Prices

December 8, 2020

CRU: Iron Ore Near $150 /dmt on Increasing Market Tightness

Written by Erik Hedborg

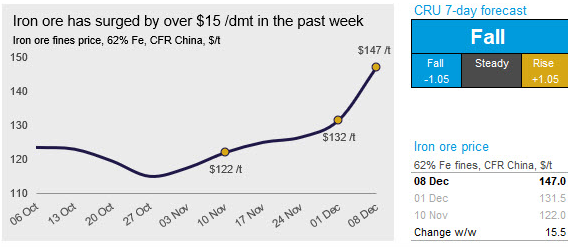

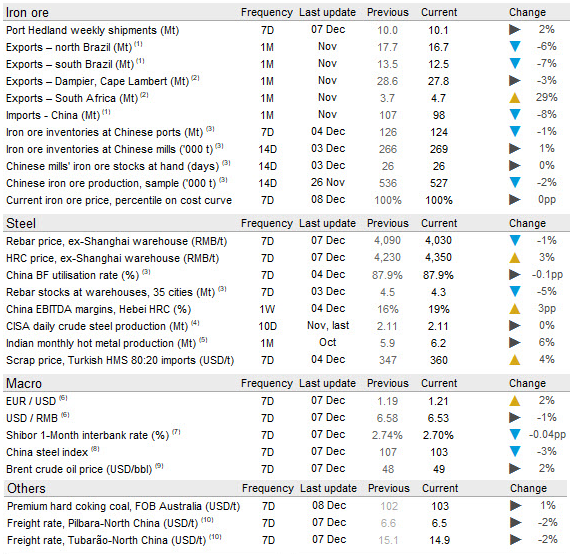

Iron ore surged in early-December as Vale’s lowered guidance fueled concerns about iron ore availability going into 2021. Short-term market tightness also contributed to the rise as Chinese demand remained strong, while seaborne supply has continued to struggle. On Tuesday, Dec. 8, CRU assessed the 62% Fe fines price at $147.0 /dmt, an increase of $15.5 /dmt w/w.

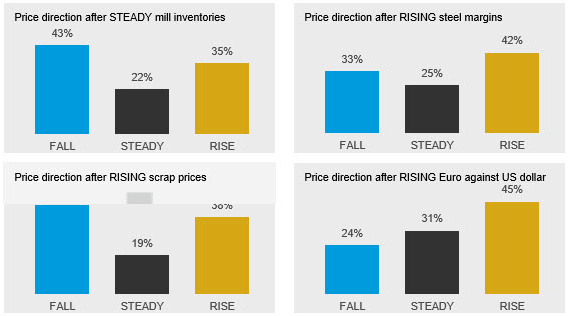

Last week, Chinese domestic HRC and rebar prices continued to march in opposite directions. While the HRC price rose by RMB120 /t w/w, the rebar price declined again by RMB60 /t. This precisely dictated the changes in supply-demand fundamentals. Given some BF maintenance, steel output dropped marginally last week. With quicker inventory drawdown, flat products demand lifted w/w, partly resulted from strong steel-containing goods exports. In contrast, steel long products demand dropped to the lowest level since late-August as temperatures dropped below the freezing point in many northern provinces. At current prices, Chinese steel margins are very high, so steelmakers kept operating intensively where possible. However, price decreases for steel long products over the last two weeks led some high-cost producers to conduct maintenance. This, coupled with stricter BF restrictions in Tangshan, resulted in lower surveyed BF capacity utilization. Having said that, steelmaking raw materials demand remained strong on the back of winter restocking.

With less shipment arrivals last week, the vessel queue and port inventories both fell w/w. This supply-demand tightness paved the way for higher iron ore spot prices, which were further supported by higher futures prices. We heard from our contacts that iron ore futures buyers kept bidding up prices through opening long positions. This would force those with short positions to physically deliver iron ore when the January contract expires with a belief that the shorts could not get enough iron ore in the tight physical market for delivery. This led DCE to launch an investigation into the “abnormal” price increases in recent days.

Seaborne supply continues to struggle with Australian producers registering yet another week of disappointing shipments. Both Rio Tinto and producers exporting from Port Hedland have shipped steadily below last year’s level in the past six weeks, mainly due to operational issues at mines and port maintenance. In Brazil, Vale’s Northern System has struggled with rainfall and accidents both at the port and at the S11D mine. Shipments in the past week have been at the lowest level since July and just below last year’s level. Export data for November also showed a 6-7% drop compared with the previous month. However, it is Vale’s reduced guidance that made the big headlines in the past week. The company announced it will miss its target of 310–330 Mt this year and has reduced its 2021 production outlook to 315–335 Mt after previously having indicated at least 350 Mt of production.

In other news, the pellet market is looking at a strong start to 2021. European demand is recovering and steel producers have reportedly been reluctant to restart sinter plants that were idled in 2020. In addition, there is talk about strong demand for pellet imports in regions such as MENA, JKT and even India and China. In Q1, the pellet premia are expected to nearly double from today’s level.

The market is extremely volatile at the moment and prices are expected to remain firm due to the exceptionally tight market. However, we see a chance for a slight correction as arrivals to China will be higher next week and we expect seaborne shipments to improve in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com