Analysis

October 17, 2025

SMU Survey: Current Sentiment sinks to lowest level since May 2020

Written by Ethan Bernard

SMU’s Steel Buyers’ Sentiment Indices both fell this week, with Current Steel Buyers’ Sentiment notching its lowest reading since May 2020.

While each of our Sentiment Indices remains in positive territory, both have dipped over 10 points from where they stood at the beginning of the year.

Every two weeks, SMU polls thousands of steel industry executives, asking them to rate their companies’ chances of success today and three to six months down the road. Their responses are used to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics we have tracked since 2009.

Current Sentiment

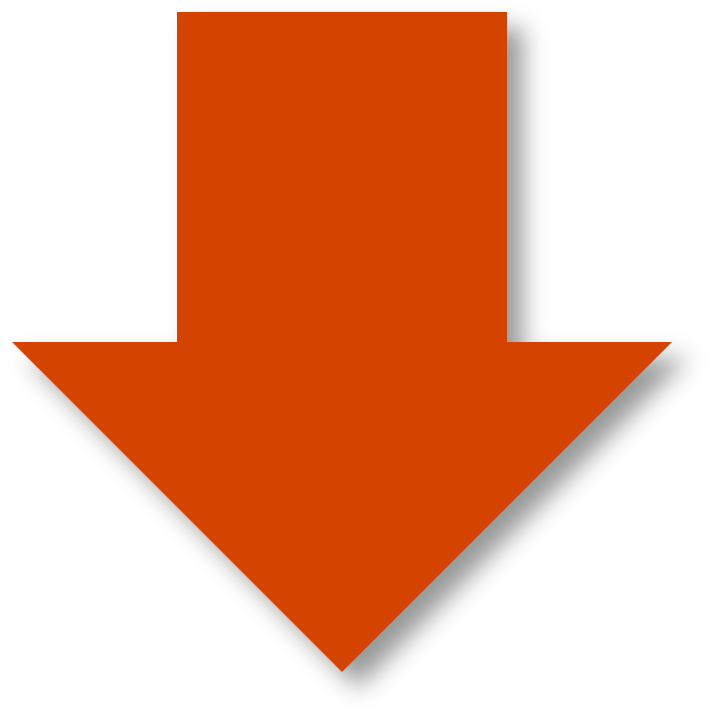

The Current Sentiment Index dropped nine points from our previous survey to +26 this week (Figure 1). The index started 2025 at +40. We have to go back to mid-May 2020, during the Covid-19 pandemic, to find a lower reading (+15).

Future Sentiment

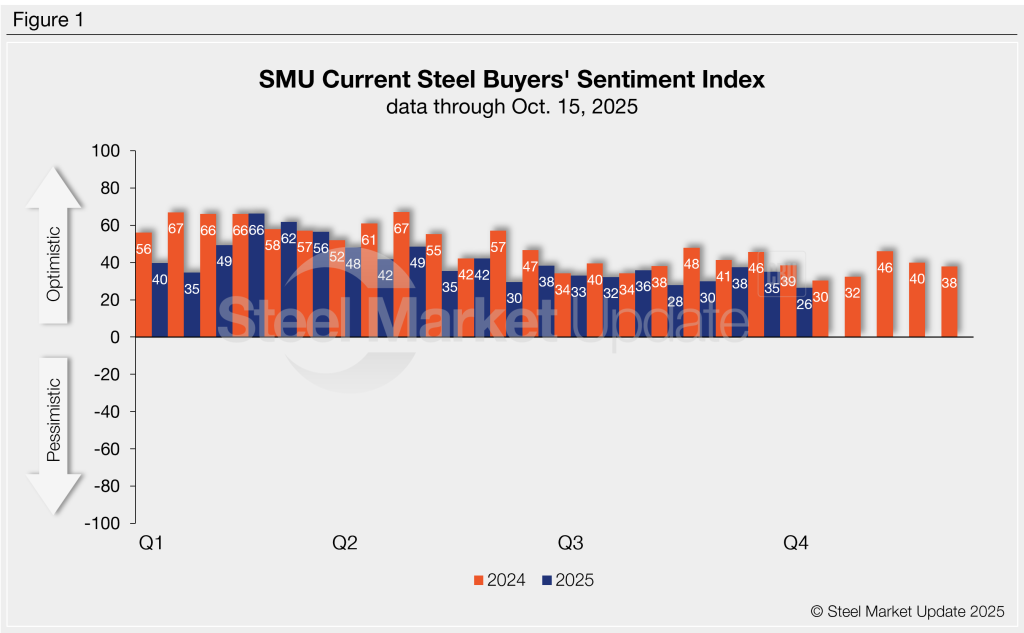

Future Sentiment edged down three points to +50 (Figure 2). The index started the year at +68. It has hovered within three points of +50 since late July.

What respondents are saying:

“Long term, we will be fine, but short term is going to be rough.”

“Importing is a challenge.”

“The unknown and overall unease is brutal.”

“Operating on much lower margins.”

“Market fears should be subsiding as policies become clearer.”

“’Fair’ to ‘Good,’ assuming we get two more rate cuts!”

Sentiment trends

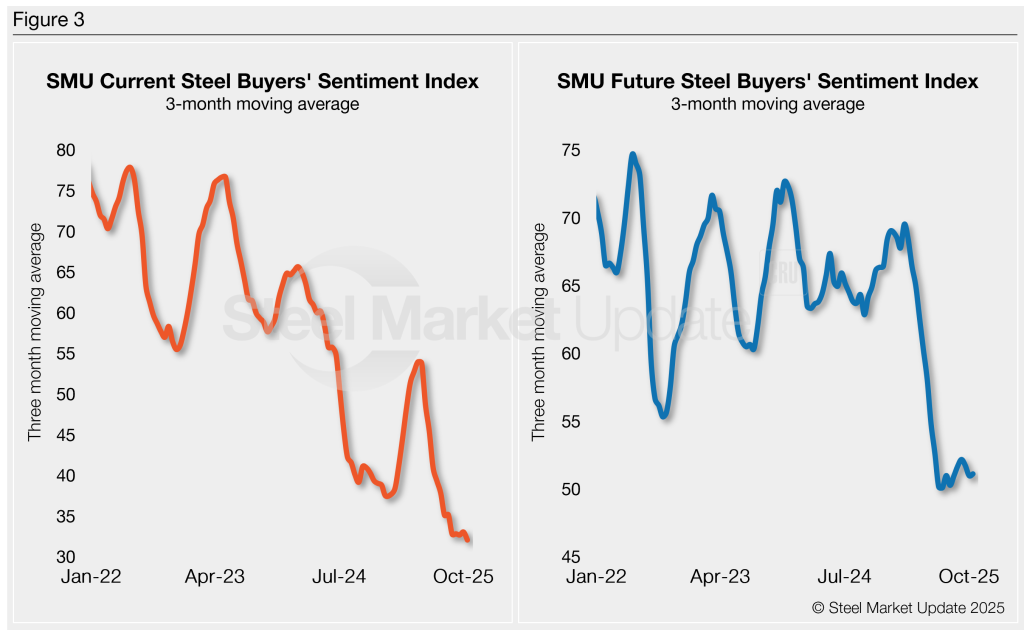

Our Sentiment Indices can be analyzed on a three-month moving average (3MMA) basis to smooth out short-term swings.

The Current Sentiment 3MMA slipped to +32.09 from +33.07 previously (Figure 3, left).

However, the Future Sentiment 3MMA inched up to +51.13 from +50.99 (Figure 3, right).

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers’ Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. View our methodology here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.