Analysis

October 29, 2024

Steel imports slip 10% from August to September

Written by Brett Linton

According to preliminary Census data released by the Commerce Department, September marked the lowest month for steel imports this year.

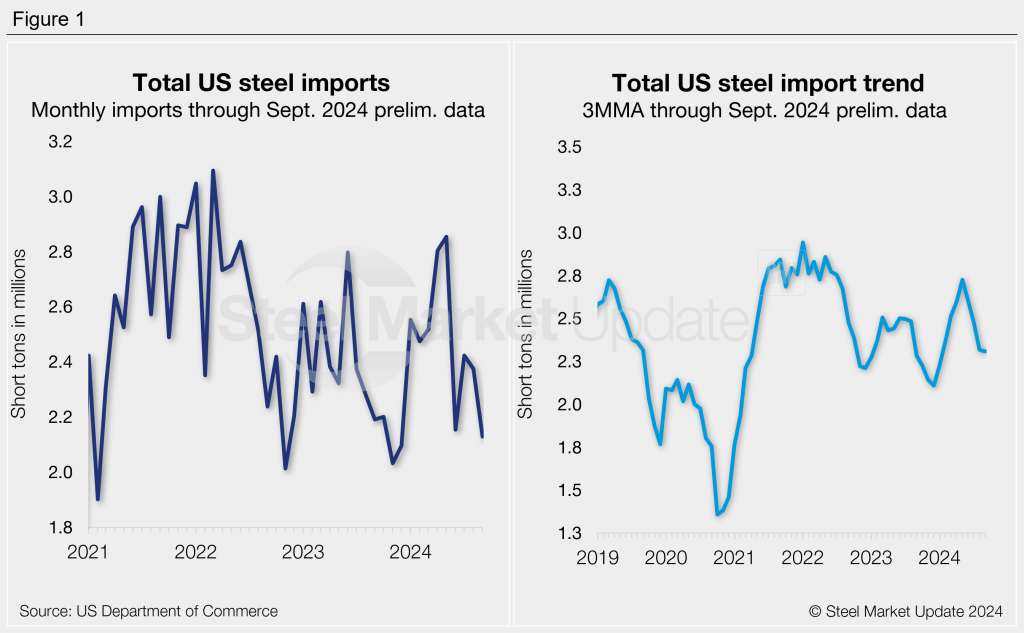

September’s preliminary count shows 2.13 million short tons (st) of steel products entered the country last month. This is down 10% from August (2.38 million st) and 25% below the multi-year high we saw in May (2.85 million st). The left graph in Figure 1 displays a history of steel imports by month.

Import trends

Looking at imports on a three-month moving average (3MMA) basis can smooth out the monthly variability and better highlight trends. On a 3MMA basis, September imports eased to an eight-month low of 2.31 million st. The September 3MMA is down less than 1% month on month (m/m) but is up 4% from the start of this year. The 3MMA at this time last year was slightly lower at 2.28 million st. The right graph in Figure 1 shows total steel imports on a 3MMA basis.

Imports by category

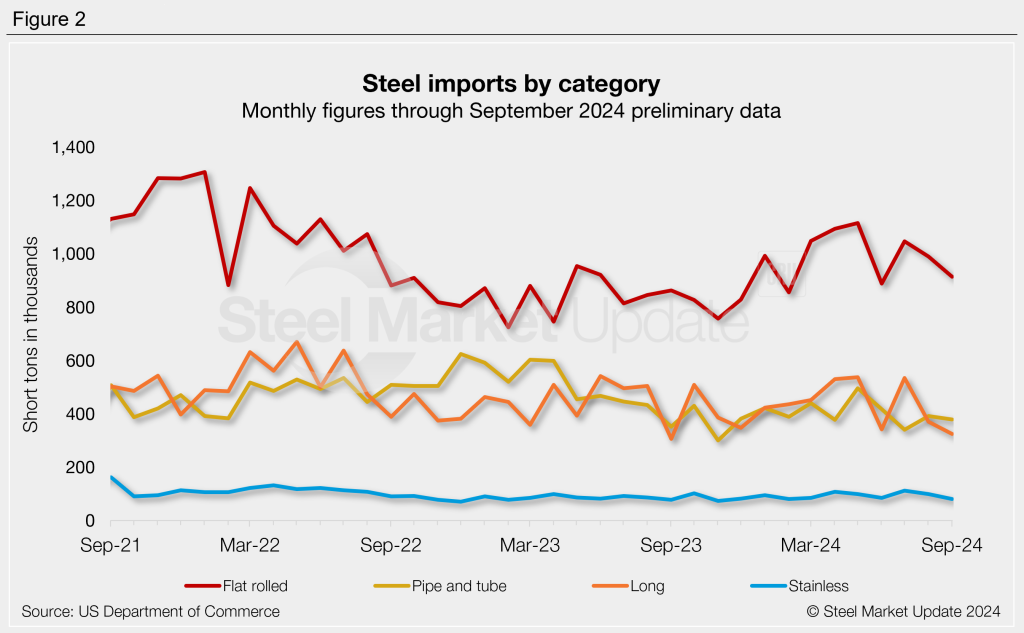

Preliminary data shows that import volumes eased across all categories from August to September (Figure 2):

- Semifinished steel imports dropped 18% to 429,000 st.

- Flat-rolled steel imports declined 8% to 914,000 st.

- Pipe and tube imports eased 3% to 379,000 st.

- Long product imports fell 12% to a one-year low of 325,000 st.

- Stainless imports slipped 18% to a seven-month low of 81,000 st.

SMU will publish a full import analysis after final September data is released next week. We will also explore October import licenses collected to date.