Analysis

August 11, 2025

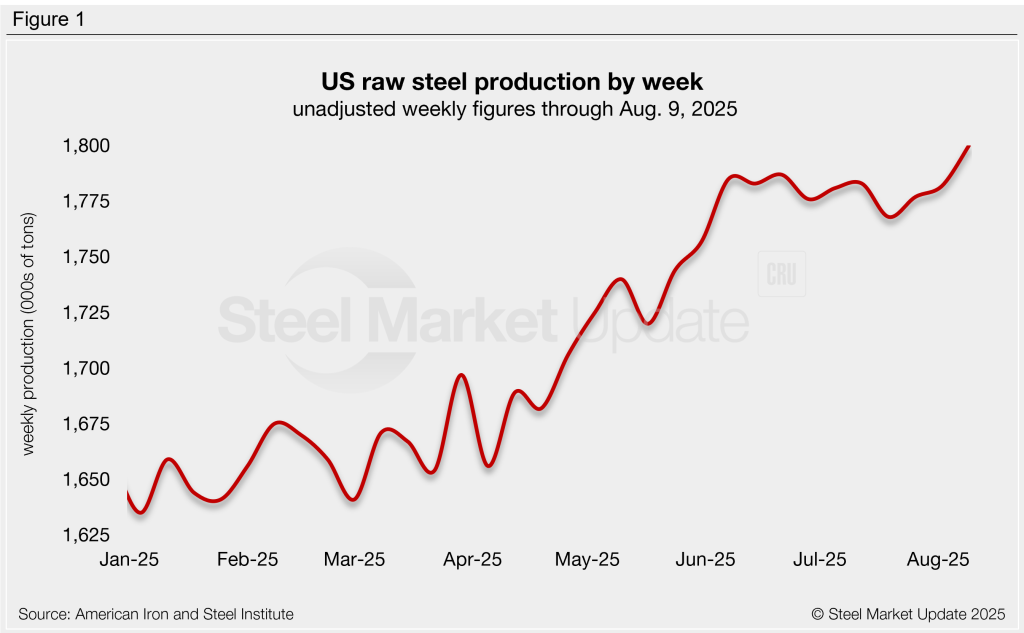

AISI: Domestic steel production climbs to a 3.5-year high

Written by Brett Linton

US raw steel production rose to a new high last week, according to the latest data released by the American Iron and Steel Institute (AISI). Mills have ramped up output since April, with weekly production increasing in all but four of the past 16 weeks.

Domestic steel mills produced an estimated 1,800,000 short tons (st) of raw steel in the week ending Aug. 9 (Figure 1). Output grew by 18,000 st, or 1.0%, from the previous week, now up to the highest unadjusted weekly total since January 2022.

Last week’s production was 5.1% above the year-to-date (YTD) weekly average of 1,713,000 st and 4.3% higher than the same week a year earlier. YTD output now stands at 54,146,000 st, up 1.2% from the same period of 2024. Prior to June, 2025 production had been trailing 2024 levels.

The mill capability utilization rate was 79.5% last week, just 0.1 percentage point below the nine-month high of 79.6% set in late June. This rate increased from 78.7% one week prior and was 77.7% in the same week of 2024. Across 2025 so far we have seen an average weekly capability utilization rate of 76.5%.

Raw production increased week over week (w/w) in three of the five regions defined by AISI:

- Northeast – 128,000 st (up 5,000 st)

- Great Lakes – 555,000 st (down 6,000 st)

- Midwest – 246,000 st (up 12,000 st)

- South – 802,000 st (up 11,000 st)

- West – 69,000 st (down 4,000 st)

Editor’s note: The raw steel production tonnage provided in this report is estimated and should be used primarily to assess production trends. The graphic included in this report shows unadjusted weekly data. The monthly AISI “AIS 7” report is available by subscription and provides a more detailed summary of domestic steel production.