Market Data

August 7, 2025

SMU Scrap Survey: Sentiment indices slip in August

Written by Ethan Bernard & Stephen Miller

Current and future scrap sentiment indices declined this month, according to SMU’s latest ferrous scrap survey data.

This comes as an anticipated tariff on Brazilian pig iron and iron ore was exempted from an Aug. 1 ad valorem tariff on the South American country. The tariff was widely seen as providing a shot in the arm to August scrap prices.

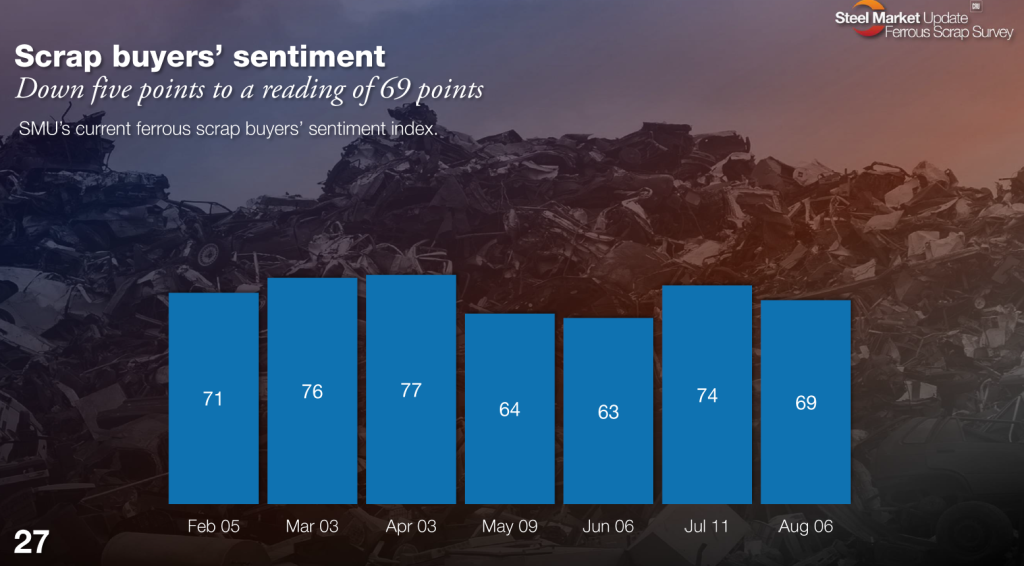

Current Sentiment Index

SMU’s Current Sentiment Index for scrap fell five points to +69 in August vs. +74 a month earlier. Since we began the survey in February, Current Sentiment hasn’t topped the +80 mark or dipped below the +60 mark.

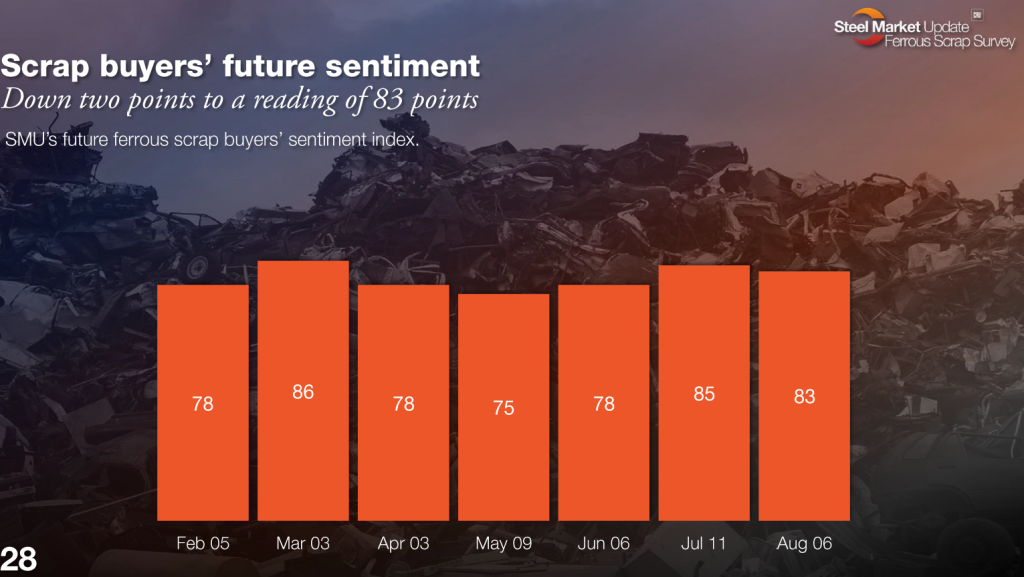

Future Sentiment Index

SMU’s Future Sentiment Index for scrap slipped by two points from the previous month, standing at +83 in August. In general, survey participants have been more bullish on Future Sentiment since our scrap survey kicked off.

What’s the word on the street?

At this point, the scrap trade is not very confident of any significant upward movement in prices. After another sideways trade in August, the outlook for the next two months doesn’t look promising.

It appears prices for hot-rolled coil (HRC) are being reassessed downward, and supply and demand for ferrous scrap seem to be in balance. The export market has stagnated. Any prospects that pig iron would influence scrap demand have been dashed.

Although steelmakers seem confident about assistance from increased Section 232 tariffs, the evidence does not bear this out. It has not improved sentiment in the recycling community.

About SMU’s Scrap Sentiment

SMU’s Current and Future Scrap Sentiment Indices mirror our Steel Buyers’ Sentiment Indices in our flat-rolled steel survey. Our Scrap Sentiment Indices are both diffusion indices. Readings above 50 indicate a more bullish outlook, while readings below 50 indicate a more bearish one.

Sentiment is only one of the indicators we measure. Our scrap survey, like our steel survey, is available only to premium members. If you would like to upgrade from executive to premium, please contact SMU account executive Luis Corona at luis.corona@crugroup.com. If you’re interested in participating in our scrap survey, please reach out to david@steelmarketupdate.com.

Ethan Bernard

Read more from Ethan Bernard