Spread between US HR prices and imports holds

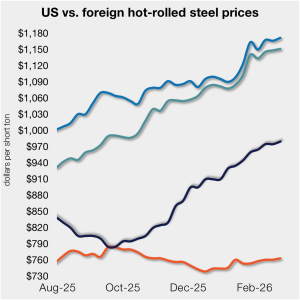

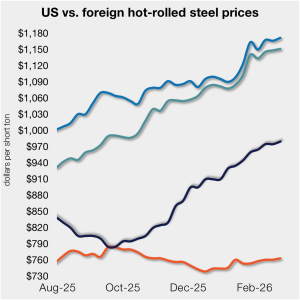

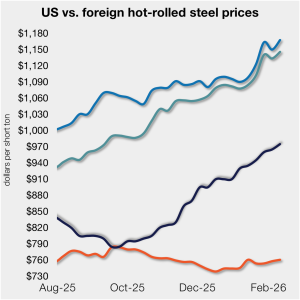

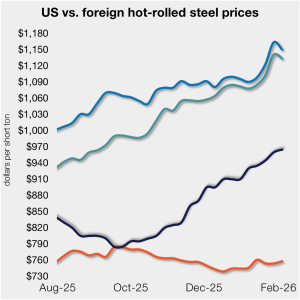

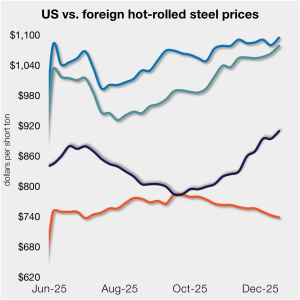

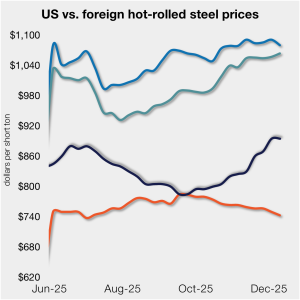

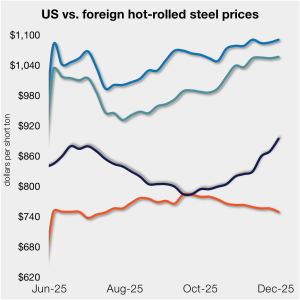

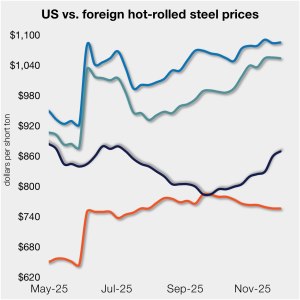

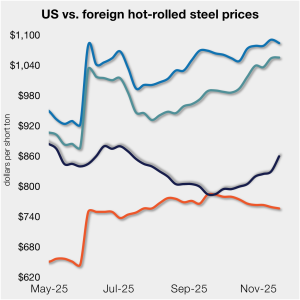

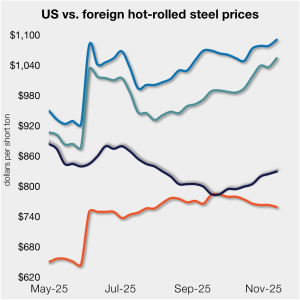

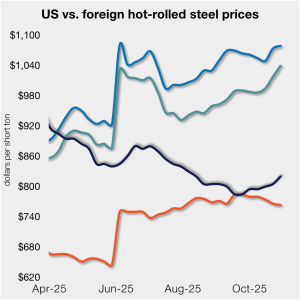

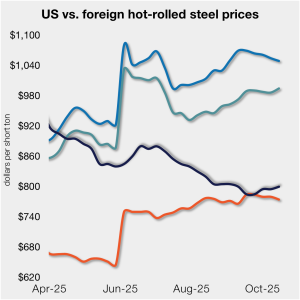

The price gap between US hot-rolled coil (HR/HRC) and landed offshore product remained largely flat again this week, as price movements stateside and abroad mirrored each other.

The price gap between US hot-rolled coil (HR/HRC) and landed offshore product remained largely flat again this week, as price movements stateside and abroad mirrored each other.

US hot-rolled coil prices are set to rise year on year in 2026, but the market will face heightened volatility as import flows recover and new domestic capacity comes online, CRU Research Principal Josh Spoores said at this year's Tampa Steel Conference.

The amount of raw steel produced by US mills rose to the highest level recorded in over four years, according to AISI's latest figures.

Raw steel production ramped up last week to one of the highest weekly rates recorded in the last four years, according to recently released American Iron and Steel Institute (AISI) data.

The price gap between US hot-rolled coil (HR/HRC) and landed offshore product was largely flat this week, as price movements stateside and abroad mirrored each other. Still, the premium for US hot band over imports has remained in a relatively tight band since early December.

Domestic mill output ramped up last week to a five-month high, according to the latest production data released by the American Iron and Steel Institute (AISI). Production has held strong in recent weeks following the multi-month lows seen at the end of the year.

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

The amount of raw steel produced by US mills eased last week according to the AISI. Production remains strong compared to the multi-month lows seen at the end of the year.

Raw steel output from US mills climbed last week to the highest rate seen in over four months, according to the latest American Iron and Steel Institute (AISI) figures

The volume of raw steel produced by US mills grew last week, holding on to the gains seen the prior week, according to the latest figures released by the American Iron and Steel Institute (AISI).

US mills have begun ramping up output after the end-of-year holiday slowdown, according to the latest data from the American Iron and Steel Institute (AISI).

Domestic raw steel production inched higher last week but remains low compared to recent months, according to the latest data released by the American Iron and Steel Institute (AISI)

The latest American Iron and Steel Institute (AISI) data confirms that US steel mills have pulled back production during the end-of-year holiday season. Still, year-to-date figures show higher output and utilization rates compared with last year.

Domestic raw steel production edged lower last week, according to the latest data released by the American Iron and Steel Institute (AISI).

The price gap between stateside hot band and landed offshore product continues to narrow, inching closer toward parity. The premium is now, on average, at its lowest level since July.

The volume of raw steel produced by US mills ticked higher last week, according to the latest figures published by the American Iron and Steel Institute (AISI).

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

Domestic raw steel production marginally declined last week, according to the latest data released by the American Iron and Steel Institute (AISI).

The price gap between stateside hot band and landed offshore product has inched closer to parity, now at its lowest level since the summer.

The volume of raw steel produced by US mills eased last week, according to the latest figures released by the American Iron and Steel Institute (AISI).

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

The price gap between stateside hot band and landed offshore product has marginally widened week over week.

Domestic steel production increased last week, according to the latest figures from the American Iron and Steel Institute (AISI). Production has trended higher since mid-October, though it is not as strong as output seen over the summer months.

The volume of raw steel produced by US mills eased last week, according to AISI's latest figures. Prior to this month, output had remained historically strong since June.

In dollar-per-ton terms, US product is on average $141/st less than landed import prices (inclusive of the 50% tariff). That’s down from $148/st last week.

Domestic mill production inched higher last week, according to the latest figures released by the American Iron and Steel Institute (AISI). Prior to the start of this month, raw output had remained historically strong since June.

Domestic mill production rebounded last week, according to the latest production figures released by the American Iron and Steel Institute (AISI). Production had been historically strong over the summer months before softening in early October.

SMU’s average price for domestic hot-rolled (HR) coil was $800 per short ton (st) this week, up $5/st week on week (w/w). In offshore markets last week, prices were varied.

As it accelerates an ambitious push to reshore American bicycle manufacturing, Guardian Bikes is seeking special tariff consideration for the bicycle industry.