Product

September 11, 2025

Scrap market chatter in September

Written by Ethan Bernard

Every month, SMU polls participants in the ferrous scrap market on a variety of topics. These include things like prices, business conditions, tariffs, among many others.

Note that these responses came in ahead of the September settle of the market. So where did survey participants see prime scrap prices heading this month? Well, 51% thought they would land sideways, and 43% thought they would be down. With prime grades down $20 and other grades sideways, that forecast proved to be spot on.

Let’s take a look at what else these participants were seeing.

Want to share your thoughts? Contact david@steelmarketupdate.com to be included in future market questionnaires.

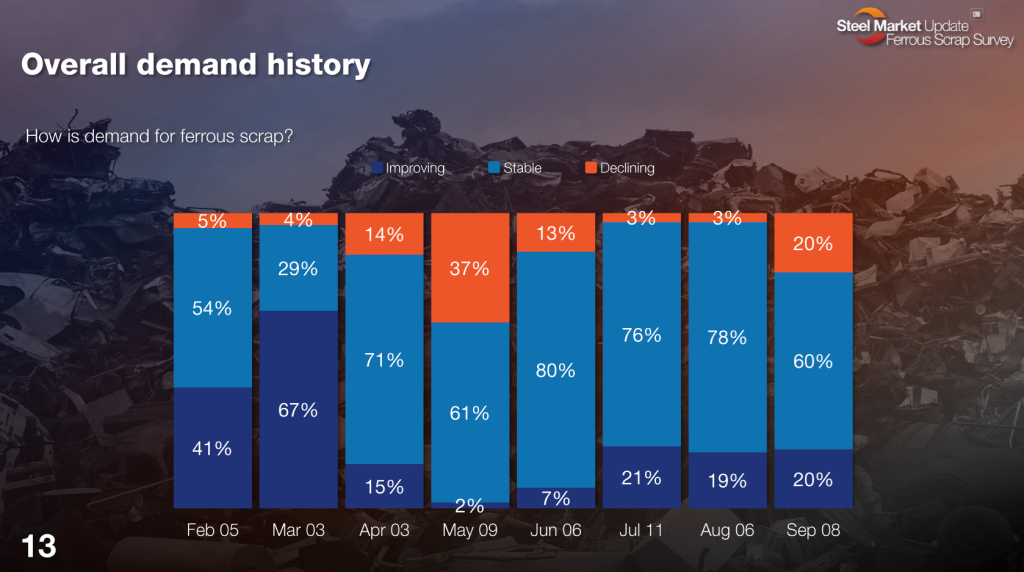

How is demand for ferrous scrap?

“Declining due to planned maintenance outages over September and October.”

“Some mills looking for smaller volumes for September. A lot of outages.”

“Outages are keeping mill demand muted.”

“Demand is good, there is just no scrap.”

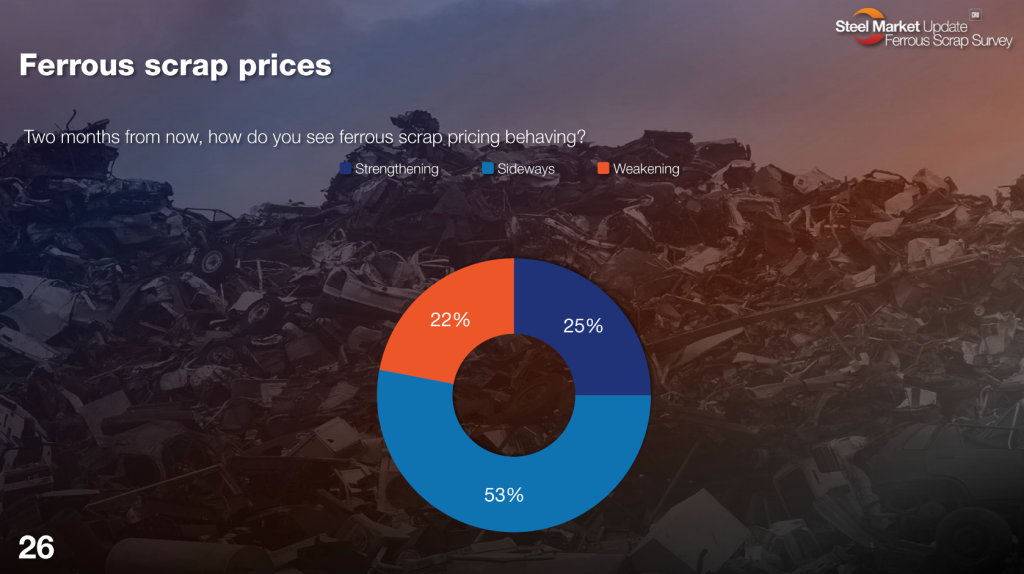

How do you see ferrous scrap pricing behaving over the next 60 days?

“A lot of planned outages for the next two months. Lower interest rates may help.”

“Sideways with an uptick on the horizon.”

“We are nearing the bottom of the last several pricing cycles, and winter will be here before we know it.”

“No clue.”

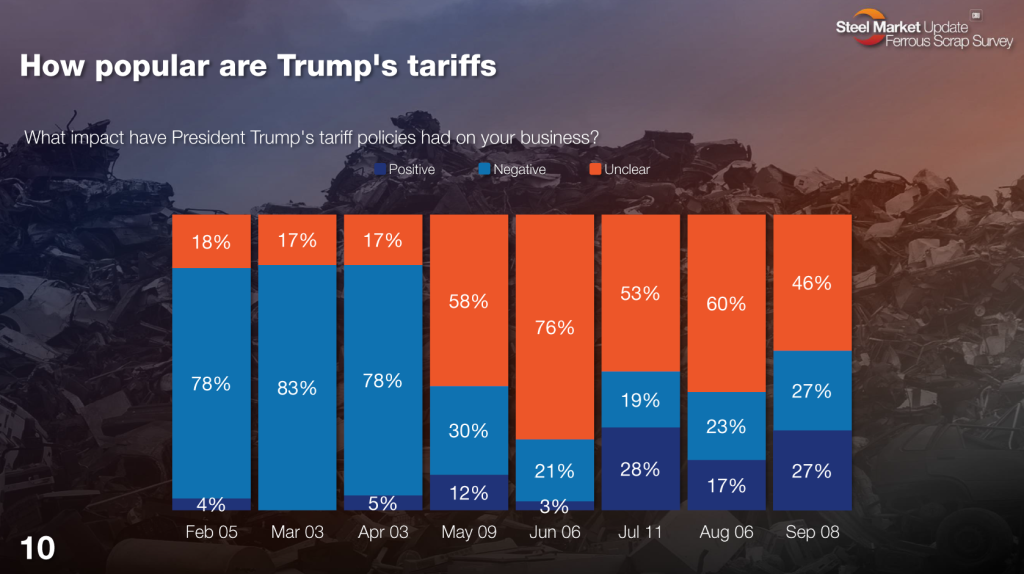

What impact have President Trump’s tariff policies had on your business? And why?

“Tariffs = uncertainty = no expansion plans.”

“Increased operating rates in the US at long-products producers.”

“More parts are coming back to the US than leaving.”

“Too much uncertainty.”

“Section 232 limiting imports has increased demand.”

“The big mills are looking to us now.”

“Tariffs affecting bottom line.”