Analysis

June 3, 2025

SMU's May at a glance

Written by Brett Linton

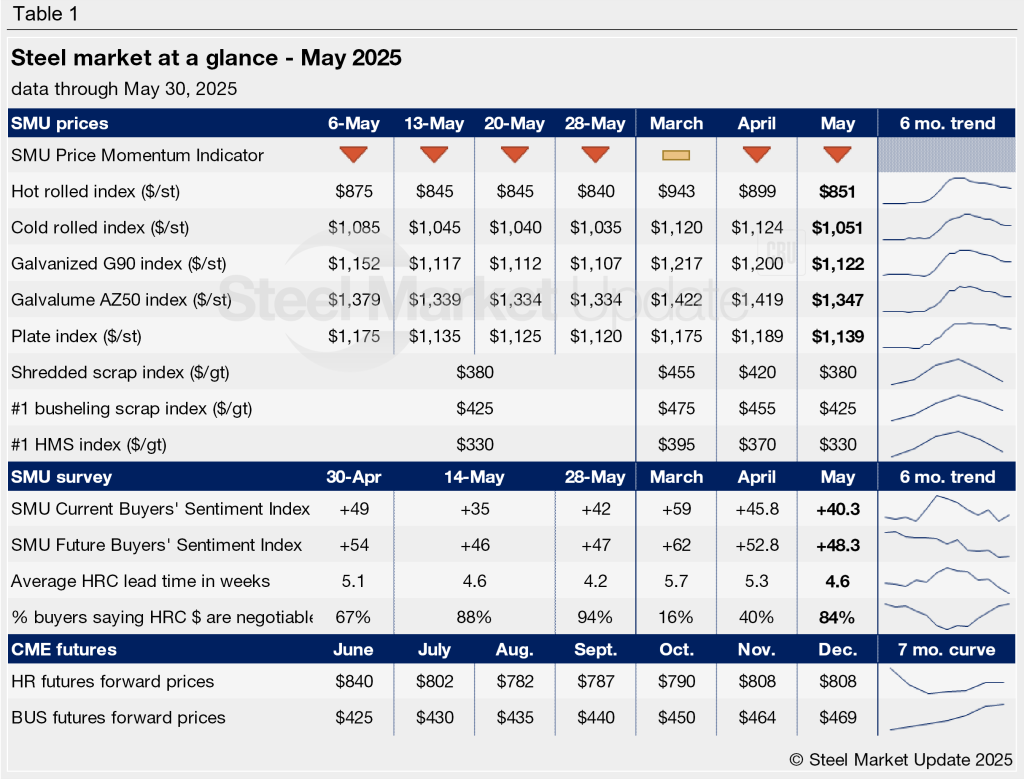

SMU’s Monthly Review provides a summary of our key steel market metrics for the previous month, with the latest data updated through May 30.

Steel prices continued to edge lower throughout the month of May, though the rate of declines slowed in the last two weeks of the month. Overall, sheet and plate prices fell $45-$65 per short ton (st) across May. SMU’s Price Momentum Indicator remained at Lower for both sheet and plate products following its late-April adjustment from Neutral.

Steel scrap prices declined $30-$40 per gross ton (gt) from April to May due to weak demand, ample supply, and sluggish exports. Early expectations for June point to a sideways or slightly weaker scrap market, with new import tariffs seen as having little immediate impact.

Our Steel Buyers’ Sentiment Indices both declined in mid-May, with Current Sentiment reaching a multi-month low and Future Sentiment falling to a multi-year low, then recovering in the final week of the month. Both Indices continue to reflect optimism among steel buyers regarding their companies’ chances of current and future success, although not as strongly as they did back in February and March.

Mill lead times continued to shorten throughout May, with some production times falling to lows not seen in years. As of last week, the average lead time for hot-rolled steel was just over four weeks, cold-rolled and coated products around six weeks, and plate at just over five weeks. Most buyers expect lead times to hold steady going into summer, citing softening demand and rising supply.

The percentage of buyers reporting that mills are willing to negotiate new spot order pricing climbed higher throughout May. Nearly 90% of buyers in our late-May survey reported that mills were flexible on price. This marks a sharp reversal from February and March, when tariff-driven price hikes gave mills the upper hand in negotiations.

See the table below for other key May metrics (click here to expand). Historical monthly review tables can be found on our website.