Final Thoughts

Let’s say the going price for HR is around $1,000/st. Want to place a 1,000-ton spot order at that price? Good luck. It probably won’t be easy.

Let’s say the going price for HR is around $1,000/st. Want to place a 1,000-ton spot order at that price? Good luck. It probably won’t be easy.

SMU's sheet and plate prices increased this week to new multi-month highs.

Crude-oil and natural-gas prices spiked, metals opened higher and some fertilizer benchmarks climbed after the US and Israel launched a “pre-emptive” strike on Iran, killing the supreme leader and plunging the region into chaos.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $1,005 per short ton (st), up $15/st from last week.

Sources in the domestic hot- and cold-rolled coil market said they are beginning to feel prices creeping up this week.

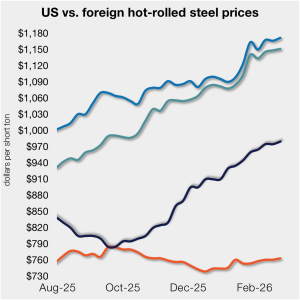

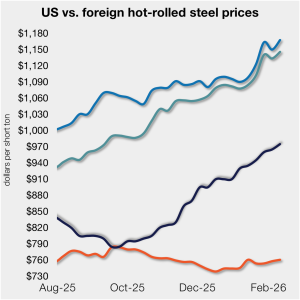

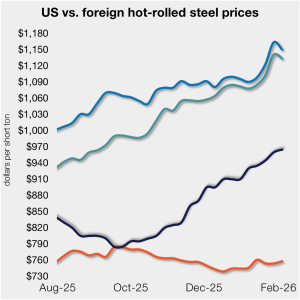

The price gap between US hot-rolled coil (HR/HRC) and landed offshore product remained largely flat again this week, as price movements stateside and abroad mirrored each other.

SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

US hot-rolled coil prices are set to rise year on year in 2026, but the market will face heightened volatility as import flows recover and new domestic capacity comes online, CRU Research Principal Josh Spoores said at this year's Tampa Steel Conference.

Sheet prices continue to grind higher on tight supply and 'okay' demand. Plate finally saw some movement after weeks of stability as price increases begin to stick.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $990 per short ton (st), up $10/st from last week.

Participants in the domestic sheet market say they experienced lighter inquiries and fewer orders than in previous weeks, rendering domestic mill price increases for spot-market hot- and cold-rolled coils irrelevant.

The spread between domestic hot-rolled coil and prime scrap prices widened slightly in February. It has been trending in that direction since October.

US ferrous scrap prices continued to rise in February, scrap sources told SMU.

Since late 2025, mills have begun to hold a firmer stance on prices, tightening their grip at the start of this year and holding on since

Once wintery weather gives way to sunnier spring conditions, plate sources foresee the market accepting the $50-60 per short ton spot price increases issued by Nucor Plate Group, Oregon Steel Mills, and SSAB.

Three of SMU’s price indices increased this week, while two remained steady, all holding at multi-month highs.

SSAB Americas wants to increase plate prices by at least $60 per short ton, $10 more than rival Nucor’s price hike last week.

Nucor increased its list price for hot-rolled (HR) coil to $980 per short ton (st) on Monday, up $5/st from last week.

Nucor on Friday announced plans to increase plate prices by $50 per short ton (st).

CRU: US Midwest sheet prices have continued to rise from our mid-January assessment.

A narrow range has emerged, suggesting the market’s repricing of downside risk is starting to stick.

The price gap between US hot-rolled coil (HR/HRC) and landed offshore product was largely flat this week, as price movements stateside and abroad mirrored each other. Still, the premium for US hot band over imports has remained in a relatively tight band since early December.

SMU’s sheet price indices inched up to new multi-month highs this week, while plate prices held steady.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $975 per short ton (st), up $5/st from last week.

Plate market participants expect domestic producers to issue a $40-60 per short ton (st) price increase.

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

US rebar and wire rod prices rose month on month (m/m) alongside continued scrap increases, while merchant bar and structurals were unchanged.

One third of the steel buyers responding to our market survey this week reported that domestic mills are negotiable on new spot order pricing. Mills began to hold a firmer stance on prices towards the end of last year, tightening their grip in early January and holding it since.

Since my last column, confidence within the physical market has been restored. However, that does not mean necessarily confidence in the outlook for demand. More so, it's confidence that better pricing is not lurking around the corner. So where do we go from there?

The US domestic scrap market is largely settled on February pricing. Despite poor weather conditions that have been wreaking havoc on scrap flows and deliveries to consumers, the pricing initially agreed between dealers and steelmakers has been fairly conservative.