Plate market participants anticipate producer hikes

Plate market participants expect domestic producers to issue a $40-60 per short ton (st) price increase.

Plate market participants expect domestic producers to issue a $40-60 per short ton (st) price increase.

The Dodge Momentum Index (DMI) fell 6.2% in January to 272.7, retreating from December’s downwardly revised reading of 291.0, according to the latest data released by Dodge Construction Network.

SMU’s Current Sentiment Index for scrap jumped again in February, according to the latest data from our ferrous scrap survey. And the Future Sentiment Index remained the same for the third consecutive month.

Former smelter sites have become increasingly attractive to data center developers competing for electricity to support AI.

SMU’s Steel Buyers’ Sentiment Indices both edged lower this week following the multi-month highs set in mid-January.

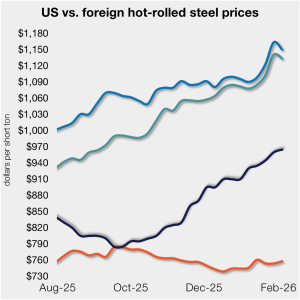

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

November apparent steel supply declined 9% or 772,000 short tons (st) from October to 7.61 million st, the lowest measure recorded since February 2021

November steel exports tumbled 15% from October to the lowest monthly export rate since July 2020.

US rebar and wire rod prices rose month on month (m/m) alongside continued scrap increases, while merchant bar and structurals were unchanged.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

One third of the steel buyers responding to our market survey this week reported that domestic mills are negotiable on new spot order pricing. Mills began to hold a firmer stance on prices towards the end of last year, tightening their grip in early January and holding it since.

SMU's ferrous scrap survey celebrates its one-year anniversary this month.

Steel mill lead times marginally declined on sheet products this week but edged higher on plate, according to responses from SMU’s latest market survey. Overall, lead times remain one to two weeks longer than levels seen three months ago.

Since my last column, confidence within the physical market has been restored. However, that does not mean necessarily confidence in the outlook for demand. More so, it's confidence that better pricing is not lurking around the corner. So where do we go from there?

The US domestic scrap market is largely settled on February pricing. Despite poor weather conditions that have been wreaking havoc on scrap flows and deliveries to consumers, the pricing initially agreed between dealers and steelmakers has been fairly conservative.

Sheet market participants said conditions this week were more stable than in past weeks, but they remain cautiously optimistic overall.

Market participant comments from this month's SMU ferrous scrap survey.

SMU’s February ferrous scrap market survey results are now available on our website to all premium members.

The USW's contracts with Cliffs and USS expire on Sept. 1 of this year.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Steel imports remain weak in November and December according to recently released final US Commerce Department data. Many of the sheet and plate products we follow slipped to multi-year lows.

The US Department of Commerce has found that certain steel pipe rolled in Oman using Chinese hot-rolled coil is illegally circumventing anti-dumping and countervailing duties (AD/CVDs).

The export market from the US and Canada has held firm, while slightly strengthening ahead of the domestic buying for February shipment.

The Tampa Steel Conference will kick off just a few days after the Super Bowl, and I think it’s fair to say that we could be reacting to market developments in real time – again.

With just 10 days to go and nearing the final countdown, we are just shy of 600 registered (and counting) so far for the 37th annual Tampa Steel Conference.

The Chicago Business Barometer rose further in January, moving into expansion territory for the first time since November 2023, said MNI and ISM.

There is no evidence that unofficial talks are taking place to secure tariff reductions on Canadian aluminum or steel. One of the biggest challenges is simply understanding what the US actually wants from Canada.

Tariffs affect different parts of the economy differently. Tariffs on steel imports have contributed to price increases from domestic mills, improving their bottom lines. But orders from customers are slowing down, hurting downstream industries’ profitability and job prospects.

Participants in the hot- and cold-rolled coil markets said winter storms in the East and Midwest may disrupt weekly order volumes and prices.

This news item was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com. Canada’s Algoma Steel signed a binding Memorandum of Understanding (MoU) with Hanwha Ocean to support Canada’s submarine program and Algoma’s diversification strategy. A new structural steel beam mill may result. Financial support, subject to conditions being […]