Market Data

June 13, 2025

SMU Survey: Steel Buyers' Sentiment sinks to near pandemic levels

Written by Brett Linton

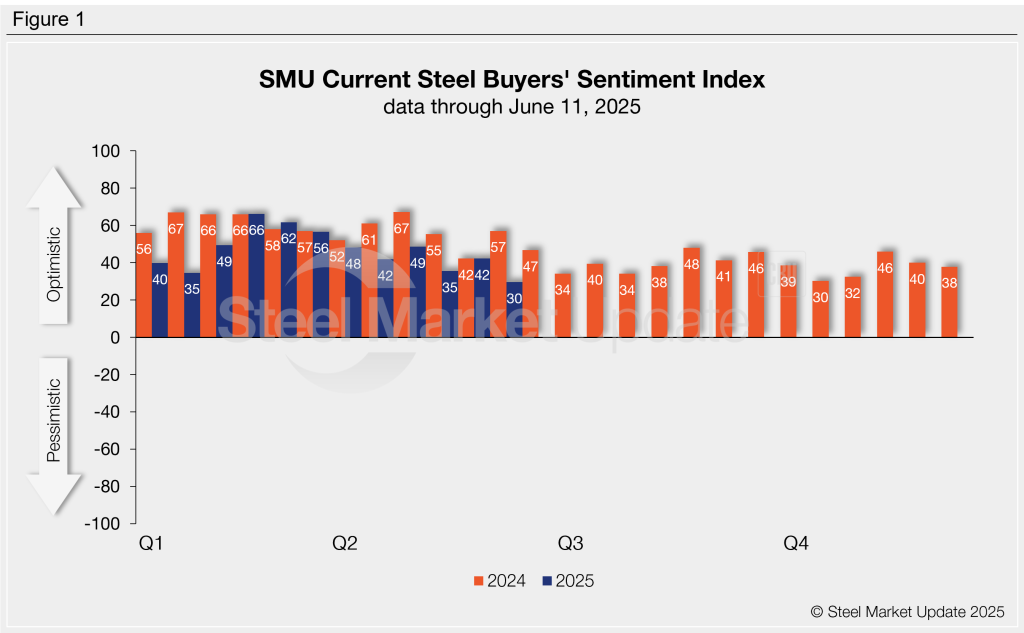

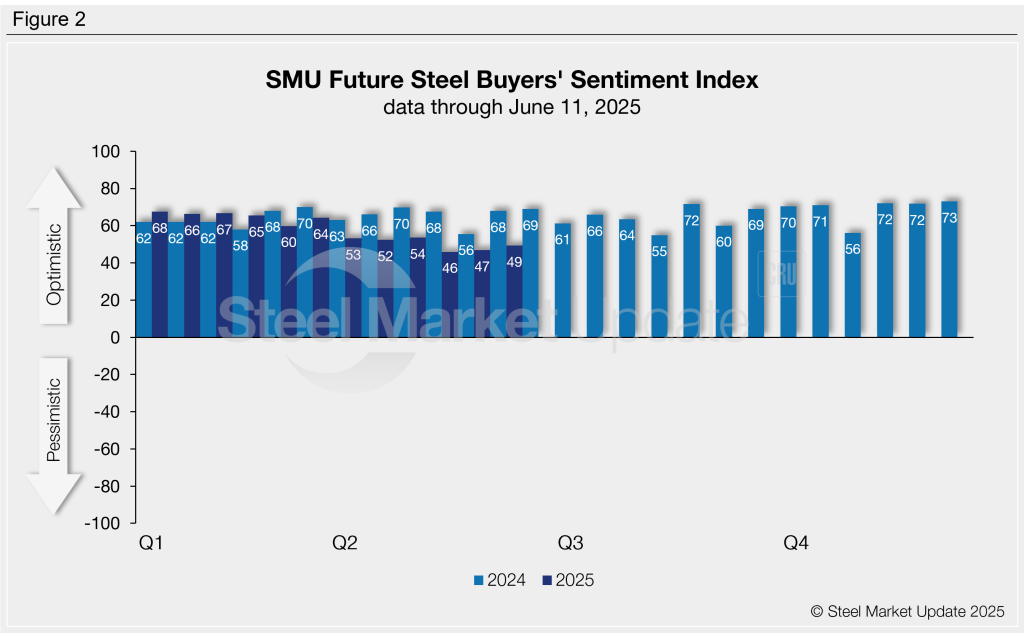

SMU’s Steel Buyers’ Sentiment Indices moved in opposing directions this week. Our Current Steel Buyers’ Sentiment Index sharply fell to one of the lowest levels recorded in five years, while Future Buyers’ Sentiment marginally improved.

Both indices continue to reflect optimism among steel buyers for their companies’ chances of current and future success, though confidence is not as strong as it was back in February and March.

Every two weeks we ask steel industry executives how they rate their companies’ chances of success today, as well as three to six months down the road. We use this data to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since SMU’s inception.

Current Sentiment

SMU’s Current Buyers’ Sentiment Index slipped 12 points this week to +30. It is now tied with October 2024 for the lowest reading since June 2020 (Figure 1). After peaking in February, Current Sentiment has lost steam, consistently staying at or below year-ago levels since March. For comparison, Current Sentiment averaged +48 across 2024 and was at +57 this time last year.

Future Sentiment

Future Sentiment rose two points from late May to +49, the highest measure seen since late April (Figure 2). This index had recently touched +46 in mid-May, the lowest measure recorded in nearly three years. Like Current Sentiment, Future Sentiment has generally trended lower in recent months and has remained at or below 2024 levels since March. Future Sentiment averaged +65 throughout 2024 and was significantly higher at +68 one year ago.

What SMU survey respondents had to say:

“My company is being careful.”

“We are focusing on markets outside of the US for growth.”

“Awful due to Section 232.”

“Excellent future outlook as we promote our short lead times and reliability.”

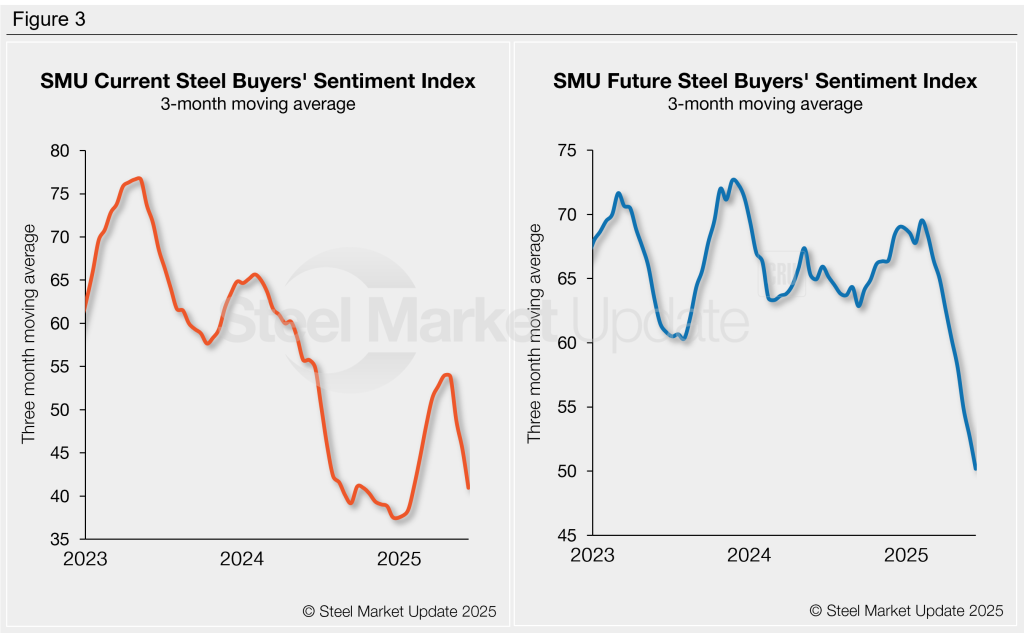

Sentiment trends

On a three-month moving average (3MMA) basis, both Sentiment Indices declined for the fourth survey in a row.

This week, the Current Sentiment 3MMA fell for the fourth consecutive survey to a four-month low of +45.45 (Figure 3, left). It had previously trended upward in the first four months of the year to reach a nine-month high.

The Future Sentiment 3MMA declined for the ninth-straight survey to +50.18, the lowest measure seen since October 2020 (Figure 3, right).

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.