Analysis

September 11, 2025

Steel export volumes remain weak through July

Written by Brett Linton

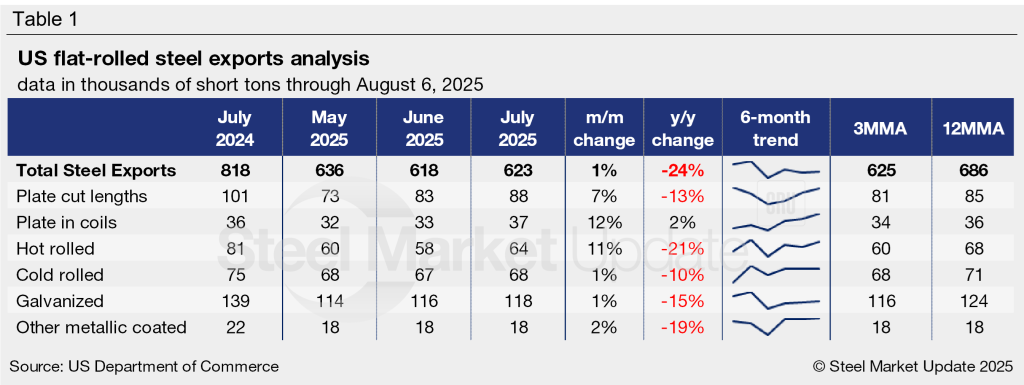

Following a 3% decline in June, the amount of steel shipped outside of the US edged up 1% in July to 623,000 short tons (st), according to recently released data from the US Department of Commerce.

July was the sixth-lowest monthly export rate since the COVID-19 pandemic, only 8% higher than the near-five-year low of 578,000 st in April (Figure 1). July trade was 9% below the average monthly export rate of the prior 12 months (686,000 st) and 24% less than the same month last year.

The vast majority of US exports (usually 90%+) are sent to US-Mexico-Canada Agreement (USMCA) trading partners. In July, Mexico received 60% of total US exports, and Canada received 33%. Other notable destinations (each accounting for 1% or less of July exports) included Brazil, China, Australia, the Dominican Republic, the United Kingdom, the Bahamas, Sao Tome and Principe, India, and the United Arab Emirates. To explore more detailed export data on specific products or countries, visit the International Trade Administration’s Steel Mill Export Monitor.

Monthly averages show downward trends

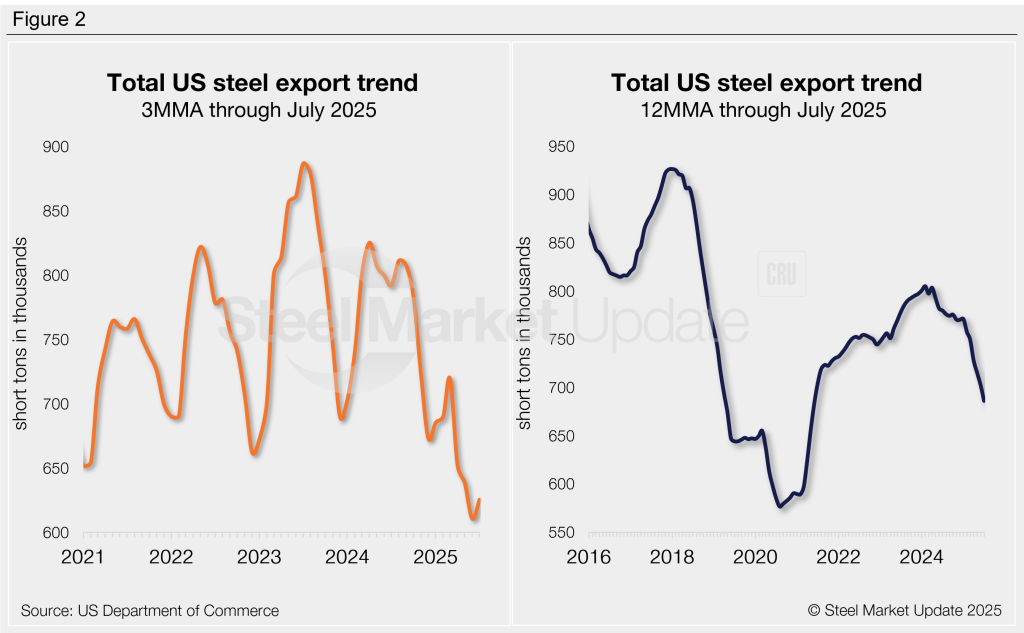

Viewing exports on a three-month moving average (3MMA) basis can dampen monthly fluctuations (Figure 2, left). On this basis, exports have trended lower overall since peaking in July 2023 at a five-year high of 887,000 st. The 3MMA rose 2% month on month (m/m) in July to 625,000 st, recovering from June’s almost five-year low of 611,000 st.

Exports can be annualized on a 12-month moving average (12MMA) to eliminate seasonal variations typically seen around the end of the year (Figure 2, right). From this angle, exports have weakened since peaking in early 2024, but remain above 2019-2021 levels. The 12MMA declined for the seventh consecutive month in July to 686,000 st, now down to a four-year low.

Exports by product

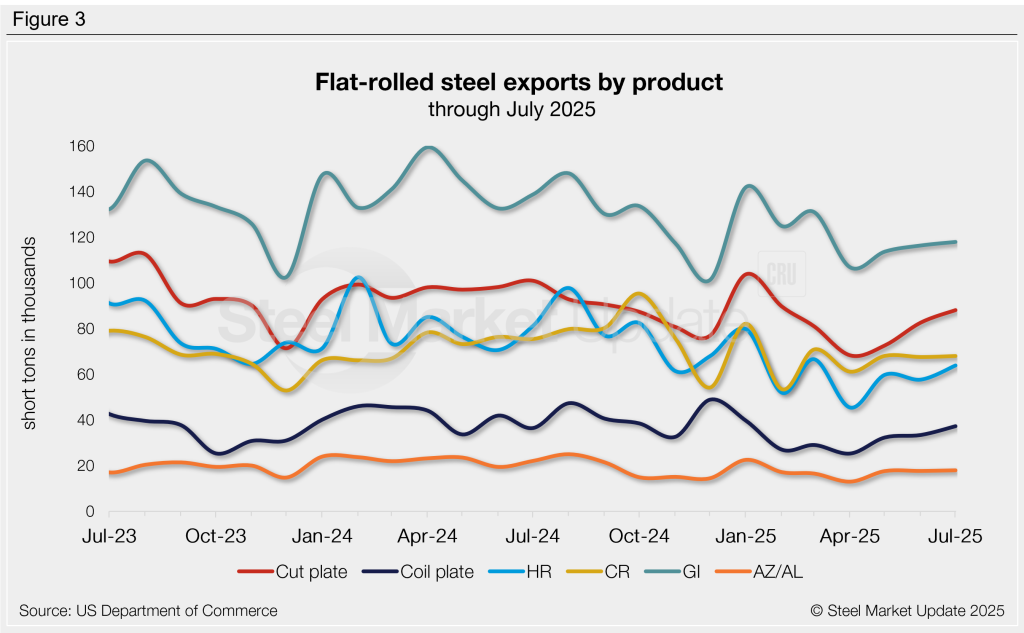

Although total exports marginally increased from June to July, three of the six flat-rolled steel products we follow saw moderate increases. Despite this, most products remained near historical lows; more than half were below their respective 12MMA rates, and all but one were significantly lower than year-ago levels. Notable July trends by product include:

- Plate-cut-length exports increased 7% m/m to the highest volume recorded since February.

- Coiled plate exports rose 12%, the highest rate since January.

- Hot-rolled exports recovered 11% to a four-month high.

- Cold-rolled exports held stable for the third-straight month, rising 1%.

- Galvanized exports increased 1% to a four-month high.

- Other-metallic coated (mostly Galvalume) increased 2% to the highest rate seen since January.

SMU members can view historical steel trade data on the Steel Exports page of our website.