Market Data

February 4, 2025

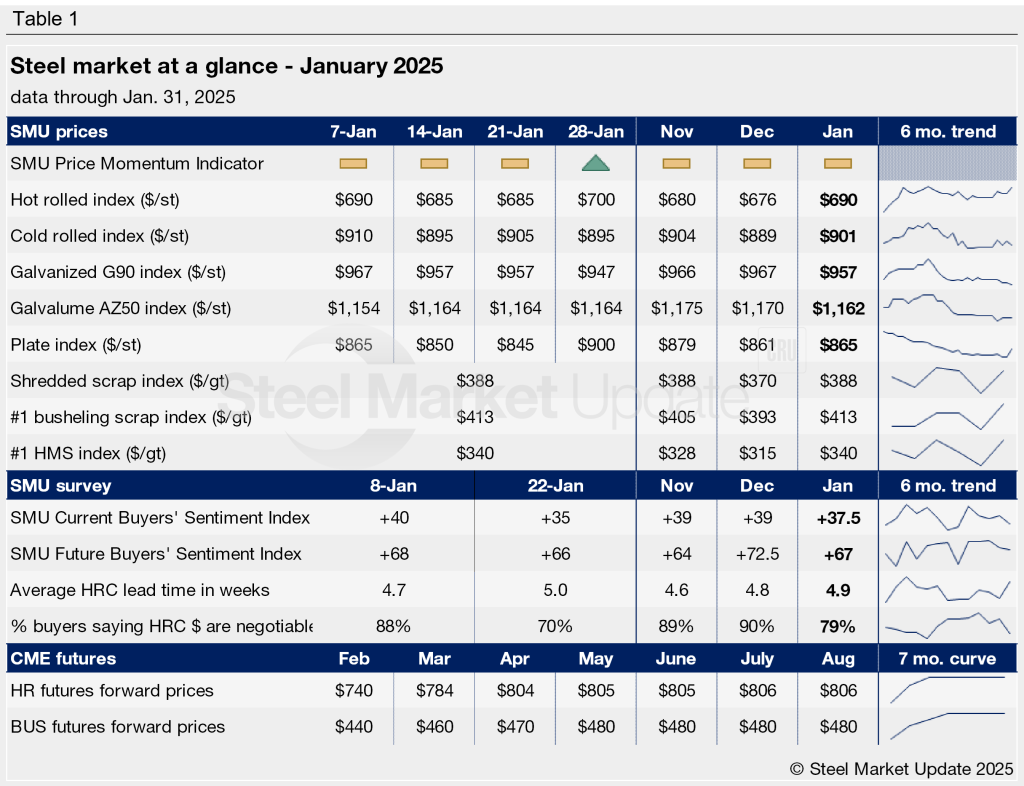

SMU's January at a glance

Written by Brett Linton

SMU’s Monthly Review provides a summary of important steel market metrics for the previous month. Our latest report includes data updated through Jan. 31.

Steel prices moved in differing directions across the month of January. Sheet prices remained near multi-month lows, fluctuating within a narrow range of $20 per short ton (st). As they have for months, plate prices eased throughout most of January but jumped $55/st in the last week of the month.

At the start of the month, the SMU Price Momentum Indicator was at Neutral for both sheet and plate products. At the end of the month, we adjusted it to Higher for hot-rolled coil and plate.

Following a dismal December, steel scrap prices rebounded in January, with the largest monthly increase in over a year. Busheling and heavy melt scrap (HMS) rebounded $20-25 per gross ton (gt) from December’s four-month low. Shredded scrap prices rose $18/gt in January, recovering from a 14-month low. Buyers have a bullish outlook for February prices, expecting another $20/gt bump.

Our Steel Buyers’ Sentiment Indices indicated continued optimism in the first month of the year. Through Jan. 22, our indices suggested that buyers were slightly less confident in their business’ chances of success than they were at this time last year. Our Future Sentiment Index reflects that buyers maintain a positive outlook for early 2025, slightly better than they felt at the start of 2024.

Buyers are still reporting short lead times on spot mill orders, although our latest survey shows that production times have marginally extended for HR, cold-rolled, and plate products. Lead times for coated products inched lower through the end of January to some of the shortest levels in months. Sheet and plate production times have been historically low since last May and July, respectively.

The majority of steel buyers continue to report that mills are negotiable on new spot order prices, though they’re not as willing as they were at the start of the month. Mill negotiation rates had been high throughout much of 2024 but were especially so in the back half of the year.

See the table below for other key January metrics (click to expand). Historical monthly review tables can be found on our website.