Prices

March 23, 2021

SMU Price Ranges & Indices: Steel Up Another $10-30 Per Ton

Written by Brett Linton

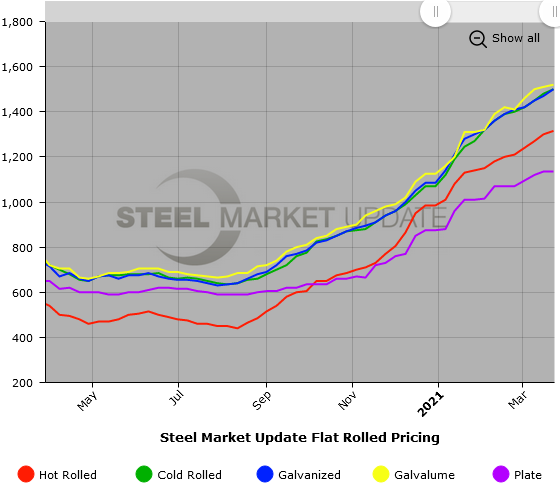

Buyers polled by Steel Market Update this week reported little change in the tight market conditions. Mills have few spot tons to offer, and those that are made available get snapped up immediately. Most of the limited spot buys on hot roll are transacting at around $1,300 per ton, but offers reportedly have ranged up to $1,330 or more. In general, prices on flat rolled products rose by another $10-30 per ton this week, while plate prices were relatively flat. Fueled by seasonal demand and economic stimulus, the uptrend that has taken steel prices to record heights is likely to continue. SMU’s Price Momentum Indicators are pointing toward higher steel prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,300-$1,330 per net ton ($65.00-$66.50/cwt) with an average of $1,315 per ton ($65.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 compared to one week ago, while the upper end decreased $10. Our overall average is up $15 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,460-$1,540 per net ton ($73.00-$77.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,460-$1,540 per net ton ($73.00-$77.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,529-$1,609 per ton with an average of $1,569 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-14 weeks

Galvalume Coil: SMU price range is $1,510-$1,530 per net ton ($75.50-$76.50/cwt) with an average of $1,520 per ton ($76.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 compared to last week. Our overall average is up $10 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,801-$1,821 per ton with an average of $1,811 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 9-12 weeks

Plate: SMU price range is $1,090-$1,180 per net ton ($54.50-$59.00/cwt) with an average of $1,135 per ton ($56.75/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.