Prices

August 10, 2017

Hot Rolled Futures: Global Rally in Raw Materials

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com.

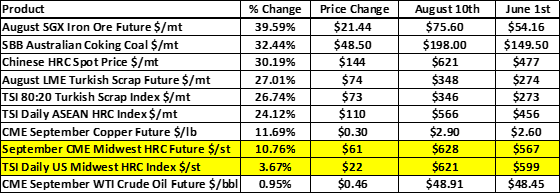

The hype around the Section 232 investigation has been swept under the rug for the time being. Perhaps it will reappear down the road, but in the meantime there has been a breakneck global rally in ferrous raw materials, flat rolled, finished steel and base metal prices. The table below shows the performance of a cross section of these products since June 1. The table is sorted by percentage change. Midwest HRC prices are lagging behind. Considering the hike in cost of steelmaking raw materials, one should expect further domestic steel mill price increases in the near future as the higher costs are absorbed.

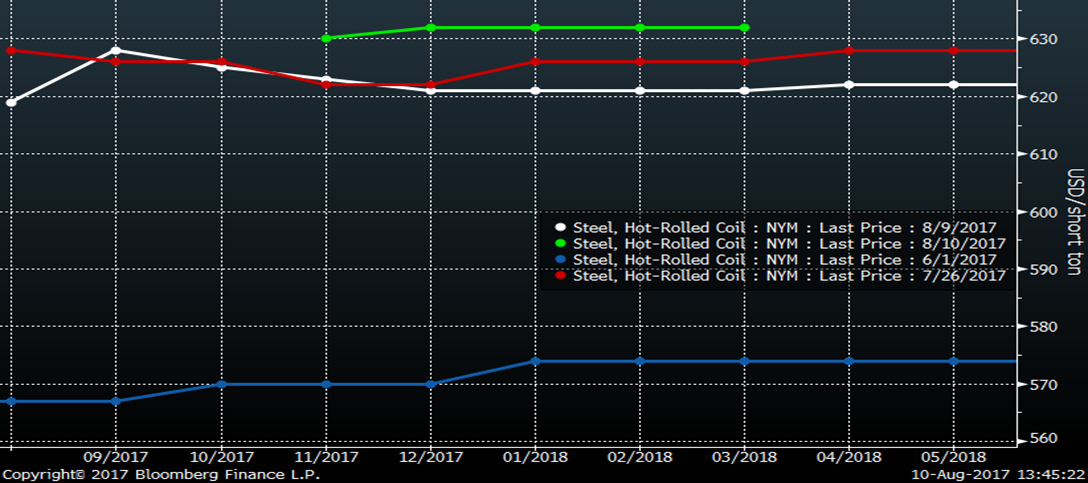

Below is the CME Midwest HRC futures curve, which has been oscillating in the $620-$635 range in the past couple weeks. The curve remains flat.

CME Midwest HRC Futures Curve

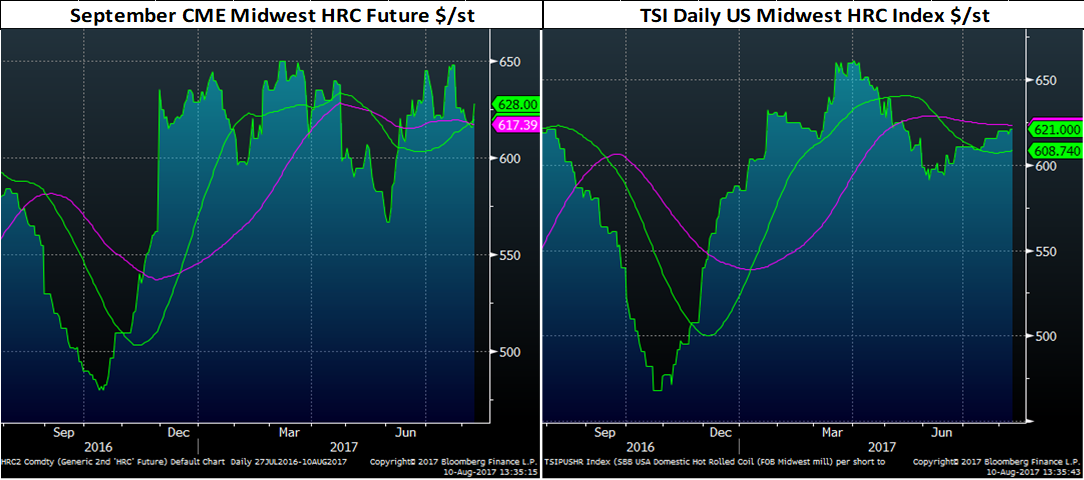

Midwest HRC prices have yet to break out with the September CME Midwest HRC futures settling at $628 as of Wednesday’s close. Earlier today, Q4 2017 traded 1000 t/m at $633 and Q1 2018 traded 1000 t/m at $635. Today, the TSI Daily Midwest HRC Index printed $621/st.

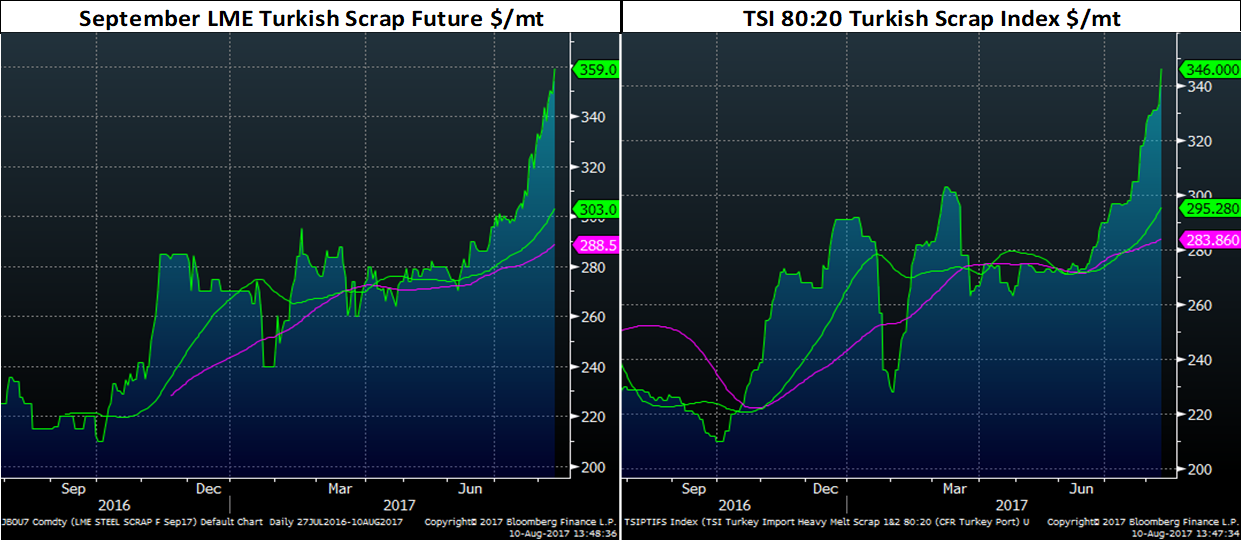

September LME Turkish Scrap has exploded, rallying $60 to $359/t since mid-July. The TSI Turkish Scrap Index settled at $346/t today.

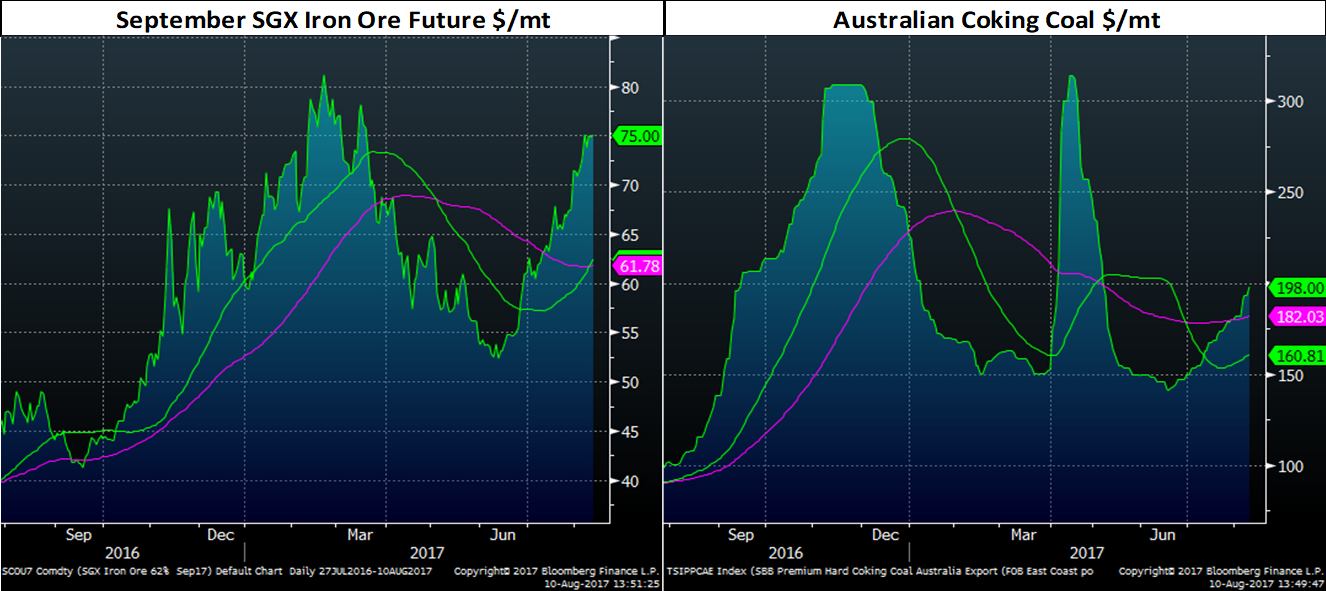

September SGX iron ore settled today at $75/t as it continues its V-shaped recovery. The SBB Australian Hard Coking Coal Index has rallied 33 percent to $198/mt since early July.

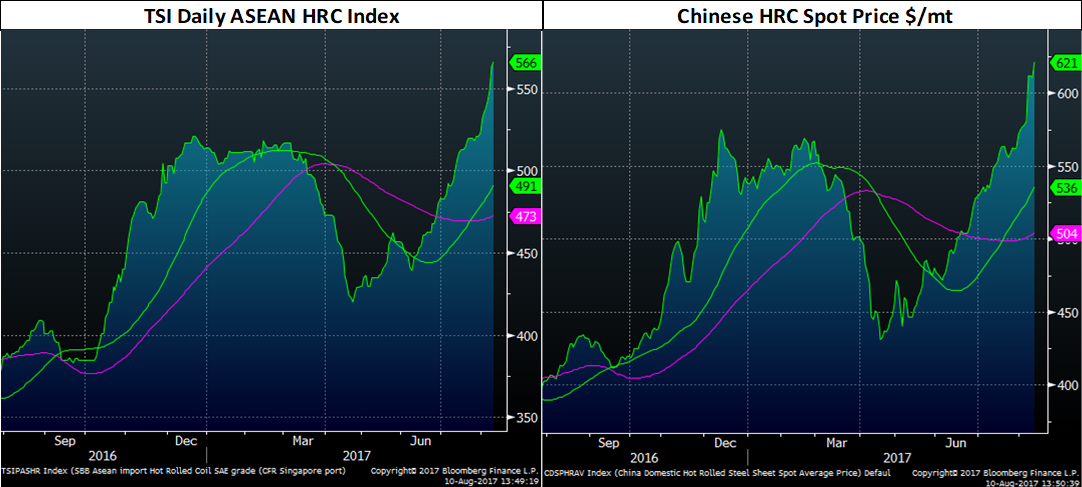

The TSI Daily ASEAN HRC and Chinese HRC spot prices have rallied; are you starting to see a pattern here yet or what?

What to believe? Are prices in China and the rest of the world about to be pulled back down in a sharp correction by the lagging U.S. prices or is it more likely that U.S. prices get ripped higher by the rest of the world?

Technical Corner

The last time we met on July 27, I wrote the following:

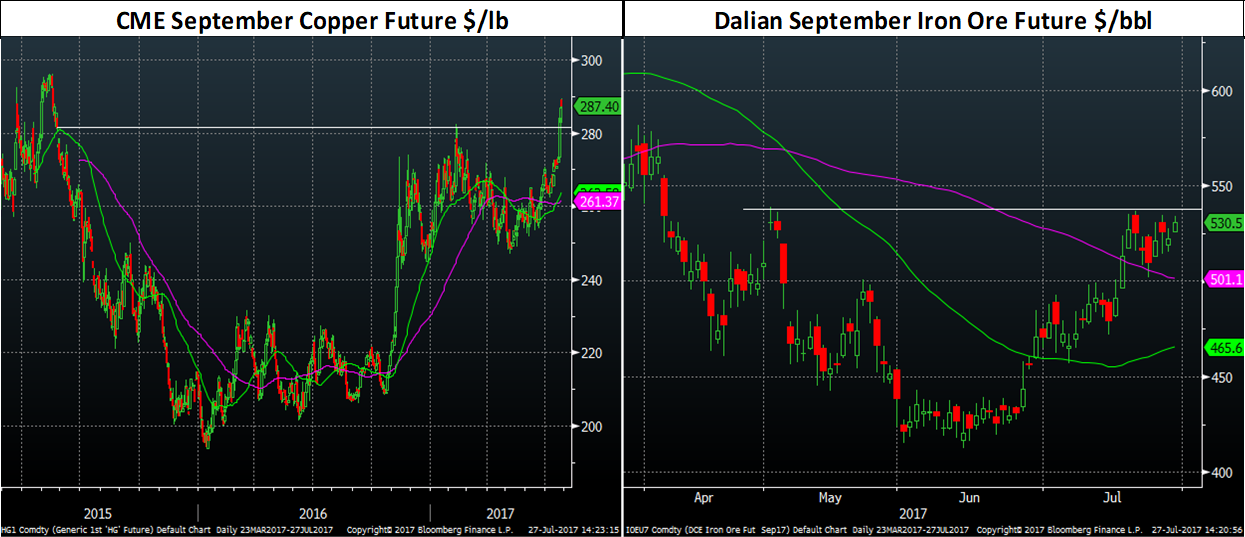

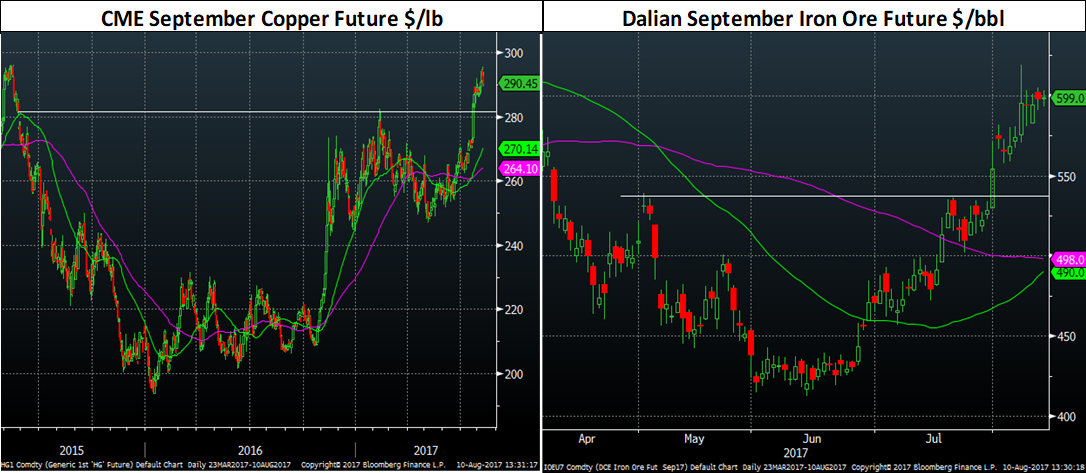

Copper and iron ore prices have both formed into a “cup and handle” pattern, which is considered a bullish continuation pattern once the top is broken above and is used to identify buying opportunities. Copper has broken above its resistance level with force. Iron ore remains below its resistance level. Since copper and iron ore are barometers of everything from China’s economy to construction to inflation, it bears watching and the implications for the prices of these products breaking out could be a huge positive for the price of steel and ferrous raw materials.

Copper has consolidated its gains adding 1 percent, but trading has been uneventful. Iron ore, on the other hand, has exploded through the top of the cup with force and is on a tear, gaining 11 percent since breaking out on July 31.

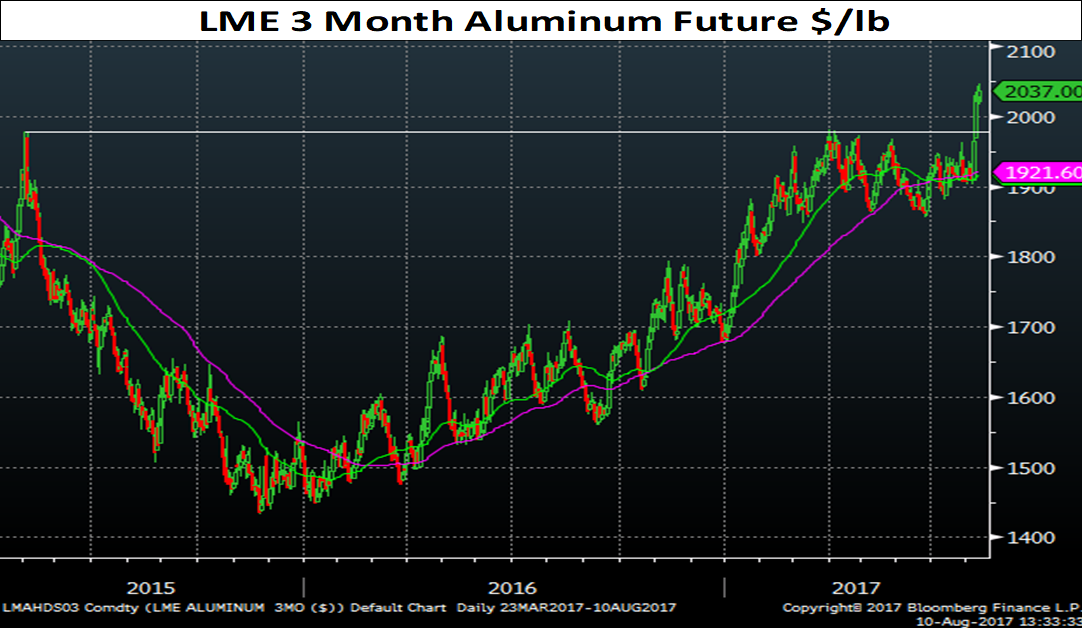

Below is the chart for the LME 3-month aluminum future showing a similar long-term cup and handle pattern. Aluminum has put on a serious rally, first off sharper than expected production cuts by the Chinese government and then gaining some momentum plowing through these major technical levels.

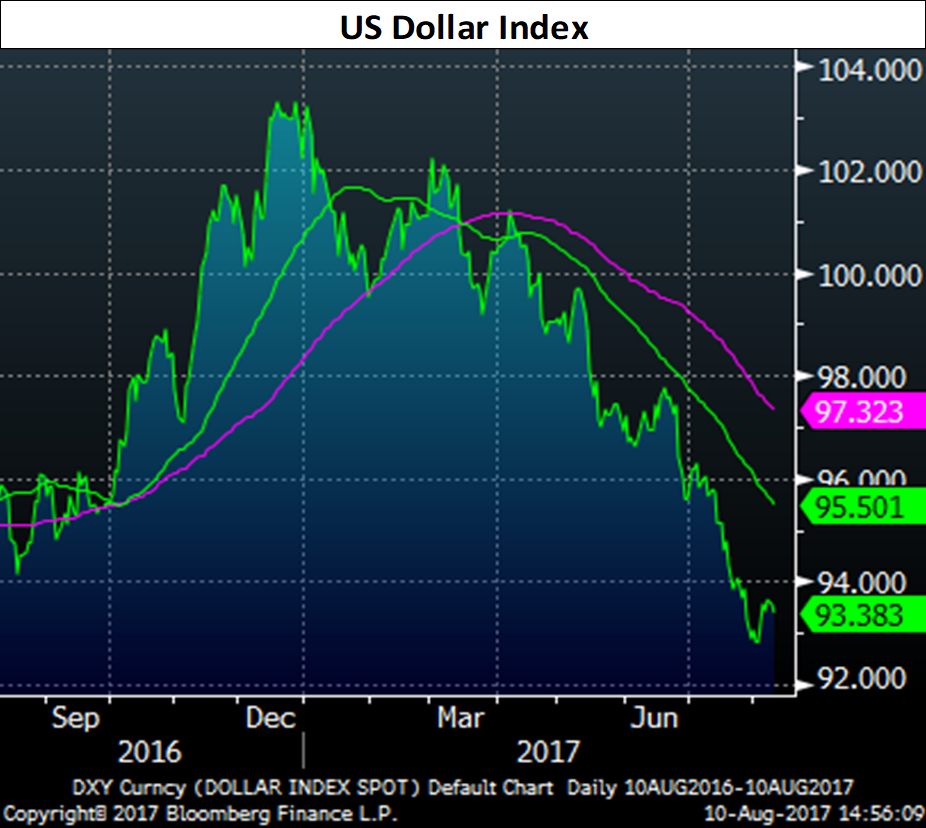

There is a global commodity rally going on at a time when inflation is disappointing. The fall in the dollar is probably one of the primary catalysts behind this rally, so keep your eye on any rebound in the dollar to provide headwinds to the rally.

The opportunity might present itself in HRC futures at any time, so pay close attention to President Trump’s tweets, keep your local broker on speed dial and remember Ferrous Bueller’s philosophy…

“Life moves pretty fast. If you don’t stop and take a look around once in a while, you could miss it.” –