Market Data

December 6, 2024

SMU Survey: Current Sentiment Index slides, Future Sentiment steady

Written by Ethan Bernard

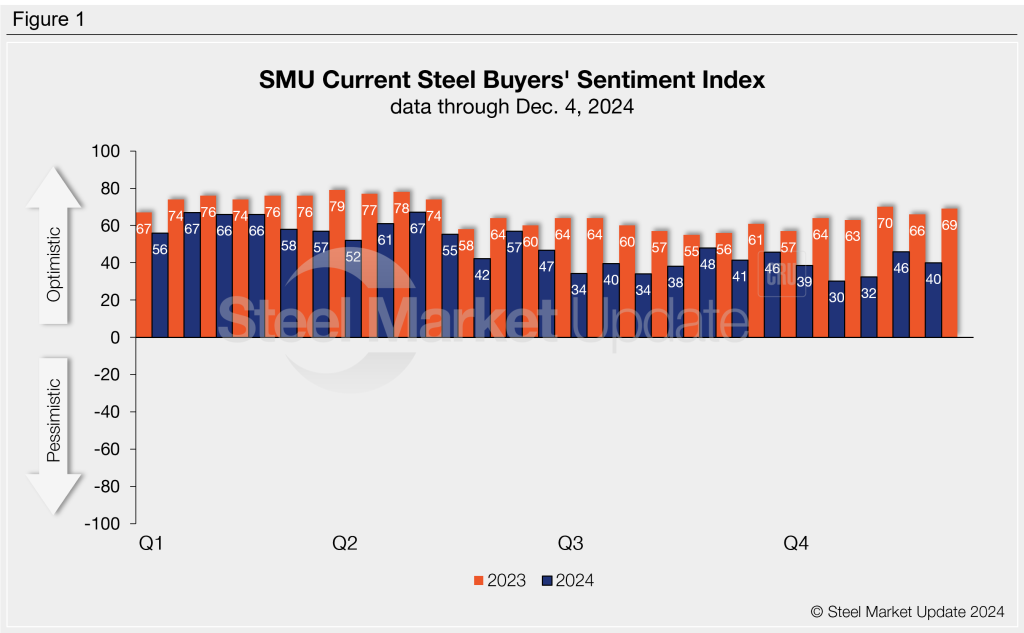

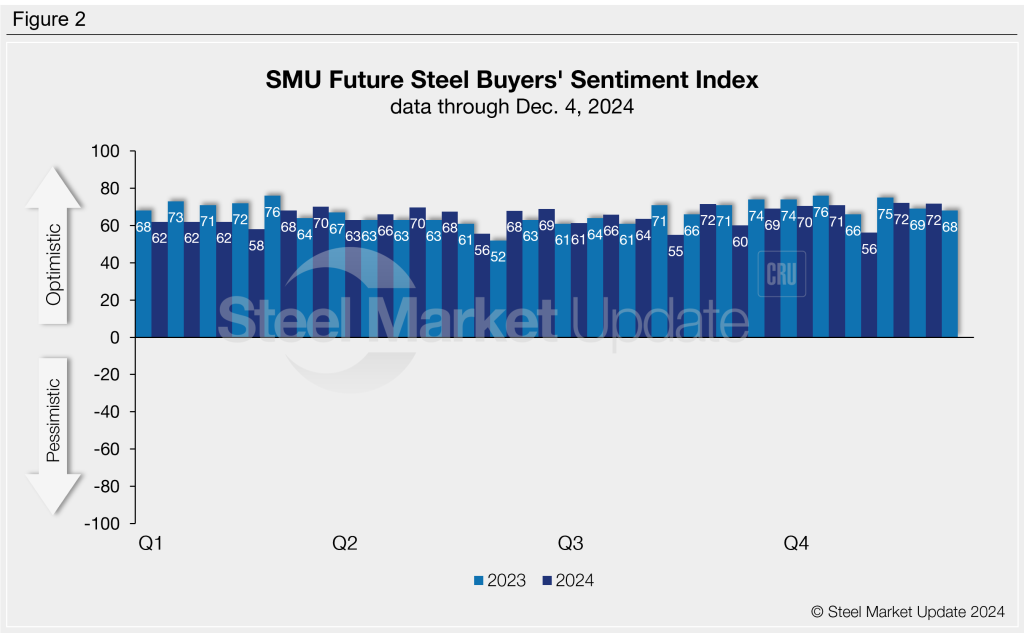

SMU’s Current Steel Buyers’ Sentiment Index slipped this week, while Future Sentiment was steady at one of the highest readings of the year, according to our most recent survey data.

Every other week, we poll hundreds of steel buyers on their companies’ chances of success in today’s market, as well as their business expectations for the next three to six months. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Steel Buyers’ Sentiment Index, measures tracked since SMU’s inception.

Current Sentiment

SMU’s Current Buyers’ Sentiment Index moved six points lower from our last market check to +40 (Figure 1) this week. The index hasn’t cracked +50 since registering +57 in June.

Future Sentiment

SMU’s Future Steel Buyers’ Sentiment Index stood at +72 this week, unchanged from two weeks earlier (Figure 2). These and another reading of +72 in August are the highest readings of the year.

What SMU survey respondents had to say:

“Bookings remain relatively soft, but positioned well.”

“Lack of business.”

“We buy better than some, maybe most, which helps our bottom line.”

“Lower imports will be a problem for us.”

“We need more building to happen.”

“Will adjust to what prevails in the trade environment.”

“Remain optimistic that demand will improve.”

“Yes, I feel after January things will begin to open up.”

“My hope is that sentiment and actual demand both start rising as 2025 kicks off. Fingers crossed.”

Moving averages

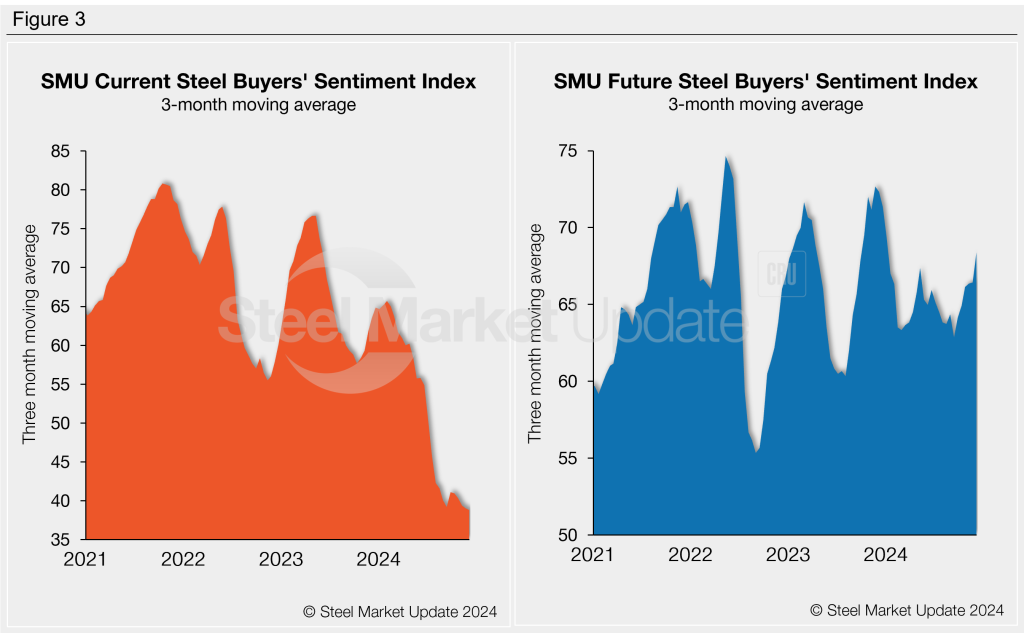

When analyzed on a three-month moving average basis, Current Steel Buyers’ Sentiment fell while Future Sentiment increased this week (Figure 3).

The Current Sentiment 3MMA dropped slightly to +38.82 vs. +39.04 two weeks earlier.

Meanwhile, the Future Sentiment 3MMA increased to +68.40 from +66.44 in the previous market check. This marked the second-highest reading of the year, bested only by the year’s first reading of +69.33 on Jan. 3.

The SMU Steel Buyers’ Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.