Prices

August 10, 2021

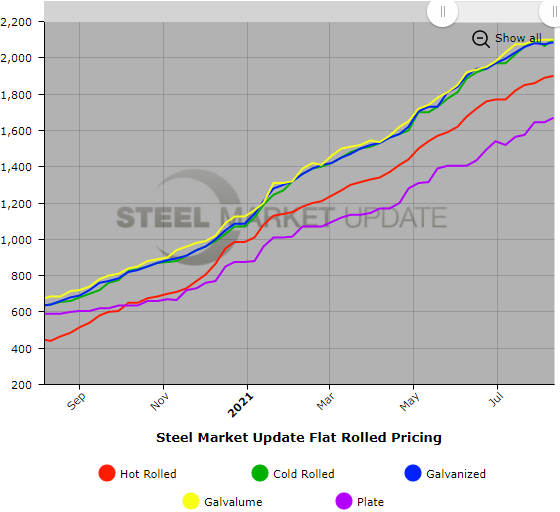

SMU Price Ranges & Indices: New High for Hot Rolled at $1,900

Written by Brett Linton

The average spot market price for hot rolled coil reached a notable new benchmark this week at $1,900 per ton, according to Steel Market Update’s check of the market on Monday and Tuesday. That’s an astounding 78% higher than the previous record of $1,070 per ton seen in the summer of 2008. Prices for flat rolled and plate showed some mixed signals last week, but all registered modest increases again this week, except for Galvalume, which was unchanged. (Reports of unusually low HRC offers from one mill in the East were considered outliers and not included in the calculation of this week’s average because of the relatively small tonnage that mill is capable of producing.) Voices speculating that prices are approaching a peak have gained some volume of late, but the numbers haven’t joined that chorus just yet. While there appears to be some narrowing in the size of the changes from week to week, the direction is still generally upward. SMU’s Price Momentum Indicators continue to point toward higher prices over the next 30 days.

Hot Rolled Coil: SMU price range is $1,880-$1,920 per net ton ($94.00-$96.00/cwt) with an average of $1,900 per ton ($95.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end decreased $20. Our overall average is up $10 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $2,080-$2,120 per net ton ($104.00-$106.00/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $10. Our overall average is up $35 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-14 weeks

Galvanized Coil: SMU price range is $2,000-$2,170 per net ton ($100.00-$108.50/cwt) with an average of $2,085 per ton ($104.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $10 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,069-$2,239 per ton with an average of $2,154 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-14 weeks

Galvalume Coil: SMU price range is $2,080-$2,120 per net ton ($104.00-$106.00/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end decreased $20. Our overall average is unchanged from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,371-$2,411 per ton with an average of $2,391 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-16 weeks

Plate: SMU price range is $1,560-$1,780 per net ton ($78.00-$89.00/cwt) with an average of $1,670 per ton ($83.50/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $25 per ton from last week Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 9-14 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.