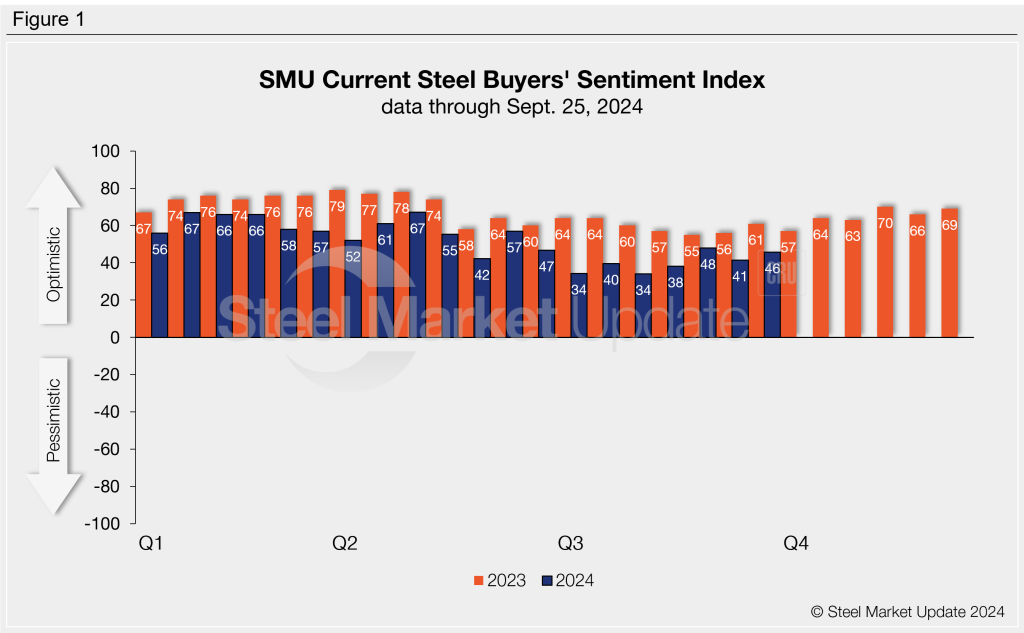

Current Sentiment

SMU’s Current Buyers’ Sentiment Index rebounded five points from the last reading to +46 this week (Figure 1). While sentiment has gradually recovered from July’s multi-year lows, it remains below levels of a year ago (+61).

Year to date (YTD), Current Sentiment has averaged +52 across the first nine months of 2024. This is notably lower than the 2023 YTD average of +68.

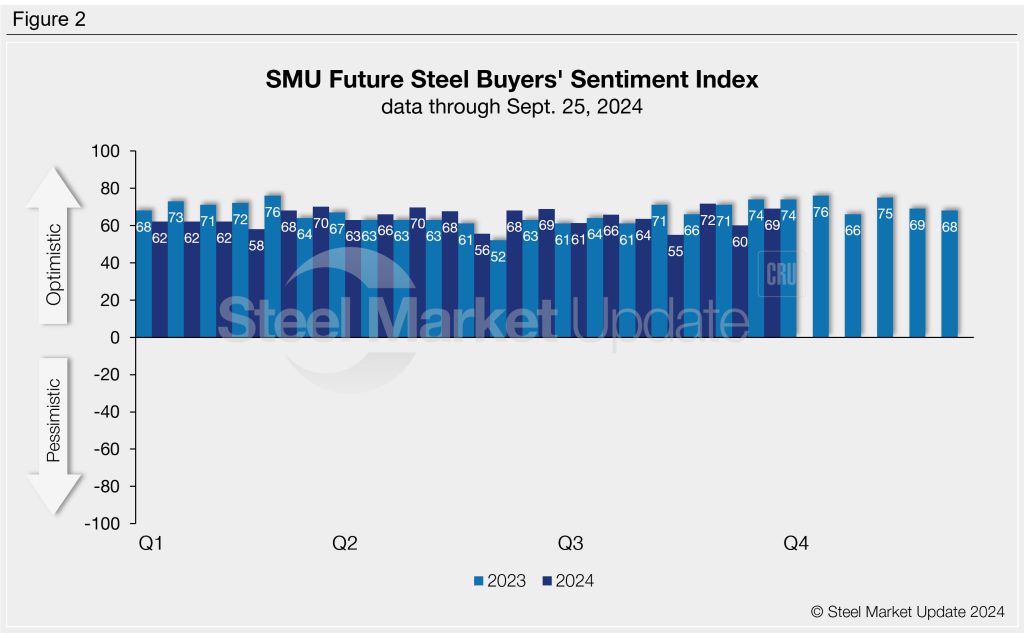

Future Sentiment

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months from now. The index jumped nine points to +69 this week, one of the higher measures recorded in the last few months. Recall that just over one month ago, Future Sentiment dipped to the lowest reading in over a year (+55). (Figure 2). This time last year, Future Sentiment was +74.

YTD, Future Sentiment has averaged +64, down two points from the same period of 2023.

What SMU survey respondents had to say:

“We could always use more work, but we’re doing acceptably.”

“Slow but steady.”

“I see economic activity picking up in a few months, especially after the election and as interest rates start to decline.”

“I feel that our market will bounce back after the election and rate decreases.”

“Overall business volumes will become more stable after the first of the year.”

“Spot business has been incredibly slow.”

Moving averages

Measured as a three-month moving average, Buyers’ Sentiment increased this week following mid-September’s lows (Figure 3).

The Current Sentiment 3MMA ticked up this week to +41.12, recovering from a four-year low registered two weeks prior. As a 3MMA, Current Buyers’ Sentiment has generally trended downward over the last year.

The Future Sentiment 3MMA rose from a one-year low to +64.15 this week.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers’ Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment can help predict their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.