Analysis

September 27, 2022

Final Thoughts

Written by Michael Cowden

Sheet prices are flattish, with hot-rolled coil averaging approximately $750-800 per ton ($37.50-40 per cwt) for the last month.

Should we start talking about mini-cycles within a new, higher normal? Or should we assume that prices will continue to resume their downward trek until we see the typical rebound in Q1 of the New Year?

The answer to that question hinges in no small part on demand. I’ll get back to that in a minute. But let’s first look at just how wild this period of radically boring prices has been compared to the volatility we’ve grown used to.

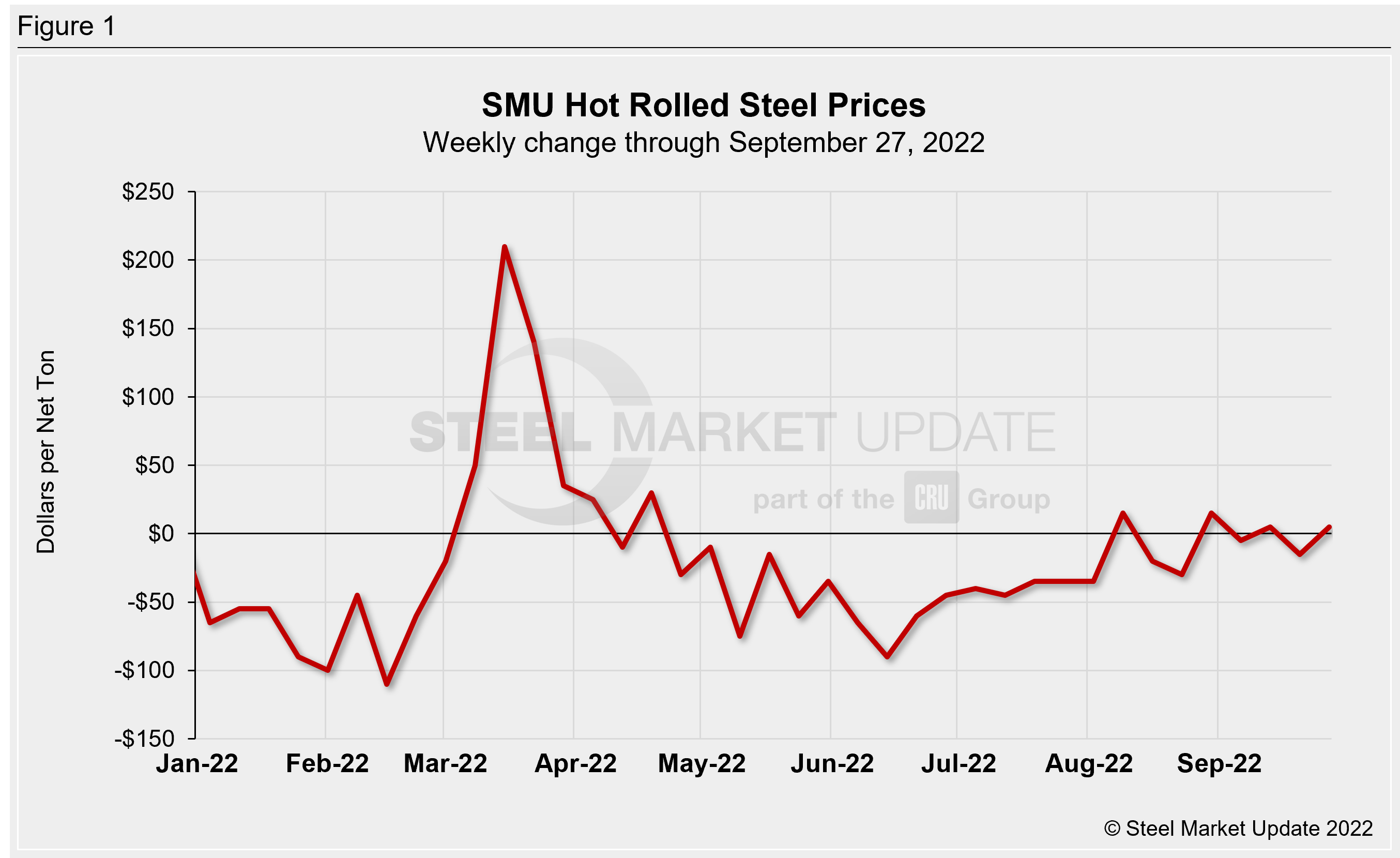

The chart below shows the week-over-week (WoW) change in hot-rolled coil prices in 2022 year-to-date.

HRC prices hit a post-Ukraine war peak of $1,480 per ton in late April. Prices fell an average of ~$45 per ton per week from then until the end of July.

What has happened since? Price hikes, maintenance idlings, and furnace idlings haven’t stopped the slide entirely. But they have succeeded in slowing it. HRC prices have since the beginning of August fallen at a rate of only $7 per ton per week.

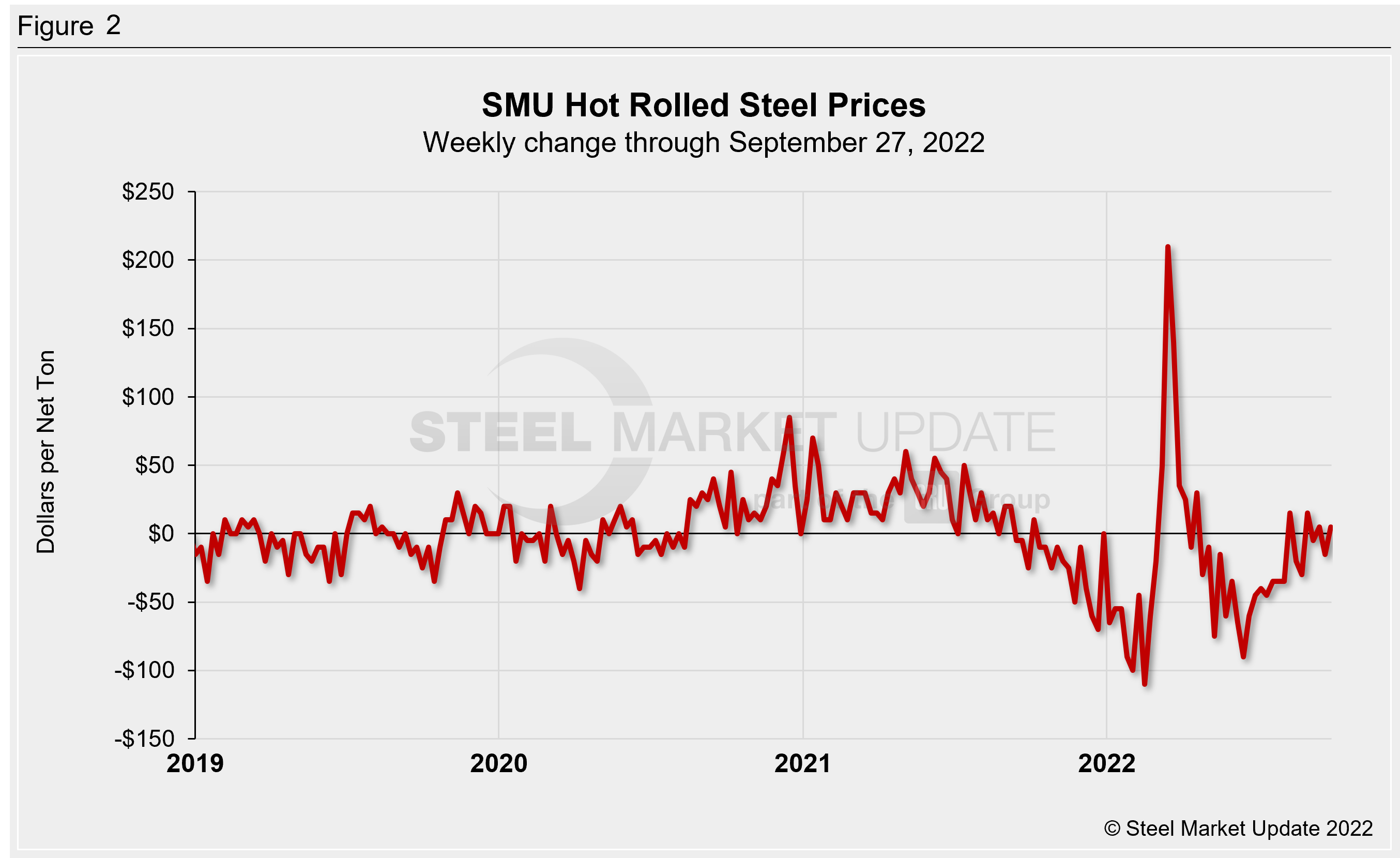

Why is that remarkable? Look at the chart below, which show WoW changes in HRC prices since 2019.

We haven’t seen a period of stability like this since July 2020, when the market – whether it realized it or not – was bottoming out before a snapback in demand sent prices soaring higher.

It’s hard to look at recent stock market gyrations, dire warnings about recession in Europe, and conclude that prices are about to shoot upward like they did in the summer of 2020. And I’ve in past columns noted the risks posed by more bearish sentiment and the potential for lower scrap prices in October. But I want to be clear the music hasn’t stopped on demand.

On SMU’s monthly call with HARDI’s Sheet Metal/Air Handling Council, the consensus was that prices would continue dragging along roughly where they’ve been for the last month. The outlook varied by region. Markets in the Northeast and Mid-Atlantic were reported to be slow, those in the Great Lakes and Midwest broadly steady, and those in the Southeast and West strong. In short, no one said the sky was falling.

Most HARDI members didn’t predict a turnaround before the end of the year. But some noted that the full impact of blast furnace idlings by US Steel had yet to be realized in the market. And they also noted that a strike or lockout at the Pittsburgh-based steelmaker, which is still engaged in contentious negotiations with the United Steelworkers union, could surprise to the upside.

For now, I’m hoping that things will drag along roughly where they’ve been. After the last two years, boring (in prices and in politics) is the new black as far as I’m concerned. That said, steel prices rarely sit still for long. They’re either moving up fast or falling hard. Which begs the questions, what’s the next market shock that will send them shooting higher or lower?

PS – A big thank you to all of you who participated in our surveys over the last two weeks about how we can improve our website and newsletter. Your input is valued, and we’ll be working hard to make those changes (while keeping the things you like) in the weeks and months ahead.

By Michael Cowden, Michael@SteelMarketUpdate.com